Copper Price Reaching New Highs

The front month LME copper is currently trading at $10,329 per metric ton, more than the high of $10,190 per ton reached in February 2011. We believe that a combination of tight supply and strong demand could push copper prices back to all-time highs. As a metal that will be a key enabler in the upcoming energy transition and burgeoning global infrastructure boom, the longer-term projections for copper also look positive.

A Market in a Supply Deficit

In October 2020, the International Copper Study Group (ICSG) forecast that the copper market would be in a 50,000 ton supply deficit in 2020. In fact, data published by the ICSG last month showed a 559,000 ton deficit for the full year 2020—more than 10 times the deficit expected back in October.1 In 2019, the copper deficit was 375,000 tons.

The ICSG pointed out that demand outside China was weak in 2020, falling by close to 10%. However, Chinese demand for copper rose 38%, offsetting the weakness elsewhere. Some of China’s purchases may have been made by the State Reserve Bureau, but the ICSG’s estimate, adjusted for stock changes in Chinese bonded warehouses, still amounts to a deficit of 456,000 ton. After its spring meeting last week, the ICSG said it expects a 79,000 ton surplus for 2021 and a 109,000 ton surplus for 2022. But given the group’s recent record and that the rest of the market is expecting a deficit, we are skeptical.

Chinese customs2 data indicates imports of unwrought copper and copper products were up 11.7% in the first quarter of 2021 compared to 2020 and stand at the highest level (for Q1) since 2016.

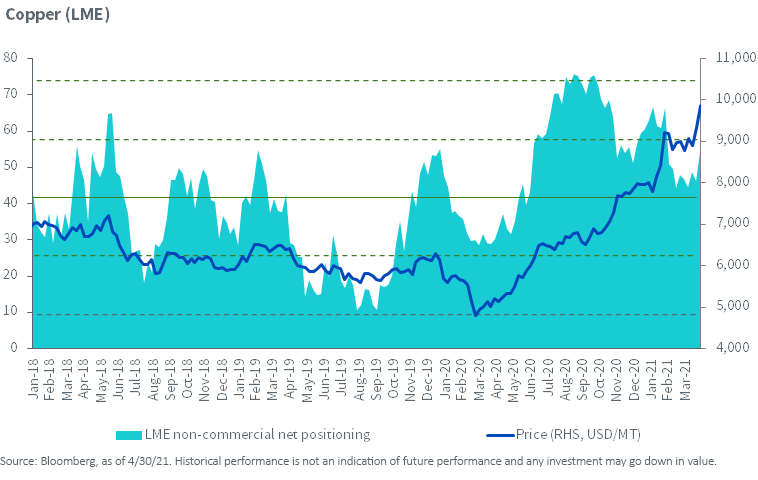

Stretched Long Positioning Has Been Flushed Out

Net positioning in LME copper futures hit a decade high of 73,000 contracts net long in December 2020. Since then, positioning has cooled to just 50,000 contracts net long. We think this is a healthy development that has opened up a better entry point into copper.

Net Speculative Positioning in LME Copper Futures

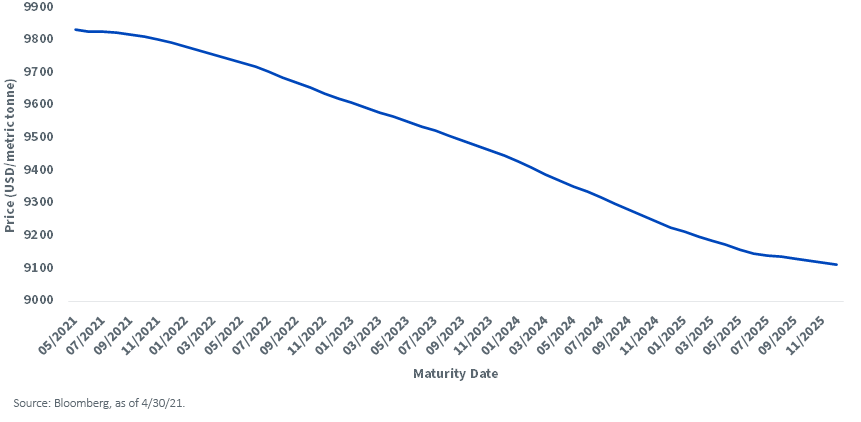

Copper Futures in Backwardation

The copper futures market is in backwardation, which is a sign of tight supply. Markets in backwardation can potentially provide a source of positive performance for investors in commodities.

Copper (LME) Futures Curve

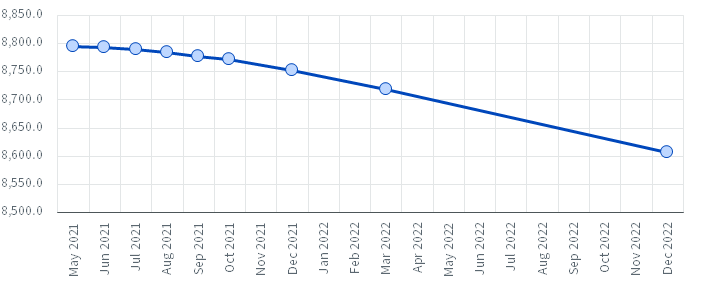

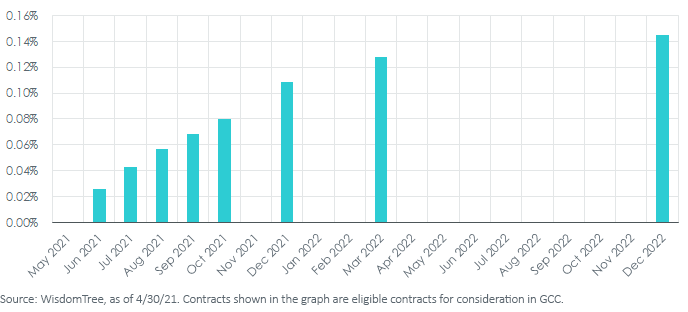

Motivated by our bullish case on copper, we over-weighted copper in the WisdomTree Enhanced Commodity Strategy Fund (GCC) for 2021, with a target weight of 8.5% compared to 5.39% for the Bloomberg Commodity Index (BCOM) and 4.97% for the S&P GSCI Index. Our enhanced rolling mechanism also attempts to maximize roll yields for a backwardated curve.

Copper Futures Curve as of 4/30/2021

Implied Roll Yield, Adjusted for Time

1In fact, in October 2019, the ICSG predicted a 280,000k ton surplus for 2020.

2Customs General Administration PRC.

Important Risks Related to this Article

Nitesh Shah is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management, Inc.’s, parent company WisdomTree Investments, Inc.

Prior to 12/21/20, the ticker symbol “GCC” was used for an exchange-traded commodity pool trading under a different name and strategy.

There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance. These factors include use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relates directly to the value of the futures contracts and other assets held by the Fund, and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

Jianing Wu joined WisdomTree as a Research Analyst in October 2018. She is responsible for analyzing market trends and helping support WisdomTree’s research efforts. Previously, Jianing completed internships and projects at Geode Capital, Starwint Capital, and Invesco Great Wall Fund Management with a focus in quantitative research. Jianing received her M.S in Finance from the Massachusetts Institute of Technology. She graduated with honors from Boston College with degrees in Mathematics and Philosophy.