Back Where It All Began…Almost

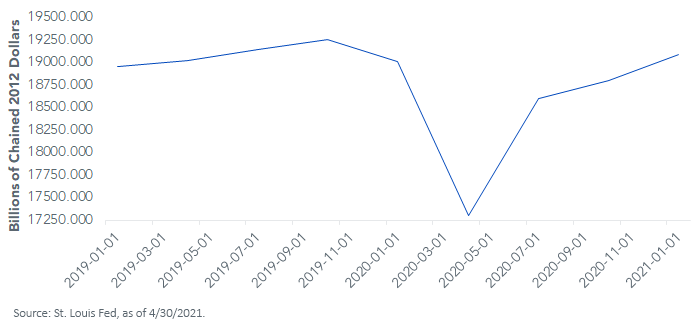

A little more than a year after the pandemic wreaked havoc on the global economy, we have now witnessed U.S. economic activity coming “oh, so close” to coming back to where it all began. In other words, the level of U.S. real GDP to begin 2021 almost matched the pre-pandemic reading from Q4 of 2019 and, more importantly, seems poised to break out to the upside.

Let’s go to the numbers. The U.S. economy grew +6.4% in Q1. While no doubt this was a solid performance, it was a bit less than consensus forecasts and visibly below some of the estimates, which pegged growth closer to +10% for the quarter. Nevertheless, the actual dollar amount of real GDP is now only a relatively modest $166 billion below its pre-pandemic reading. Now, some readers may be thinking that $166 billion is still a large number, but let’s put it in perspective. The U.S. economy is a $19 trillion behemoth, so the aforementioned amount is only 0.9% (less than 1%) below the Q4 2019 level, or to put it another way, it stood at $19.1 trillion in Q1 versus a $19.3 trillion pre-pandemic reading.

Why the miss?

- Inventories and net exports came in on the negative side of the ledger, acting as visible drags on the overall level of activity

- Inventories and net export numbers are based on incomplete data (remember, this is the advanced estimate for GDP) and could possibly be revised upward in the next two subsequent GDP reports

What was robust?

- Personal consumption surged +10.7%, reportedly the second-fastest pace since the 1960s

- Residential investment rose +10.8%, and business (non-residential) investment was up +9.9%

- And to no one’s surprise, Federal Government spending increased +13.9%

U.S. Real GDP

Perhaps a more interesting way to look at the GDP numbers is to focus on the category final sales to domestic purchasers. Think of this figure as GDP minus both inventories and exports. This measure of final domestic demand posted a robust +9.8% gain in Q1. And the dollar amount is now actually above its pre-pandemic level.

Conclusion

The momentum coming out of Q1 appears to be strong and is setting the stage for potentially faster growth in not only the second quarter but for 2021 as a whole. Increasing vaccination rates, unprecedented fiscal stimulus and the Fed’s “pedal to the metal” monetary policy are certainly all important driving factors. In addition, as lockdowns get lifted, consumer demand and fixed investment appear poised to continue their breakout. In other words, it’s looking increasingly likely the next time I blog about U.S. real GDP, economic growth will be above pre-pandemic levels and, more importantly, reaching new highs.