Nickel’s Role in Electrifying Cars

“I'd just like to re-emphasize, any mining companies out there, please mine more nickel. Wherever you are in the world, please mine more nickel and … go for efficiency, obviously environmentally friendly nickel mining at high volume.” Elon Musk, from Tesla’s August 2020 quarterly earnings call.

This blog post will dive deep into the technical details of why the WisdomTree Enhanced Commodity Strategy Fund (GCC) is strategically over-weight in this battery metal on a long-term view.

Around 15% of the world’s greenhouse gas (GHG) emissions come from the transportation sector, and policymakers are keen to curb this activity. To meet future emission targets, electric vehicles (EV) play a critical role. We expect EV sales to rise from close to 5% of all vehicle sales to close to 50% by the year 2040—with the potential for more.

Nickel Batteries

EVs are powered by rechargeable batteries. Batteries provide a reversible chemical reaction, allowing both their discharging and charging processes. During the battery discharging process, the electrical current flows from cathode (+) to anode (-), while the reverse process occurs during charging. Lead acid batteries have been used in conventional internal combustion engine vehicles and are relatively inexpensive.

Nickel metal hydride (NiMH) batteries are another mature battery technology. These batteries have higher specific energy1 than lead acid batteries, which allows vehicles using them to be lighter. However, NiMH batteries have lower charging efficiency than other forms of batteries and also have issues of self-discharge (up to 12.5% per day under normal room temperature conditions).

These two batteries are now considered obsolete with regard to the main source of energy for battery powered EVs.

Nickel in Battery Cathodes

The lithium-ion (Li-ion) battery is currently the dominant technology powering EVs today and is likely to remain so for the next decade. There are many variants of Li-ion batteries but manufacturers are focusing on those with excellent longevity. These batteries have even higher specific energy than NiMH. But this doesn’t mean that nickel chemistries have come to the end of the road in battery technology.

There are four principal components of a Li-ion battery: cathode and anode active materials, electrolytes and separators. Within Li-ion battery technology, various cathode chemistries exist at a commercial level such as lithium cobalt oxide (LCO), lithium manganese oxide (LMO), lithium iron phosphate (LFP), lithium nickel manganese cobalt (NMC) and lithium nickel cobalt aluminum oxide (NCA).

Nickel is thus one of the key cathodes utilized by Li-ion batteries, as it is present in NMC and NCA.

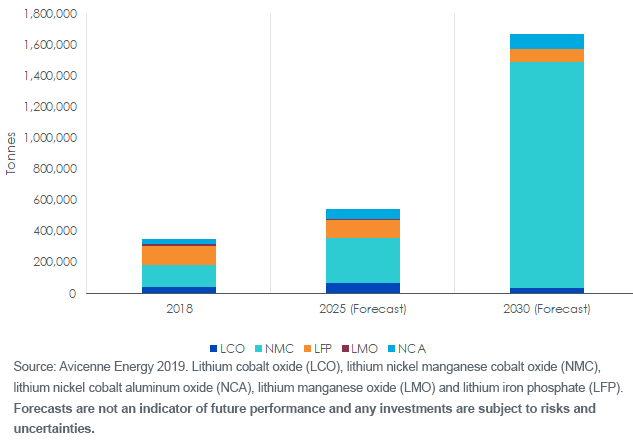

By 2018, the NMC cathode was already the dominant cathode material in Li-ion batteries, having overtaken LFP that year. NMC is expected to continue to grow, accounting for more than half of cathode solutions by 2025 and then close to 90% by 2030 (figure 1).

Figure 1: Cathode Active Materials in Lithium-Ion Batteries

Toward Higher Nickel Weighting

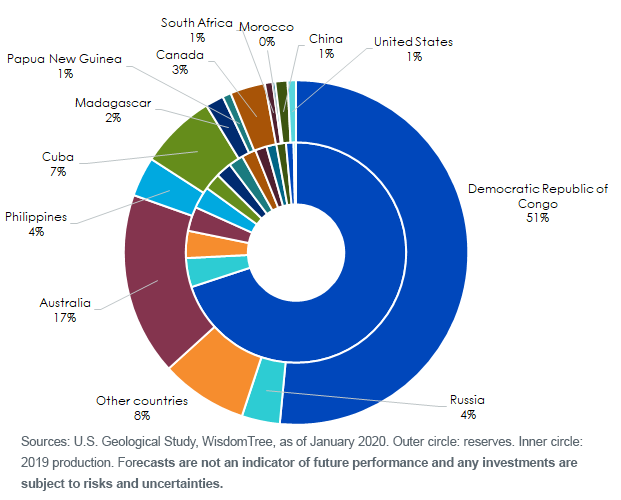

Not only are cathodes with nickel becoming more popular, the nickel content of those cathodes is increasing. Due to price volatility and the risky supply chain of cobalt, manufacturers have been keen to diversify away from the metal, favoring higher nickel loadings in the chemistry. Most of the world’s supply and proved reserves of cobalt come from the Democratic Republic of the Congo (figure 2). The country is notorious for human rights violations, including the use of child labor in many of the country’s artisanal mines. Sourcing cobalt that is completely free from this risky supply chain is difficult.

Figure 2: World Cobalt Mine Production and Reserves (2019)

In addition, increasing the nickel content of the cathodes can promote higher energy densities. This can help improve range and reduce weight of vehicles.

The move to higher nickel chemistries is underway. A few years ago, in the NMC cathode, each of the three atoms—nickel, manganese, cobalt—was applied in equal proportions, known as NMC-111. Manufacturers are increasingly finding a path to a weighting of eight parts nickel relative to one-part manganese and one-part cobalt, known as NMC-811. We aren’t there yet, although six-parts nickel, two-parts manganese, two-parts cobalt (NMC-622) is commercially ready and being utilized. The International Energy Agency estimates that in 2019, 16% of EVs manufactured were utilizing NMC-622 cathodes (up from 7% in 2018).

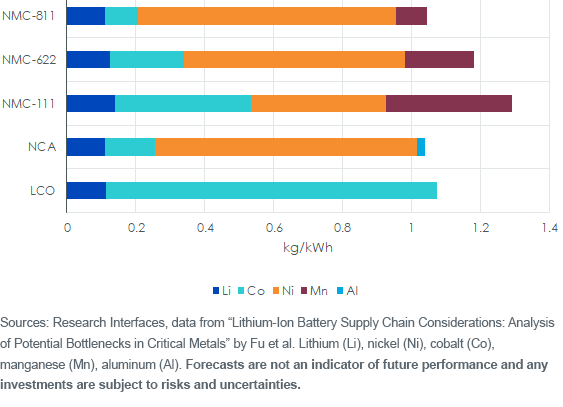

Figure 3 highlights how NMCs with higher nickel loading can be lighter than other cathodes. NCAs that have a similar weight to NMC-811 are mainly manufactured by Panasonic and used in Teslas. They also have a similar nickel content to NMC-811.

Figure 3: Element Requirements in kg/kWh

Challenges in Increasing Nickel Content

In the NMC cathode, nickel is the main cathode active material, and manganese and cobalt help with chemical and structural stability. Therefore, maintaining the chemical and structural stability is the key challenge when migrating to higher nickel chemistries. Several manufacturers claim they are close to commercializing NMC 811, and the market expects this solution will be the mainstay some time around 2025.

Higher Purity Nickel Market Likely to Remain Tight

We see these shifts in battery cathode chemistries as positive for nickel demand. Currently batteries constitute less than 5% of nickel demand. But that is likely to rise to close to 30% of nickel demand by the year 2040, according to Wood Mackenzie.

Trends in battery demand will have an increasing influence over nickel prices, shifting away from stainless steel as nickel’s main price driver today. The stainless steel market uses both Class 1 (high-purity) and Class 2 (low-purity) nickel. Historically only Class 1 has been suitable for battery-grade chemistries. The tightness in the Class 1 market will likely be more acute for that reason.

The nickel that underlies the London Metals Exchange futures contract is Class 1.

WisdomTree recently re-positioned our broad-based diversified commodity strategy, GCC, to include a structural over-weight in nickel and industrial metals—for their role in the decarbonization trend.

1Specific energy or massic energy is energy per unit mass. It is also sometimes called gravimetric energy density.

Important Risks Related to this Article

Nitesh Shah is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company WisdomTree Investments, Inc.

Prior to 12/21/20, the ticker symbol “GCC” was used for an exchange-traded commodity pool trading under a different name and strategy.

There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance. These factors include use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

GCC will not be invested in physical commodities. Futures may be affected by backwardation and contango. Backwardation: A market condition in which a future’s price is lower in the distant delivery months than in the near delivery months. As a result, the Fund may benefit because it would be selling more expensive contracts and buying less expensive ones on an ongoing basis. Contango: A condition in which distant delivery prices for futures exceeds spot prices, often due to costs of storing and inuring the underlying commodity. Opposite of backwardation. As a result, the Fund’s total return may be lower than might otherwise be the case because it would be selling less expensive contracts and buying more expensive ones.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.