If It’s Not One Thing, It’s Another

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

“Well, Jane, it just goes to show you, it’s always something—you never can tell. If it’s not one thing, it’s another.”

(“Roseanne Roseannadanna,” played by Gilda Radner, Saturday Night Live, 1977–1980)

The Evolution of Rates, Spreads and Yields

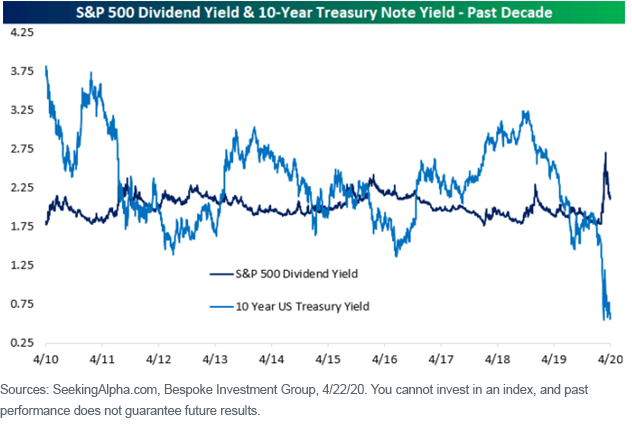

Let’s begin this blog post with a graph we used in a blog post from last June, highlighting the historical disparity between the S&P 500 Index dividend yield and the 10-Year Treasury note yield:

At that time, we made the argument that investors seeking to optimize current income out of their portfolios were better off over-allocating to yield-focused equities than to traditional bond investments.

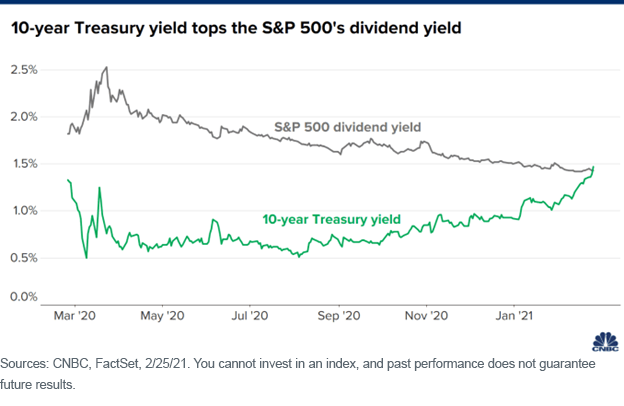

Well, what a difference eight months make:

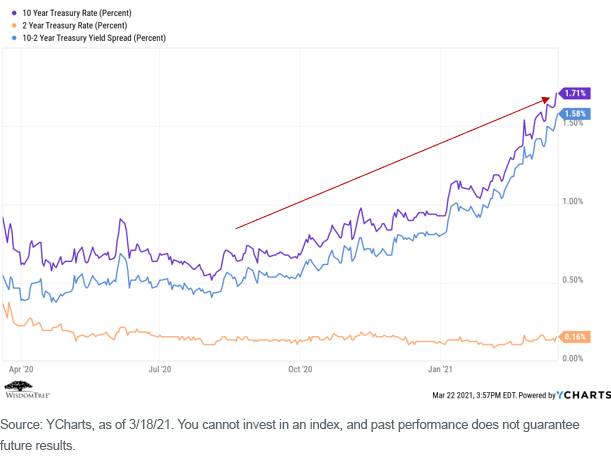

The U.S. yield curve steepened dramatically over the past several months, driven by expectations for an improving economy, massive fiscal stimulus and a continuation of accommodative monetary policy.

To provide some perspective, the rise in the UST 10-Year yield began early last August when the all-time low watermark of 0.51% registered on August 4. Since that date, the rate increase has been an eye-opening 120 basis points (bps) through March 18.1 However, the development getting the lion’s share of attention is what has transpired so far this year, where the rise has been a whopping 78 bps.

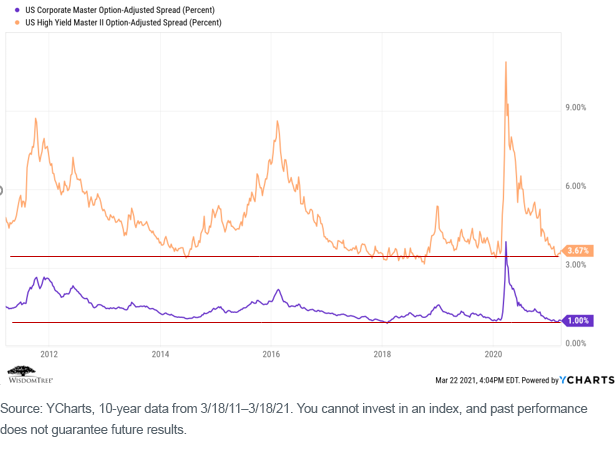

At the same time, U.S. credit spreads have narrowed and come all the way back to reside at pre-pandemic levels. In fact, both investment-grade and high-yield are hovering near lows not seen since 2018.

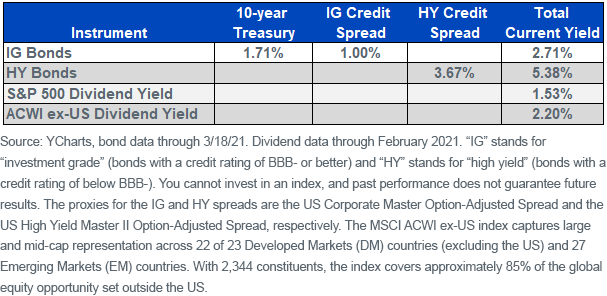

The result is that, for the first time in a long time, investors can now generate current income out of their bond portfolios that is higher than what they can get from their equity portfolios:

Portfolio Implications

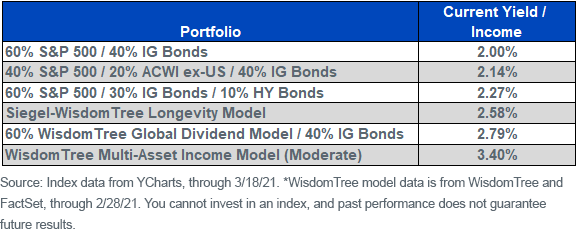

From a portfolio perspective and using the yield information above, let’s begin with a comparison of the current income available from a traditional stock and bond portfolio and the WisdomTree Model Portfolios that are designed explicitly to optimize risk-adjusted current income, specifically the Global Dividend model, the Global Multi-Asset Income model and the Siegel-WisdomTree Longevity model:

Conclusions

Despite the higher current income available from bond allocations, we view the total return risk to be much higher in the bond market. In our base case outlook, we believe rates will continue to grind higher, resulting in a further steepening of the yield curve. Credit spreads could also continue to tighten, but the runway from present levels is a shrinking one.

From a portfolio perspective, we continue to recommend that investors seeking to optimize risk-adjusted current income continue to focus on their equity allocations because, well, “you never can tell.”

1Source: Ycharts, as of March 18, 2020.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.