All Along the Watchtower, Part II

In part I of this two-part blog series, we focused on personal sentiment and confidence indicators, as well as income and consumption metrics. We concluded that, in general, individuals, families and small businesses are exhibiting a sense of “cautious optimism” as the COVID-19 vaccinations continue apace, massive fiscal stimulus has been passed and the economy continues to recover from its pandemic-induced recession of last year.

How is that general optimism translating into actual investor behavior?

Investor Behavior

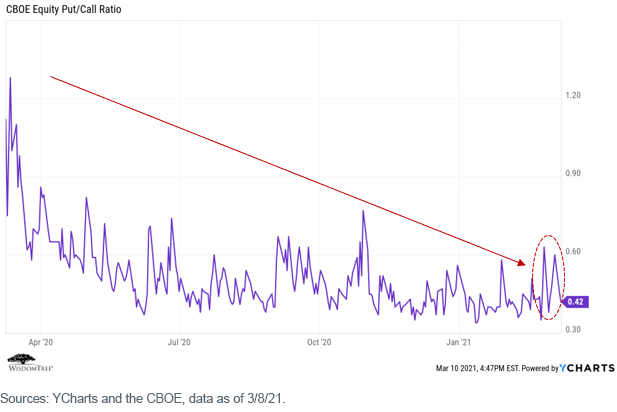

First up is the put/call ratio. This measures the degree to which investors are buying protection against the market (buying put options—a bearish indicator) versus buying leveraged access to the market (buying call options—a bullish indicator). The lower this ratio (i.e., the fewer put options purchased than call options), the more bullish investors are behaving.

Note the bouncy but steady decline in this ratio over the course of 2020, suggesting increased optimism. But what is most noticeable is the volatility over the past 2–3 months, as interest rates spiked, and investors seemingly expressed renewed concerns over potential inflation (driving the ratio upward). This was followed quickly, however, by a sharp decline as good news about COVID-19 vaccinations increased, and Congress passed a massive $1.9 trillion fiscal stimulus package.

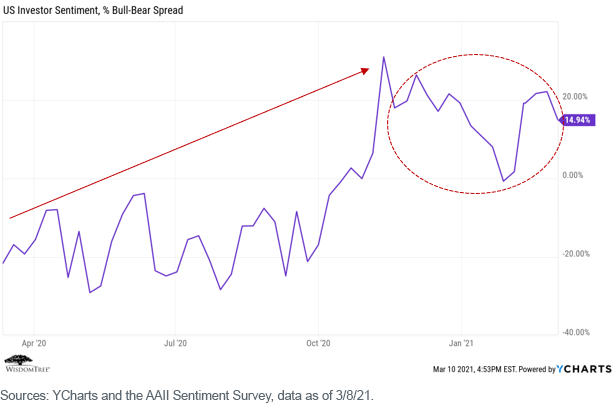

The inverse of the put/call ratio is the bull/bear spread, which measures the ratio of investors indicating they are bullish versus bearish on the market.

We see similar results to the put/call ratio—a steady increase in bullishness over the course of 2020, followed by increased volatility over the past few months—perhaps an indication of investor concerns over frothy equity market valuations and rising interest rates.

While retail investor behavior is interesting, most market trading still takes place with institutional investors (Reddit/Robinhood speculators aside), so let’s examine that next.

What we see (not surprisingly) is more consistent behavior and a generally bullish trend over the past 12–24 months (but, again, with a slight decline over the past month or two).

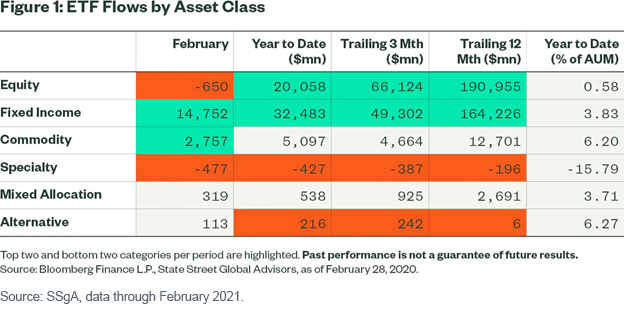

Finally, let’s look at actual fund flows, focusing on ETFs. What we see is a small majority of flows into equity ETFs over the previous 12 months (a bullish indicator), but a reversal into bond ETFs so far in 2021. Given current interest rate and credit spread levels, this is a fairly bearish indicator.

Conclusions

What can we conclude from examining the various individual, consumer and investor indicators discussed in these two blog posts?

In our opinion, it is a mixed bag. Individuals and investors seem generally optimistic about the current and future state of the economy and the stock market, but there are signs that some level of caution is creeping into the market “mood.”

This may be the result of any number of issues—uncertainty over the potential impacts of the newly passed fiscal stimulus package and/or the effectiveness of the COVID-19 vaccination program, inflation and valuation concerns, or perhaps just “fatigue” over continuing lockdowns and school closings.

Given human emotions, most of these sentiment and behavior indicators tend to be volatile, and they can and do reverse course and back again quickly. So, it is wise to view them with some level of detachment and a longer-term time horizon.

But they are worth paying attention to. I participated in a market outlook webinar in late December and was asked: “What’s the one thing that maybe people aren’t paying enough attention to that could have an impact on the market?”

My response was as follows, and I stand by it today. We need to maintain our vigilance “all along the watchtower”:

Investor sentiment currently is in a euphoria stage. If you look at various investor sentiment indicators, there is a lot of optimism priced in. So, at the retail level, we are in a “risk-on” environment, and I agree with much of that optimism.

But a potential shock might be that there is too much optimism built into the market. If we get an event that turns sentiment around, and people begin to de-risk, it could happen quickly and dramatically.