All Along the Watchtower, Part I

“There must be some way out of here,” said the joker to the thief

“There’s too much confusion, I can’t get no relief

Businessmen, they drink my wine, plowmen dig my earth

None of them along the line know what any of it is worth”

“No reason to get excited,” the thief, he kindly spoke

“There are many here among us who feel that life is but a joke

But you and I, we’ve been through that, and this is not our fate

So let us not talk falsely now, the hour is getting late”

(From “All Along the Watchtower” by Bob Dylan, 1967, covered by Jimi Hendrix, 1968)

In this two-part blog series, we will discuss what we believe are a collection of under-reported—or perhaps underappreciated—market metrics. Specifically, we will discuss sentiment and behavior and what they might tell us about future market movements. In this first part, we will discuss confidence indicators and personal income and consumption metrics. In the second part, we will focus on investor sentiment and trading behavior.

Investor sentiment and behavior, whether retail or institutional, capture the market “mood”—is it optimistic or pessimistic? The given level of a given indicator may be less important than its trend—that is, which direction it is moving. This may provide information about how investors are likely to behave in the near to mid future.

Confidence Indicators

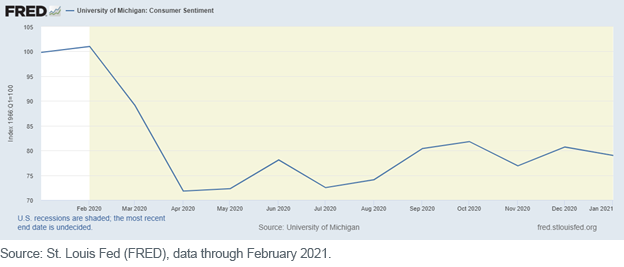

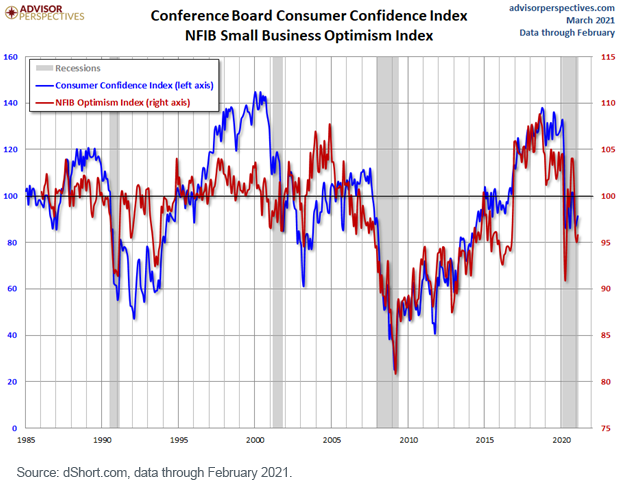

The three most commonly referenced confidence indicators are the University of Michigan Consumer Sentiment Index, the Conference Board Consumer Confidence Index and the NFIB (National Federation of Independent Businesses) Small Business Optimism Index.

The first two of these are surveys of families and households, asking their opinions of general economic conditions, family financial health, expectations for the future and so forth. Since personal consumption drives roughly 70% of the U.S. GDP, gauging the “mood” of individuals and families can be very helpful for anticipating future consumption patterns, which may, in turn, influence future market movements.

The NFIB Index surveys small business owners and asks them about such things as hiring plans, optimism regarding the economy, anticipated sales, etc. Small businesses employ roughly 50% of all U.S. workers, and so, again, knowing how they feel about the economy and their anticipated hiring plans can provide important information regarding potential future income and consumption.

Through the end of February, these indicators showed dramatic decline in the early days of the pandemic, followed by another sharp decline immediately after the elections in November, but now have improved slightly. There may still be some level of residual uncertainty regarding COVID-19 and new uncertainty over the future state of taxes and regulations under the new administration.

Personal Income and Consumption

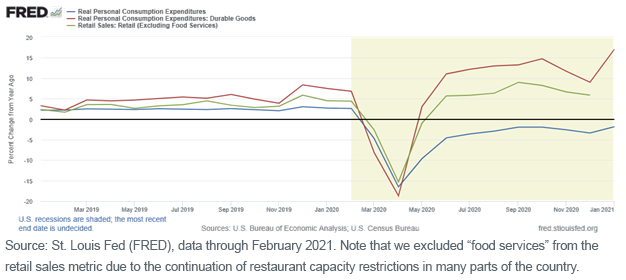

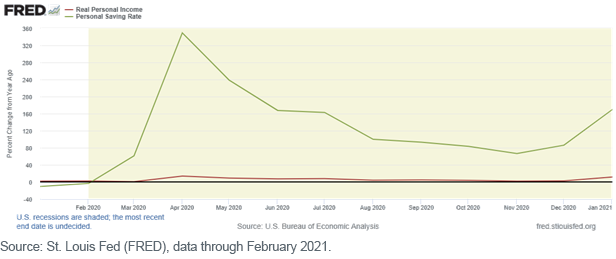

Other useful metrics concern the financial health and spending patterns of consumers. These metrics indicate how much money consumers have to spend, how much they choose to save instead of spend (the higher the savings level, the more pessimistic the consumer) and how they choose to spend.

We believe the current readings of these various metrics send generally positive but slightly mixed signals. Retail sales and durable goods sales seem to have regained and passed pre-pandemic levels, no doubt encouraged by the December $600 stimulus checks and by expectations for additional checks following the recent passing of the new $1.9 trillion fiscal stimulus package.

Next, let’s compare the change in personal income (which, again, was and will be boosted by transfer payments from the stimulus packages) to the change in the personal savings rate. What is interesting is that, despite only modest increases in personal income, the savings rate has been quite volatile. We saw a sudden spike last year as the pandemic hit, followed by a steady decline as confidence returned over the rest of the year (a bullish signal), but then a sudden spike again over the past two months—perhaps people are becoming cautious again over virus, economic and inflation concerns.

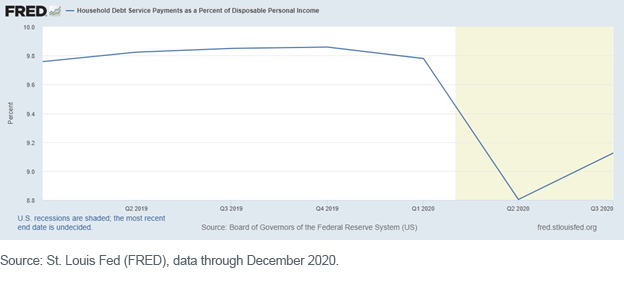

Some good news is that, perhaps because they were locked down over much of 2020, consumers took the opportunity (and their stimulus checks) to strengthen their family balance sheets. This was no doubt aided by a more than 10% increase in average home prices (as measured by the S&P/Case-Shiller U.S. National Home Price Index) and a dramatic drop in mortgage refinancing rates.

Conclusions, Part I

While uncertainty remains over new taxes and regulations that are almost certain to come under the Biden administration and a Democrat-controlled Congress, the general mood of most consumers seems to be one of cautious optimism.

Stimulus checks should spur additional consumption and provide a strong growth catalyst to an already recovering economy. As the vaccination-received levels increase and families and businesses begin to return to more normal spending patterns once again, we may see a burst of consumption—which should provide a “consumption put” under the equity markets, despite concerns over frothy valuations and rising interest rates.