XSOE: “If you trade it, liquidity will come”

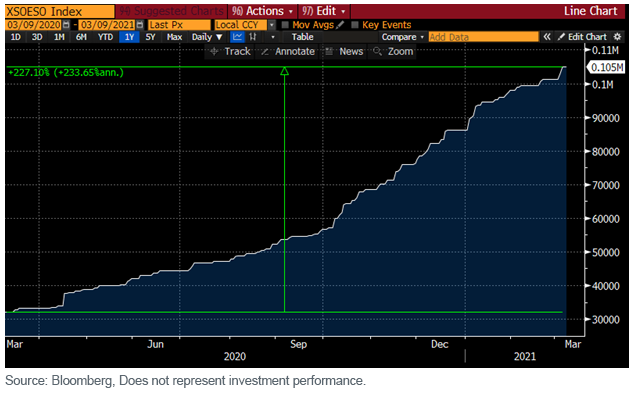

Over the past year, the WisdomTree Emerging Markets ex-State-Owned Enterprise Fund( XSOE) has seen impressive outperformance relative to its largest emerging markets ETF peers.1 It is no wonder shares outstanding in the ETF have grown by 227% over the same period, as seen in figure 1.

Figure 1

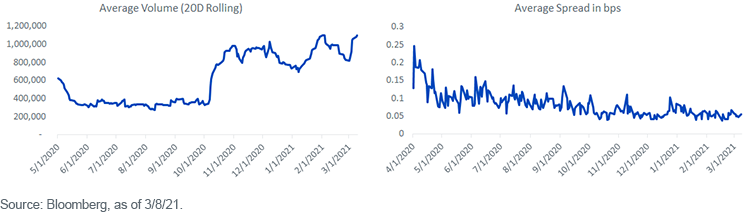

With this type of growth, it’s not uncommon to see bid/ask spreads compress as a significant increase in average daily volume results from investor interest, as shown in figure 2.

Figure 2

As the saying goes from the 1989 film, Field of Dreams, “If you build it, they will come.” The same can be said for ETFs: “If you trade it, liquidity will come.” The ETF wrapper can act as source of liquidity that can trade at lower than underlying costs as investors meet on exchange to pair off risk. Alternatively, market makers can leverage this two-way flow rather than using the creation/redemption mechanism to unwind their positions.

Over this period of demand in XSOE, more market makers throughout the ETF eco-system have been competitively providing liquidity to investors of all shapes and sizes, using various trading strategies. Over the past six months, we have seen three examples that highlight both the liquidity profile of the Fund and the varying execution strategies that can be used to achieve exceptional execution:

- On November 5, 2020, we saw an investor buy $37 million of XSOE in a single “risk block” with an ETF liquidity provider. This trade printed 4 cents above the screen offer, which only showed 300 shares to buy at the time. That’s only 11 basis points (bps) of cost above the on-screen price for a very large amount of emerging markets (EM) exposure during the middle of the U.S. trading session.

- On March 3, 2021, an investor swapped $65 million of a large beta EM fund for XSOE in two block trades. The trades were priced as a switch trade where the market maker is using the correlation and overlap efficiencies of the two ETFs to improve the client’s overall execution. This trade went up on the “touch,” meaning the broad beta EM fund was sold on the screen bid and XSOE bought on the screen offer. A tremendous display of liquidity.

- On March 8, 2021, an investor had their broker trade $225 million using a volume-weighted average price (VWAP) algorithm. This is where the broker buys shares electronically throughout the day, attempting to match the volume-weighted average price. An incredible display of on-screen liquidity in the Fund.

No matter if you are trading 100 shares of XSOE or 5 million, market makers stand ready to provide liquidity at competitive prices.

Remember, there are many ways to trade, but strategy matters. A few tips: always use limit orders when trading on-screen and never market orders; work with your platform trading desks when trading in larger size; and if you are selling another similar exposure ETF, try to maximize those efficiencies using a switch trade. If you are not sure what’s the best decision, don’t guess—we on the Capital Markets desk are here to assist with your trading strategy decisions to help save you money on your execution! Email us at uscapmkts@wisdomtree.com.

1Source: Bloomberg, as of 3/8/21.

Important Risks Related to this Article

Past performance is not indicative of future results.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.