Why We’re Bullish on Commodities in 2021

This appears to be the year of reflation.

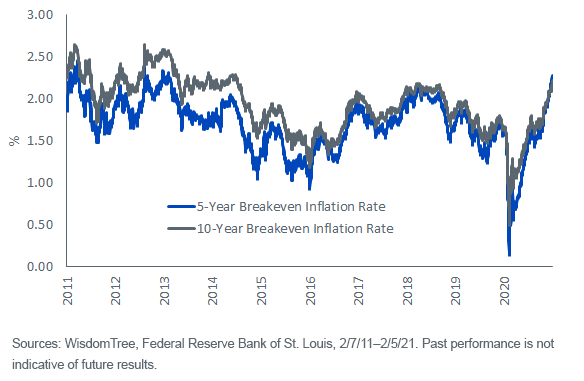

Massive fiscal stimulus from the government combined with the Federal Reserve’s (Fed) loose monetary policies have resulted in an ample, if not excessive, monetary supply. Inflation expectations, measured by 5- and 10-year breakeven rates, have risen to the highest level since 2014.

Against this backdrop, we believe broad-based commodity investing can play an important role in addressing potential risks in the years ahead.

Breakeven Inflation Rate

Low Yields from Fixed Income

As short-term U.S. Treasury yields remain low, investors question whether bonds can be relied on to generate sufficient levels of income. Inflation-adjusted 10-Year bond yields are negative—indicating losses in real purchasing power over 10 years from investments in bonds that provide inflation protection.

A dovish Fed and Chair Powell’s promise to let the economy run hot could imply yields being low for the foreseeable future. Aggressive fiscal stimulus is also expected in response to the global pandemic.

As bonds struggle to generate meaningful returns, we believe commodities may be one of the most straightforward ways to directly benefit from an increase in inflation. As we emerge from the COVID-19 pandemic, global manufacturing activities are recovering. Supply chains are improving and demand is picking up quickly. These developments could lead to a rally in commodities, which is what we’ve seen in the past month.

Asset Allocation

In December 2020, we replaced 3% of our core fixed income position with the WisdomTree Enhanced Commodity Strategy Fund (GCC) in the Siegel-WisdomTree Longevity Model Portfolio to help combat inflation. By reallocating to commodities from bonds, we reduce the overall duration risk in our portfolio, while creating room for a potential return boost from commodities.

Commodities’ Performance during Inflation

What drove this allocation shift? Historically, commodities have offered a hedge against inflation because their prices are largely determined by supply and demand. When economic activities ramp up, production material utilization increases, which in turn causes an increase in demand for raw materials, leading to higher prices.

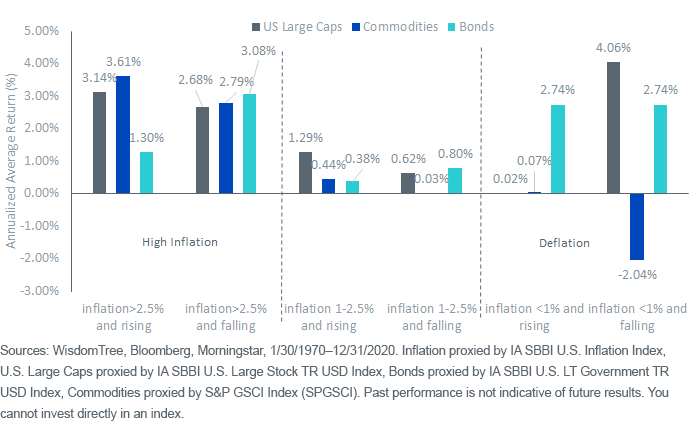

Compared to other major asset classes such as equities and bonds, commodities have historically been the strongest performing asset class during times of high inflation.

Below we show performances of equities, commodities and bonds during various inflation regimes. During periods when inflation exceeded 2.5% over the last five decades, commodities generated the highest returns, outperforming equities by approximately 30 basis points (bps) with lower volatility.

Asset Class Performance during Inflation Regimes

For definitions of indexes and terms in the charts throughout this blog, please visit our glossary

Commodity as an Alternative for Diversification

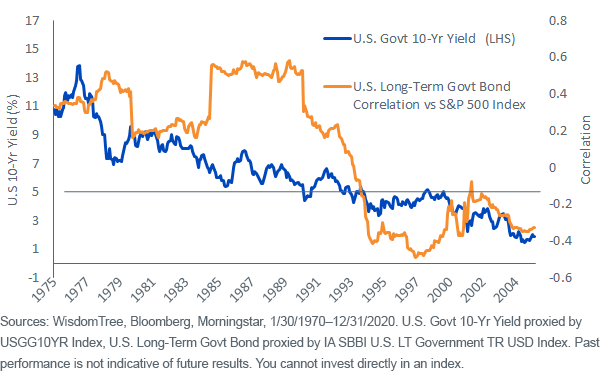

Bonds have traditionally served as an important diversifier in portfolios. Their low volatility and negative correlation have helped dampen total portfolio risk. But in the current market environment of low yields, bonds’ diversification benefit comes with a cost of low returns.

Rolling 5-Yr Correlation of U.S. Long-Term Govt Bonds vs. S&P 500 Index

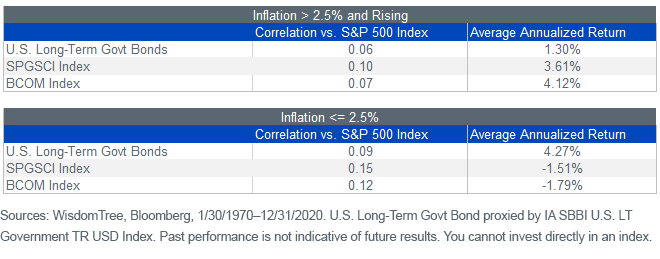

We believe commodities can serve as an alternative to achieve portfolio diversification while preserving returns. Below we show commodities’ and bonds’ correlations versus equities and their relative returns during different inflation regimes over the past five decades.

Historically, commodities and bonds have similar correlations versus the S&P 500 Index—both are near 0. But in a high and rising inflation environment, commodities outperformed bonds by 2%–3% annually while keeping a near-0 correlation.

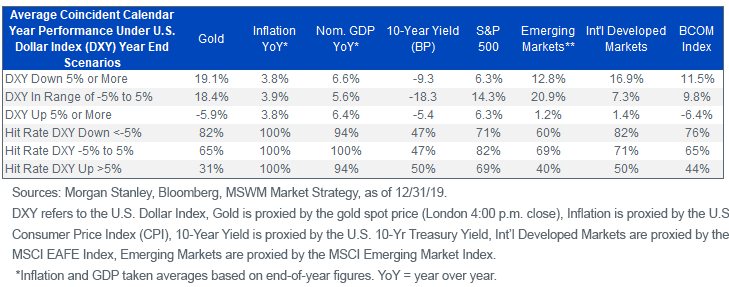

Hedging Risks to the Dollar

With higher anticipated inflation and an expanded monetary base, the U.S. dollar (USD) may be on a weakening path. To hedge the USD’s bearish outlook, we believe investors should allocate part of their portfolios to commodities.

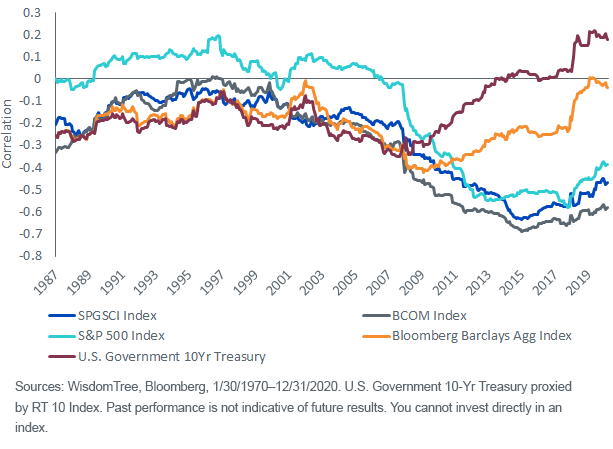

Commodities have historically tended to have a negative correlation against USD since they are priced in U.S. dollars—when the value of USD declines, global commodity prices become relatively less expensive for buyers in other currencies, and demand has tended to rise. A historical correlation chart shows that correlations between commodities and USD are in the negative territory, while the correlation with Treasuries rose above 0 in the recent years.

Rolling 10-Yr Correlation vs. USD

This inverse relationship can also be shown through commodities’ performance during different USD regimes. Commodities performed well during weak dollar periods—they generated a 11.5% return with a hit rate of 76%, meaning that their returns are positive 76% of the time, when the USD dropped 5% or more.

Conclusion

We expect 2021 to be a year of strong economic performance supported by large fiscal stimulus, loose monetary policy and the COVID-19 vaccine program. As investors balance between risk and return in this environment, we believe commodities should be considered as an essential allocation in portfolios to hedge inflation and to position for an economic rebound.

Important Risks Related to this Article

Prior to 12/21/20, the ticker symbol “GCC” was used for an exchange-traded commodity pool trading under a different name and strategy.

There are risks associated with investing including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors which contribute to the Fund’s performance. These factors include use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

GCC will not be invested in physical commodities. Futures may be affected by Backwardation: a market condition in which a futures price is lower in the distant delivery months than in the near delivery months. As a result, the fund may benefit because it would be selling more expensive contracts and buying less expensive ones on an ongoing basis; and Contango: A condition in which distant delivery prices for futures exceeds spot prices, often due to costs of storing and inuring the underlying commodity. Opposite of backwardation. As a result, the Fund’s total return may be lower than might otherwise be the case because it would be selling less expensive contracts and buying more expensive one.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

Using an asset allocation strategy does not assure a profit or protect against loss. Investors should consider their investment time frame, risk tolerance level and investment goals.

Diversification does not eliminate the risk of experiencing investment losses.

Jeremy Siegel serves as Senior Investment Strategy Advisor to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management, Inc. (“WTAM” or “WisdomTree”). He serves on the Model Portfolio Investment Committee for the Siegel-WisdomTree Model Portfolios of WisdomTree, which develops and rebalances WisdomTree’s Model Portfolios. In serving as an advisor to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.

Jianing Wu joined WisdomTree as a Research Analyst in October 2018. She is responsible for analyzing market trends and helping support WisdomTree’s research efforts. Previously, Jianing completed internships and projects at Geode Capital, Starwint Capital, and Invesco Great Wall Fund Management with a focus in quantitative research. Jianing received her M.S in Finance from the Massachusetts Institute of Technology. She graduated with honors from Boston College with degrees in Mathematics and Philosophy.