WisdomTree Cloud Computing Fund – February 2021 Rebalance Summary

The WisdomTree Cloud Computing Fund (WCLD) was the second-best performing ETF in the U.S. Technology Category in 2020, according to Morningstar, out of 64 funds.

The Fund returned 109.4% in 2020—an impressive achievement for a strategy with less than 6% overlap with the Nasdaq-100, a benchmark Index for growth investing.12

In our view, WCLD’s target exposure to pure-play, fast-growing cloud companies along with its equal-weighting mechanism are what sets it apart from its competitors.

WCLD—which seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index—recently completed its semiannual reconstitution and rebalance process.

Our strategy follows a rules-based methodology that resets constituents and weights back to equal weight in February and August. It is a simple, yet effective, approach that provides significant exposure to fast-growing, emerging businesses that are often overlooked or diluted in market cap-weighted benchmarks. The semiannual cadence also helps maintain a fresh pipeline of new additions, which we believe is key to sustaining WCLD’s strong performance.

Rebalance Results

The rebalance produced two key themes—initial public offerings (IPOs) and mergers & acquisitions (M&A).

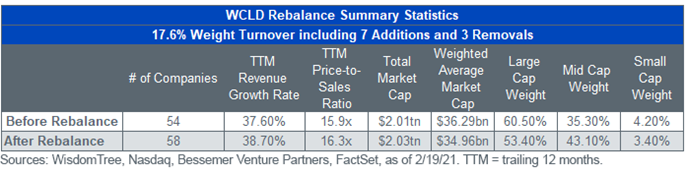

During this semiannual cycle, WCLD’s constituent count increased to 58 companies from 54, reflecting seven new additions and three removals from the Fund.

For definitions of terms in the table, please visit our glossary.

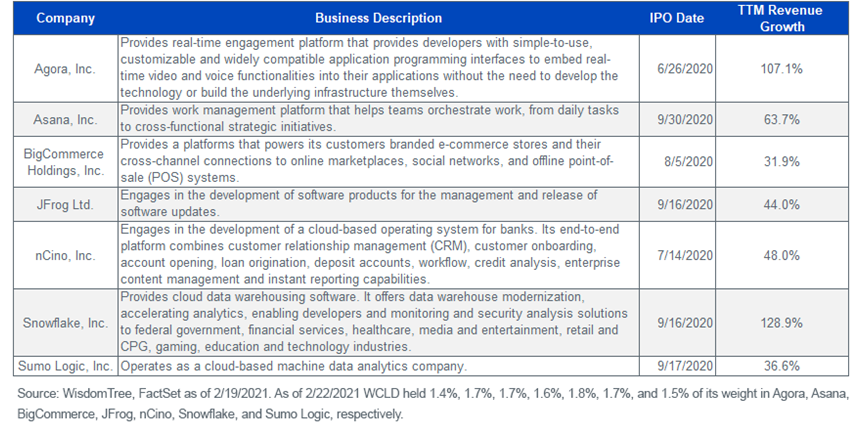

WCLD New Additions – All 2H 2020 IPOs

We recently wrote about the robust pipeline of cloud IPOs slated for the back half of 2020. But an influx of new public cloud stocks does not necessarily translate to a growing number of holdings in WCLD.

As a refresher, new additions to WCLD must meet two key fundamental criteria to be eligible for inclusion: 50% or more of their revenue must be derived from a cloud computing business or service, and companies must be generating at least 15% revenue growth.

The number of newly minted additions to WCLD this cycle attests to the impressive growth and focus that these recent market entrants are exhibiting.

Importantly, six of the seven additions to WCLD appeared on Bessemer Venture Partners’ Cloud 100 list prior to going public. Bessemer’s list ranks the top private cloud companies and serves as a measure of the strength of the private cloud market.

Twenty-six of the 58 constituents in WCLD are Cloud 100 graduates, and this subset of companies makes up a meaningful portion of WCLD’s total market capitalization.

Of course, not every Cloud 100 company will IPO. But Bessemer’s list provides valuable insight into the trends and developments in the private cloud market that may impact the public side. At the release of the list in September 2020, Bessemer noted that the developer software category had one of the largest percentage changes in aggregate valuation of more than 200% year-over-year.

Bessemer sees these same trends reflected in the rebalance of the BVP Nasdaq Emerging Cloud Index, with the addition of developer software companies like Agora and JFrog.3

“We saw a wave of cloud companies go public in 2H20 that we are excited to now include in the BVP Nasdaq Emerging Cloud Index after their seasoning period, and with this addition we note the maturity of cloud companies focused on building developer platforms and cloud infrastructure.” – Mary D’Onofrio, Partner at Bessemer Venture Partners

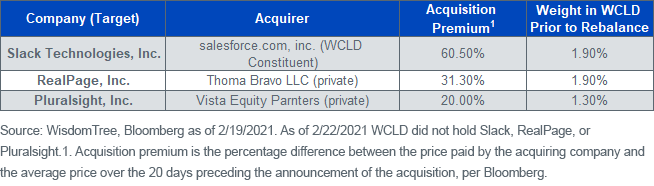

WCLD Removals – All Acquisition Targets

The only removals from WCLD were companies that are expected to be acquired.

From a quality-control perspective, this is an encouraging development. Not a single member of WCLD failed the fundamental screens to remain eligible, which include maintaining 7% revenue growth in at least one of the last two fiscal years and continuing to derive at least 50% revenue from cloud computing businesses or services.

This also marks a continuation of M&A activity we had written about previously. A total of 13 companies held within WCLD have been acquired at premium deal multiples. D’Onofrio said it best in her 2020 Benchmarks Report: “On the M&A front, cloud assets are highly prized and are being actively pursued for strategic acquisitions.”4

In Our View, WCLD Is the Preeminent Cloud ETF

WCLD, through the license of the BVP Nasdaq Emerging Cloud Index from Nasdaq, leverages the expertise of Bessemer Venture Partners, a leading venture capital investor in cloud-based businesses with a pulse on the private cloud market.

To gain exposure to the evolution of the public cloud market, investors should consider adding WCLD to their portfolio.

Please visit the WCLD Fund page for more information.

1Source: Morningstar as of 12/31/20.

2Sources: WisdomTree, Nasdaq, as of 12/31/20. Weights are subject to change. You cannot invest directly in an index.

3WCLD seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index.

4Mary D’Onofrio, “The Cloud 100 2020 Benchmarks Report,” Bessemer Venture Partners, 9/16/20.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost.

For standardized and month-end performance click here.

There are risks associated with investing, including possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

THE INFORMATION SET FORTH IN THE BVP NASDAQ EMERGING CLOUD INDEX IS NOT INTENDED TO BE, AND SHALL NOT BE REGARDED OR CONSTRUED AS, A RECOMMENDATION FOR A TRANSACTION OR INVESTMENT OR FINANCIAL, TAX, INVESTMENT OR OTHER ADVICE OF ANY KIND BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS DOES NOT PROVIDE INVESTMENT ADVICE TO WISDOMTREE OR THE FUND, IS NOT AN INVESTMENT ADVISOR TO THE FUND AND IS NOT RESPONSIBLE FOR THE PERFORMANCE OF THE FUND. THE FUND IS NOT ISSUED, SPONSORED, ENDORSED OR PROMOTED BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS MAKES NO WARRANTY OR REPRESENTATION REGARDING THE QUALITY, ACCURACY OR COMPLETENESS OF THE BVP NASDAQ EMERGING CLOUD INDEX, INDEX VALUES OR ANY INDEX-RELATED DATA INCLUDED HEREIN, PROVIDED HEREWITH OR DERIVED THEREFROM AND ASSUMES NO LIABILITY IN CONNECTION WITH ITS USE. BESSEMER VENTURE PARTNERS AND/OR POOLED INVESTMENT VEHICLES WHICH IT MANAGES, AND INDIVIDUALS AND ENTITIES AFFILIATED WITH SUCH VEHICLES, MAY PURCHASE, SELL OR HOLD SECURITIES OF ISSUERS THAT ARE CONSTITUENTS OF THE BVP NASDAQ EMERGING CLOUD INDEX FROM TIME TO TIME AND AT ANY TIME, INCLUDING IN ADVANCE OF OR FOLLOWING AN ISSUER BEING ADDED TO OR REMOVED FROM THE BVP NASDAQ EMERGING CLOUD INDEX.

Nasdaq® and the BVP Nasdaq Emerging Cloud Index are registered trademarks and service marks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.