Reflation, Flation, What’s Your Nation?

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Conjunction Junction, what’s your function?

I got “and,” “but,” and “or,”

They’ll get you pretty far…

Conjunction Junction, how’s that function?

I like tying up words and phrases and clauses

(From “Conjunction Junction,” School House Rock, 1973)

Investment Themes for 2021

As described in a previous blog post, WisdomTree has identified five primary investment themes that we believe have a high probability of playing out over the course of 2021 and beyond:

- Cyclical rotation back toward small-cap, value and emerging market stocks;

- Emerging markets, both in equity and fixed income;

- A focus on quality and income, both in equity and fixed income;

- Disruptive growth; and

- Reflation (higher-than-expected inflation in the second half of the year)

In this blog piece, we want to take a deeper look into this last theme—reflation.

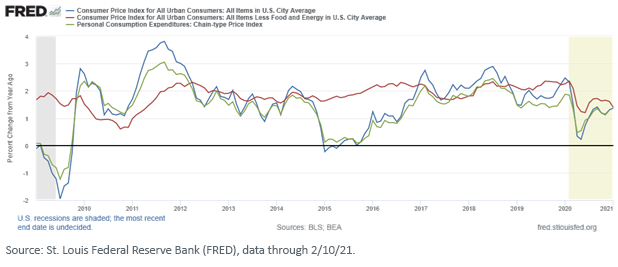

While official inflation indicators, such as the Consumer Price Index and the Personal Consumption Expenditures Price Index, are not yet showing any signs of a re-emergence of inflation, the U.S. bond market is preparing for a potential shift in the pricing outlook. In our “Inflate-Gate? Don’t Tell That to the Bond Market” blog post a couple of weeks ago, we highlighted how inflation expectations have been noticeably on the rise thus far in 2021.

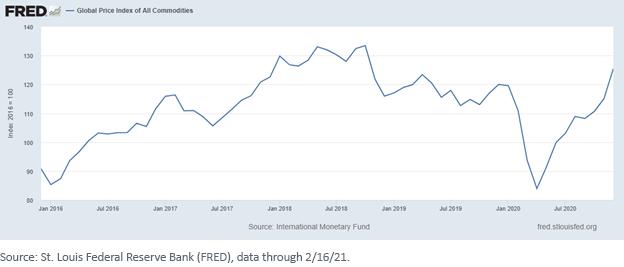

In addition, investors have witnessed rising price trends in purchasing managers’ surveys and, perhaps more importantly, in actual commodities. According to data from the International Monetary Fund, the Global Price Index of All Commodities has experienced a rather noticeable V-shaped recovery of its own, finishing 2020 at its highest level in more than two years… And guess what? According to real-time commodity gauges, both futures and spot prices have continued this ascending trajectory here into the first two months of the new year.

Product and Portfolio Implications

As we discussed a few weeks ago, WisdomTree offers a variety of fixed income product strategies that can help navigate inflation/interest rate risks. Another approach would be to focus exclusively on the commodity sector.

WisdomTree recently completed the reorganization of the WisdomTree Continuous Commodity Index Fund into the WisdomTree Enhanced Commodity Strategy Fund (GCC). The Enhanced Commodity Strategy Fund is organized under the Investment Company Act of 1940, as amended, with no Schedule K-1 that provides broad exposure to a diversified basket of commodities.

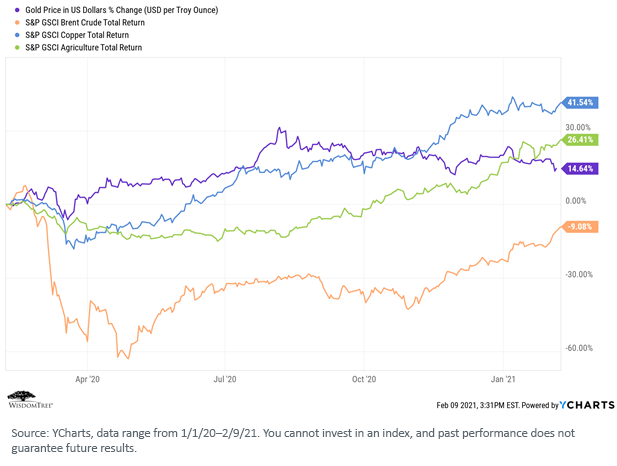

GCC emphasizes a diversified nature of commodities compared to the traditional well-established commodity indexes like the S&P GSCI Index (SPGSCI), which could have as much as 70%–80% of risk driven by exposure to the energy sector. Our approach maximizes this diversification with strategic weights roughly balanced between precious metals, industrial metals, agriculture and energy. In addition, we dynamically manage the futures contract “rolls” to potentially mitigate the headwinds faced by the more traditional use of just the front month contract.

Within the WisdomTree Model Portfolios, specifically within the Siegel-WisdomTree Longevity Model Portfolio and our Endowment Model Portfolios, we took an explicit gold position last March, and that trade worked well for us, though gold has stabilized over the past 2–3 months.

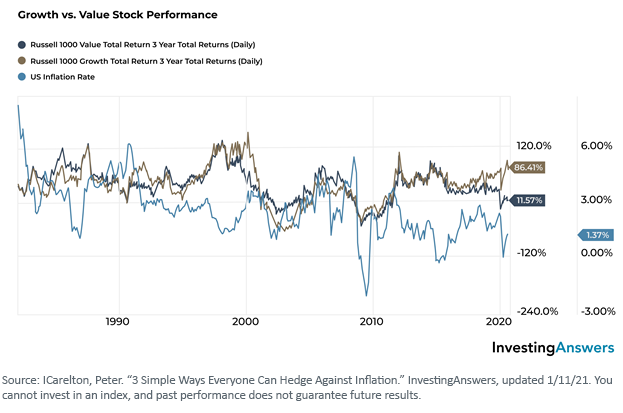

In addition, the Siegel-WisdomTree Longevity Model Portfolio is, by design, over-weight in equities versus fixed income. (We try to maximize current income via yield-focused equities instead of taking on excessive risk in our fixed income allocation.) Historically, equities have shown to be an effective hedge against modestly rising inflation:

In our December Model Portfolio Investment Committee meeting, we made some additional changes. While maintaining our existing gold position within the Siegel-WisdomTree Longevity Model Portfolio, we reallocated from our fixed income position into a broader commodity complex position, specifically GCC. Within our Endowment Model Portfolios, we reallocated out of gold and into GCC to give us a broader exposure to the global commodity complex.

Conclusion

If we are correct in our views on global economic recovery, a weak dollar and a general “reflationary” regime in the second half of 2021, we believe WisdomTree has both the strategies and Model Portfolios to meet your needs and help deliver a differentiated end client investment experience.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.