Winning against the Race to Zero

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Maybe someday, saved by zero

I'll be more together

Stretched by fewer thoughts that leave me

Chasing after my dreams, disown me, loaded with danger

So maybe I'll win (saved by zero)

Maybe I'll win (saved by zero)

Holding onto words that teach me

I will conquer space around me

So maybe I'll win (saved by zero)…

(From “Saved by Zero” by The Fixx, 1982)

Few would disagree that the wealth management industry is becoming increasingly competitive. Many refer to the current state of the industry as “a race to zero.” This is true on both the asset management side and the advisory side.

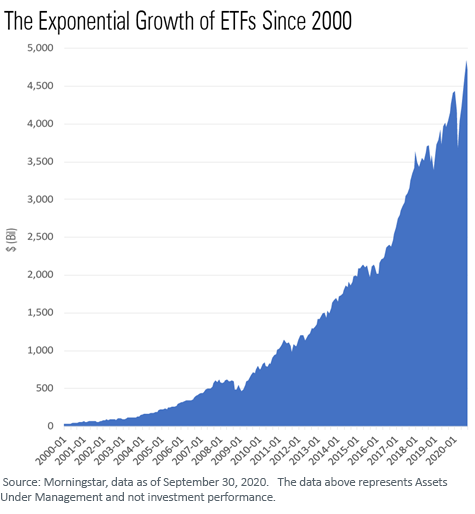

On the asset management side, the explosive growth of ETFs has put significant pressure on active management fees:

Even within the ETF space itself, we see continued downward pressure on the expense ratios for passive market beta products, up to and including zero fees, rebates on fees and even paying investors to invest.1

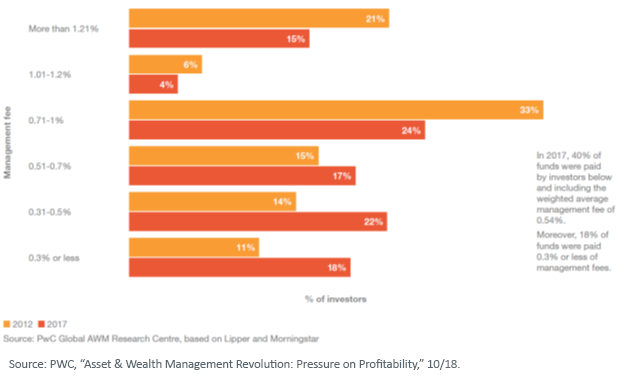

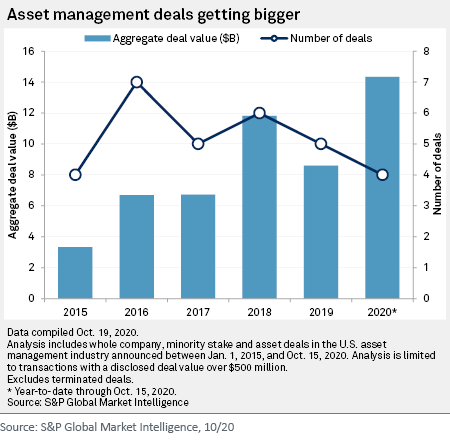

This fee pressure and the movement by both institutional and retail investors toward ETFs led to dramatic consolidation within the industry in 2020:

Distribution Analysis of Management Fees: Active Mutual Funds, 2012 vs. 2017

Advisors are facing similar competitive pressures. While fees have not felt the same level of downward pressure as in the asset management industry, it is happening. Clients want either lower fees or higher levels of service for the fees they pay.

One result is that there has been a distinct shift toward financial planning and holistic advice, and away from investment management as an advisor’s primary value proposition.

In 2020, Envestnet MoneyGuide published the results of a survey of financial advisors.2 Some of the key highlights of this survey include:

- Demand for financial plans is growing: The number of clients with a financial plan has been increasing since 2015. More than half (55%) of advisors' clients have a financial plan in 2020, up from 48% in 2015. In addition, advisors providing comprehensive planning grew 39% from 2017.

- 3 out of 4 advisors charge some type of planning fee: Advisors charging a fee, commission or via AUM for financial planning has jumped to 72%, up 8% from 2017. Of the 38% of advisors who charge a separate fee for a financial plan, almost two-thirds (65%) charge a flat fee and almost one in five (18%) charge an hourly fee. Interestingly, 8% charge a subscription fee. Additionally, 29% of advisors who charge some type of fee are considering implementing a different fee model in the future. For example, of those advisors, 44% are now considering implementing a subscription model in the next 12 months.

- Financial planning fees are on the rise: Since 2015, we have seen an increase in fees charged. Flat fees went up by almost 50%, averaging $2,482, and hourly fees went up almost 25%, to $257. On the other hand, those who charge as a part of AUM have maintained a fee rate steady around 1% since 2015.

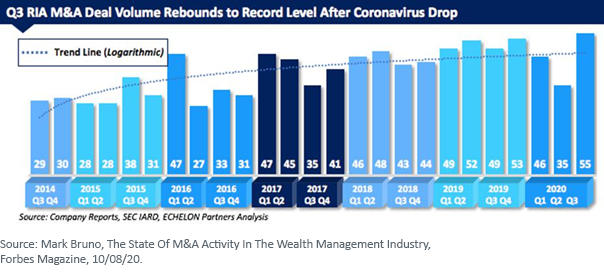

Another aspect of this evolving industry business model is that to successfully grow enterprise value, scale and efficiency are paramount. One way to accomplish this is consolidation, and 2020 was a banner year for mergers and acquisitions in the wealth management industry, despite (or perhaps because of) the Covid-19 pandemic:

Another way to drive scale and efficiency in an enterprise is through the use of outsourcing. There is no shortage of outsource providers in almost every aspect of running a wealth management practice—accounting, legal, marketing, compliance, performance reporting and so forth.

In the WisdomTree context, this means the use of WisdomTree Model Portfolios. We have written extensively about our models solution, including how the use of models can help drive scale and efficiency in a practice.

We have also done extensive research on how both advisors and clients view the use of model portfolios. The bottom line is that most clients have little to no reservations about advisors using third-party model portfolios if it helps them achieve their long-term investment objectives. In fact, many of them view the use of models as a distinct positive, and a majority indicate they would consider switching advisors if they knew the advisor used model portfolios.

Despite these survey results, we recognize that many advisors still view investment and portfolio management as a primary value proposition of their practice, which is why we are happy to work with advisors to build customized model portfolios tailored to their specific practices and investment objectives.

We want to be viewed as an extension of already in-house investment expertise, helping advisors deliver institutional-quality portfolios to their clients and, oh, by the way, helping those advisors drive scale and efficiency in their practices.

In addition to assisting with investment management, WisdomTree has also developed an award-winning Advisor Solutions Program that retains professional experts to help advisors with other aspects of running their practice—optimizing their online presence, recruiting and retaining appropriate professionals, retirement planning, improving communication and persuasion skills, and business transition and succession planning.

The race to zero is tough, and some will not finish. But the advisors who have the best opportunity to survive and thrive in this increasingly competitive marketplace will be those who

- Focus on their core competencies

- Enhance their retirement and financial planning offering

- Understand that their clients are objectives-based and not benchmark-based

- Optimize their online presence

- Access professional outsourcing solutions

WisdomTree created our Model Portfolios and our Advisor Solutions Program to do just that—help advisors maximize their potential to deliver a successful, profitable and differentiated client experience.

1See https://www.cnbc.com/2019/10/10/who-won-the-zero-fee-etf-war-it-looks-like-no-one.html. It should be noted that these somewhat exotic fee structures have, to date, not been sufficient to drive significant asset flows into those products. It appears the phrase “there is no such thing as a free lunch” still resonates with many investors.

2Envestnet MoneyGuide, “State of Financial Planning and Fees: The Bigger Picture,” https://www.envestnet.com/press/envestnet-moneyguides-latest-advisor-survey-finds-financial-planning-services-fees-rise.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on, for tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client, and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on, for tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client, and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures are subject to change and may not be altered by an advisor or other third party in any way. WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses, or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.