What if the Thing That “Roars” in the 2020s Is Commodities?

We recently completed the reorganization of the WisdomTree Continuous Commodity Index Fund (CCIF) into and with the WisdomTree Enhanced Commodity Strategy Fund (GCC). GCC is organized under the Investment Company Act of 1940, as amended, with no Schedule K-1 and an expense ratio of 0.55%.

There is an idea floating around that we are on the precipice of another Roaring ‘20s. By comparing Covid-19 to the Spanish Flu and adding in World War I to spice up the story, the thesis goes that a post-reopening build-out could set the stage for a booming economy and stock market.

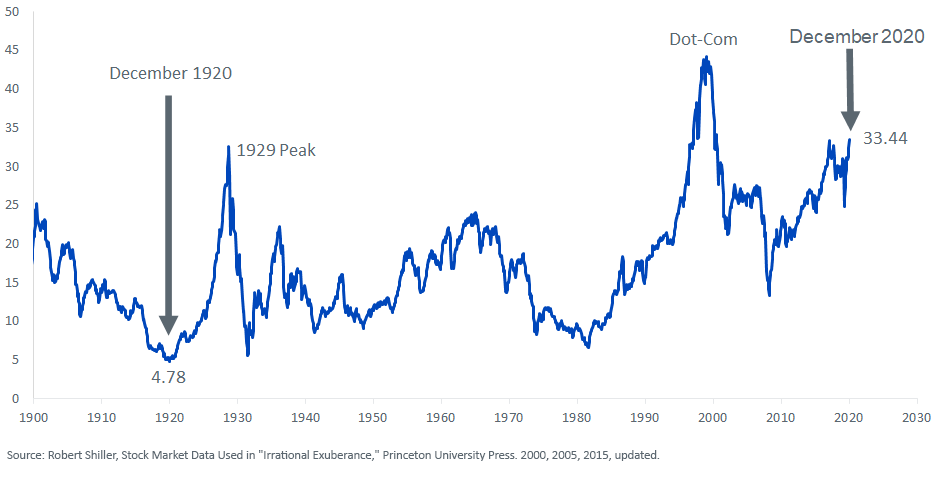

Just one problem. The stock market in 1921 was in a very different state than the stock market of 2021. Take a look at the cyclically adjusted price-to-earnings (CAPE) ratio, the measure that divides stock prices by 10-year average annual earnings, an effort to account for the market’s earnings power across good and bad times.

With data from Yale’s Robert Shiller, we know that December 1920 witnessed a CAPE ratio of 4.78, the absolute low of the 20th and 21st centuries. In the most recent reading, December 2020, the ratio was 33.44, higher than the valuation witnessed at the end of that decade-long bull market, in 1929 (figure 1).

Figure 1: S&P Composite Cyclically Adjusted Price-to-Earnings Ratio (CAPE)

With starting point valuations like that, the “60” in 60%/40% equity/fixed income portfolios may be on shaky ground—to say nothing of the current unprecedentedly low yields on offer in the “40.”

I do not want to deny some of the legitimate arguments put forth for justifying higher equity valuations in the modern era. For example, information availability has driven down risk premia. Diversification is also easier. Think about the process of buying and selling in the 1920s. You had to get yourself physically to the broker’s office. Once there, your guide was a chalkboard with quotes that could be hours old. Today, you can buy 500 companies from your iPhone while waiting in line at Starbucks.

Still, when the current CAPE ratio is exceeded only by the dot-com bubble, investors may need to consider a contingency plan for a struggling stock market. When appropriate, commodities can take the role of portfolio diversifier as the Roaring 20s turn into something closer to the “Meowing 20s.”

Why a meow?

As bad as the 2020 experience was, I think comparing Covid-19 to the combination of WWI and the Spanish Flu is faulty. Back then, the global population was one-fifth the size of today’s 7.8 billion. On that base, some historians estimate that as many as 100 million people perished. The current Covid-19 count is about 1/50th that amount.

Also–and critically—the war lasted from July 1914 to November 1918, far longer than the year we have been dealing with Covid-19. It’s hard not to rally after such devastation.

Another absent part of the comparison between the 1920s and the 2020s: entire swaths of Europe were destroyed, burned or bombed out from 1914 to 1918. There was physically something to rebuild. Today the buildings are still standing.

I know what you are thinking: a pending struggling economy, especially in commercial real estate, so why the bull case for commodities?

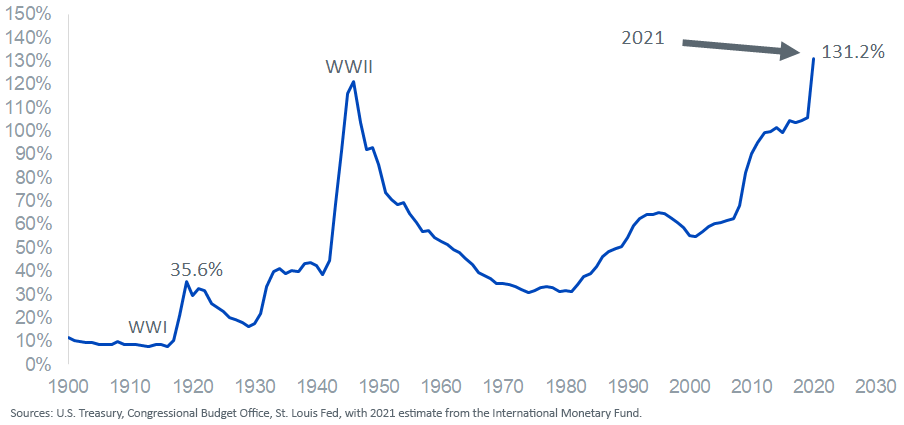

Because you know how officialdom plans to get out from underneath figure 2.

Figure 2: U.S. Debt-to-GDP Ratio

I believe the U.S. government’s financial situation may be so out of control that it will counter natural deflationary forces such as declining office rents and labor’s lack of bargaining power.

Consider that Fitch, the ratings agency, is penciling in a 2020 deficit-to-GDP ratio of 18.5%. For 2021, more red ink; Fitch expects a deficit equal to 11.3%. For context, that is a deeper deficit than in 2009, the worst year of the global financial crisis, when the federal government put up a $787 billion stimulus package.

How does the U.S. escape the debt burden? The same way that many governments do when they get into a pinch: they liquefy it via money creation. After all, U.S. M2 money supply has doubled in just the last nine years. It sets up a case for a rally in commodities, the asset class that may “find some love” in a stagflation scenario that witnesses stocks and bonds struggling.

Take a look at GCC. If officialdom continues to seek a way out of the debt build-up via monetary expansion, and stocks and bonds decide to misbehave, GCC could buffer trouble.

Here is something that may be noteworthy: in our Endowment Model Portfolios, which are available for financial professionals only, we recently began incorporating GCC. Please take a look to see how we work the strategy into an asset allocation.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk, and should not constitute an investor's entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund's performance. These factors include use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.