“Word Man, We Need Each Other – Words and Music”

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

“Word man, we need each other. Words and music.”

(From the movie Eddie and the Cruisers, 1983)

If you don’t know the movie Eddie and the Cruisers (and it’s likely that you don’t, though I recommend it), the actor Michael Paré plays Eddie Wilson, a talented but troubled musician in the early 1960s—the birth days of rock ’n’ roll. Tom Berenger plays Frank Ridgeway, a shy poet, whom Eddie calls “Word Man.” Eddie was expressing his belief that you need both words and music to succeed—which was why the two of them got along despite being completely different people.

In late 2020, the WisdomTree Research team built a list of five distinctive investment themes that we believe have a high likelihood of playing out over the course of 2021. That’s the “music.” The “words” are the WisdomTree Model Portfolios that fit each investment theme.

Here is a summary of those themes (presented alphabetically), why we believe in them and the corresponding WisdomTree Model Portfolio that aligns with that theme.

COVID-19 cases are spiking, which may put a damper on economic growth in Q1. At the same time, we believe we are making progress on the vaccination front, and the worst may soon (hopefully) be behind us. Additionally, Congress just passed a substantial fiscal stimulus package, and with the Biden Administration stepping in and the Democrats in control of both houses of Congress, we believe yet another (perhaps even larger) fiscal stimulus package will be approved before the end of Q1.

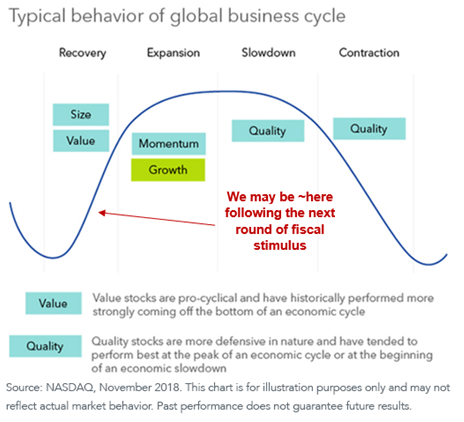

This translates into a potentially substantial catalyst to the economy. As we’ve noted in other blog posts, small cap, value and emerging market stocks tend to perform very well as economic growth recovers:

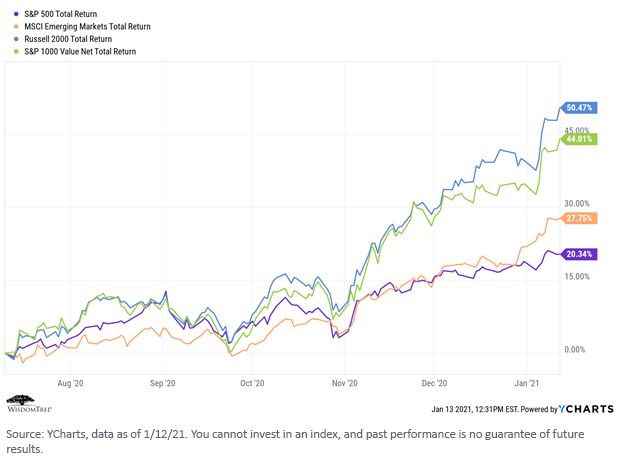

We can also see this in “real time” by comparing the recent performance of these three asset classes versus the broader S&P 500 Index:

Model Portfolio Implications: The WisdomTree Strategic Core Equity, Siegel-WisdomTree Longevity and Global Equity models all have strategic “tilts” toward small cap and value stocks and are over-weight in emerging markets (EM) compared to the MSCI ACWI Index. They are well positioned to benefit from what we believe will be a continuance of the current cyclical rotation as the economy recovers.

2. Disruptive Growth

While we believe in the current cyclical rotation back toward size, value and EM, we also believe that the COVID-19 pandemic fundamentally and perhaps permanently altered the way we work, socialize and entertain ourselves. We believe this has led to certain “thematic” sectors and industries that are showing huge growth trends. We refer to this as “disruptive growth,” and we think it will be with us for years to come. These industries include (but are not limited to) financial technology, cloud-based computing, platform-oriented businesses, human genomics, cybersecurity and online gaming and e-sports.

Model Portfolio Implications: With this growth theme in mind, in mid-2020 we launched the WisdomTree Disruptive Growth model. We identified six specific industry sectors and ETFs that focused on those sectors, and the performance of this model since inception has been exactly what we hoped for, outperforming both broad market indexes (e.g., the S&P 500) and even tech-oriented indexes (e.g., the NASDAQ). This portfolio carries high valuations corresponding to its high growth rates, and it will be volatile, but for advisors looking to capitalize on a thematic growth trend, we think it may be very interesting.

3. Emerging Markets

Based on our evaluation of fundamentals, economic and earnings growth prospects and our view on the dollar, we made the strategic decision back in late 2018 to go over-weight in emerging markets compared to the MSCI ACWI Index. (We are also over-weight in the U.S. and correspondingly under-weight in developed international, or EAFE stocks.)

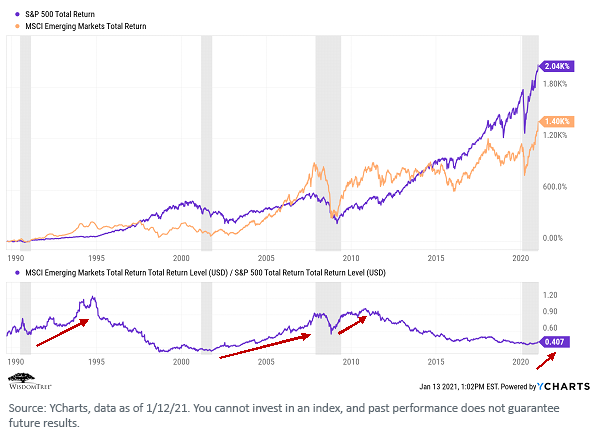

Our conviction to EM remains in place and is perhaps stronger than ever. As we mentioned above, EM historically has outperformed during periods of economic recovery. (The shaded gray areas below show periods of U.S. recession.)

Model Portfolio Implications: All of our Strategic Core Equity models are strategically over-weight in EM, and we believe they are well positioned to capitalize on the resurgence in EM performance.

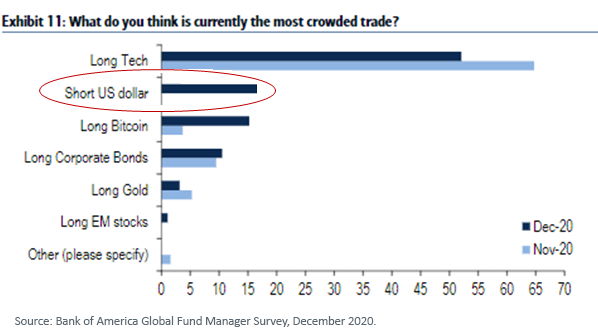

While our general market outlook is for a continuation of a weaker dollar, we do recognize that this has become a very “crowded” trade and is perhaps due for somewhat of a reversal:

Despite this, we continue to like the fundamental story of emerging markets and remain very comfortable with our current over-weight positioning.

4. Quality and Income

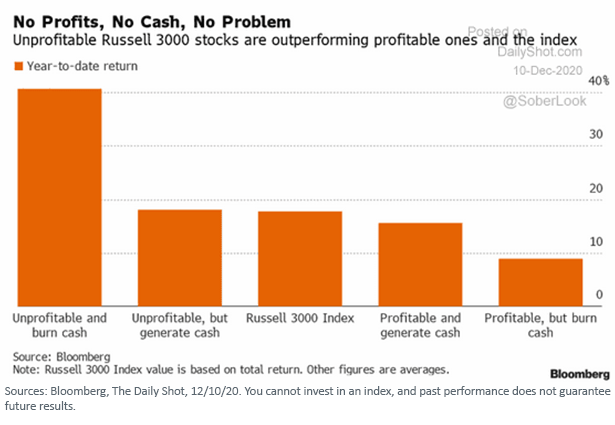

“Quality” companies refer to those with strong balance sheets, earnings and cash flows. This was a particularly “out of favor” factor throughout most of 2020, as “junk” companies dominated:

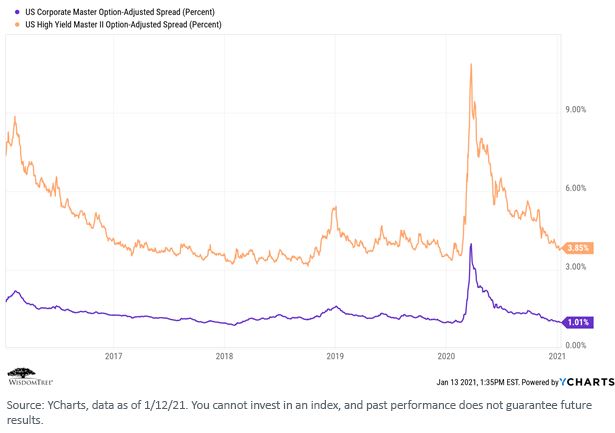

On the income front, we maintain our belief that interest rates will remain lower for longer. We have seen an increase in rates over the past several weeks as economic and COVID-19 vaccine news have hit the headlines, but that is relative—they are still very low, and credit spreads are back to historical averages:

Model Portfolio Implications: We continue to believe that advisors and end clients looking to generate current income out of their portfolios are better served by focusing on high-quality, yield-focused equities versus taking excessive risk in their bond portfolios.

Our Global Dividend, Global Multi-Asset Income and Siegel-WisdomTree Longevity models are built explicitly with these themes in mind. They all “tilt” toward higher-quality companies and are currently income-focused but allocate to yield-oriented equities instead of potentially riskier bond strategies. In a marketplace generally “starved for yield,” we have seen a great deal of advisor interest in these models, and we like how they are positioned in the current environment.

5. Reflation

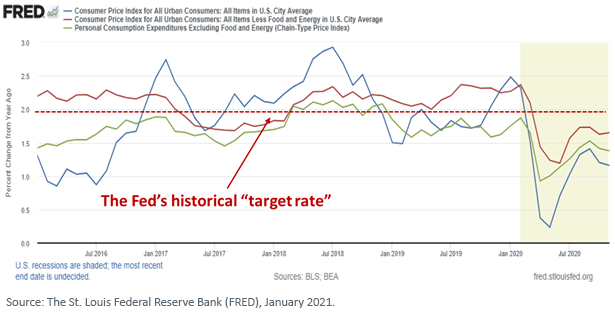

The last, but not the least, of our investment themes for 2021 is “reflation”—the reappearance of inflationary pressures as the global economy recovers. It is true that, to date, these inflationary pressures have not really materialized, at least in the “headline” indicators:

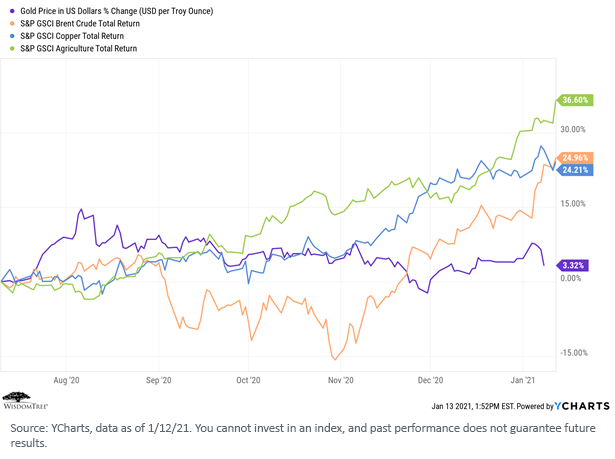

That said, the recovering global economy, combined with a weak dollar, has put upward pressure on the global commodity complex (i.e., “input prices”)—a trend we expect to continue:

We also believe there is a tremendous level of “pent-up demand” because of the COVID-19 lockdowns. As the vaccinations roll out and additional fiscal stimulus is implemented, we believe we may see a surge in consumption in the second half of 2021.

Model Portfolio Implications: We believe our Strategic Core Equity and Endowment models are well positioned in the event that we do see “reflation” enter the markets over the course of 2021. Both portfolios have allocations to inflation-sensitive equities, and the Endowment model has an explicit allocation to commodities and other real assets.

Conclusion

All WisdomTree models are built with specific investment objectives in mind and are designed to be “all-weather” portfolios—performing consistently regardless of market conditions.

That said, many of our models do have either strategic or tactical tilts embedded into them. Based on what we believe will be the five primary “investment themes” of 2021—cyclical rotation, disruptive growth, emerging markets, quality and income, and reflation—we are very comfortable with our current positioning and believe our models have the opportunity to perform very well as we move through the year.

For definitions of terms in the blog, please visit our glossary.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

The Siegel-WisdomTree Longevity Model Portfolio seeks to address increasing longevity by shifting the focus to potential long-term growth through a higher stock allocation versus more traditional “60/40” portfolios.