U.S. Quality Dividend Growth—2020 Reconstitution

Across the globe, quality stocks were among the best performers in 2020, as companies with high profitability maintained an earnings edge despite Covid-19’s impact on the economy.

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW), which seeks to track the WisdomTree U.S. Quality Dividend Growth Index (WTDGI), selects companies that look attractive according measures of profitability like return-on-equity (ROE) and return-on-assets (ROA), and earnings growth prospects, and weights them by their dividend stream.

This fundamental model has allowed WTDGI to garner exposure to dividend growers and stay away from companies at risk of cutting or suspending dividend payments.

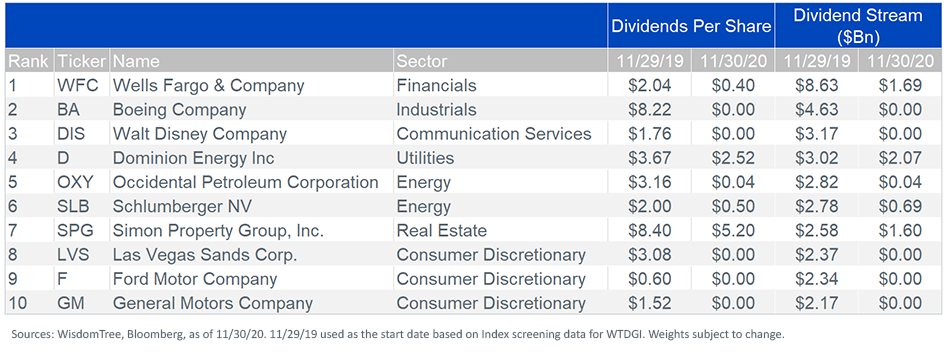

The below table shows the 10 largest S&P 500 Index companies that cut or suspended dividends since WTDGI’s 2019 rebalance.

Excluding Schlumberger NV, which was not in WTDGI’s starting universe, these companies cut a total of $26.3 billion in dividends. WTDGI did not hold any of the companies in the top seven, and the impact to its dividend stream was only $5.4 billion.

WTDGI is rebalanced annually to reset exposure to these companies and adapt to changing economic conditions. Here are some of the major changes after its December reconstitution.

Fundamentals

WisdomTree recently implemented a new Composite Risk Screening in the reconstitution process that aims to mitigate exposure to the riskiest dividend payers across our broad Indexes. Because WTDGI already explicitly screens for quality, these additional metrics were more marginal but slightly improved the Index’s overall quality profile.

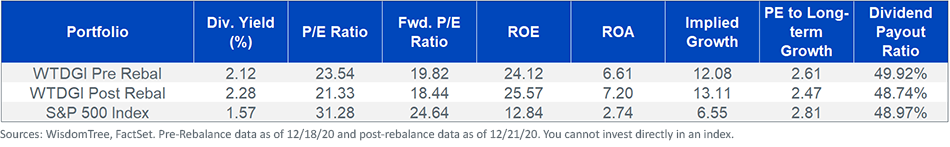

ROA improved from 6.61% to 7.20% and ROE improved over 100 basis points (bps), from 24.12% to 25.57%. Both of these significantly exceed metrics about the S&P 500 Index.

Along with improved quality metrics, the post-rebalance basket shows higher implied growth as measured by the earnings retention times the ROE. WTDGI also has 0.71% higher dividend yield than the S&P 500, with a 34% discount in forward valuation:

For definitions of terms in the table, please visit our glossary.

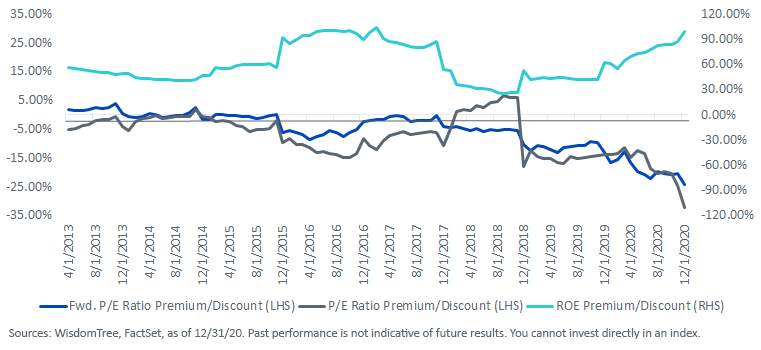

It is worth pointing out that WTDGI is trading at its largest valuation discount versus the S&P 500 Index since its inception in April 2013. In the chart below we can see how both the trailing and forward P/E ratios are at their largest discounts, while the relative improvement in quality as shown by the ROE premium, on the right-hand axis, is near an historical maximum.

Relative Valuation

Sector Exposure

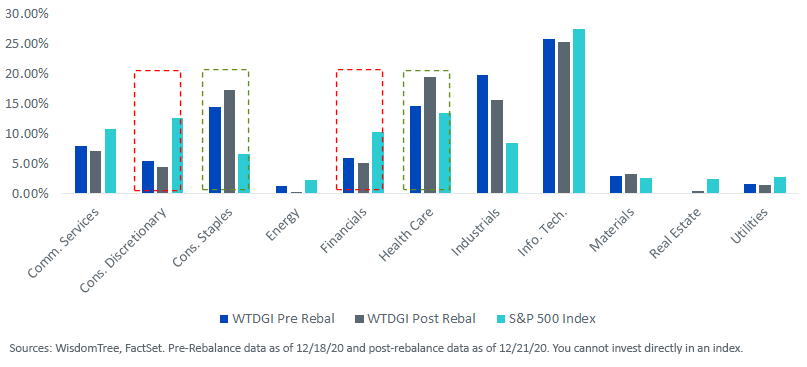

Another new feature in WTDGI’s 2020 rebalance relates to its sector caps. Starting in 2020, WTDGI will have a 25% cap in the Information Technology sector, better reflecting current market characteristics, while keeping a 20% cap in all other sectors.

During this latest reconstitution, the Health Care sector had the biggest percentage weight increase, driven by the addition of companies like Johnson & Johnson and Pfizer Inc, with weights of 4.61% and 3.68%, respectively. The Consumer Staples sector also saw an increase in exposure driven by the addition of The Coca-Cola Company at a 3.29%.

Noteworthy weight reduction came from the Industrials sector. Companies with large weight reductions were Raytheon Technologies, UPS and Union Pacific Corp.

Overall sector tilts versus the S&P 500 Index remain consistent as WTDGI remains underweight Financials and Consumer Discretionary while being overweight Health Care and Consumer Staples.

Single-Company Changes

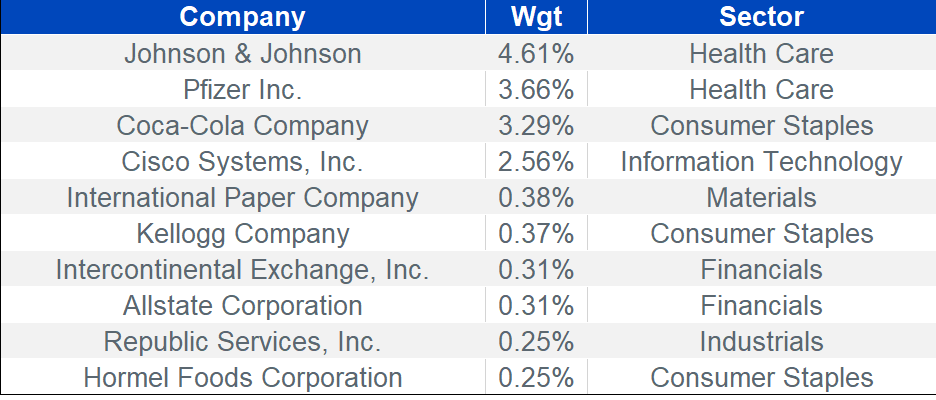

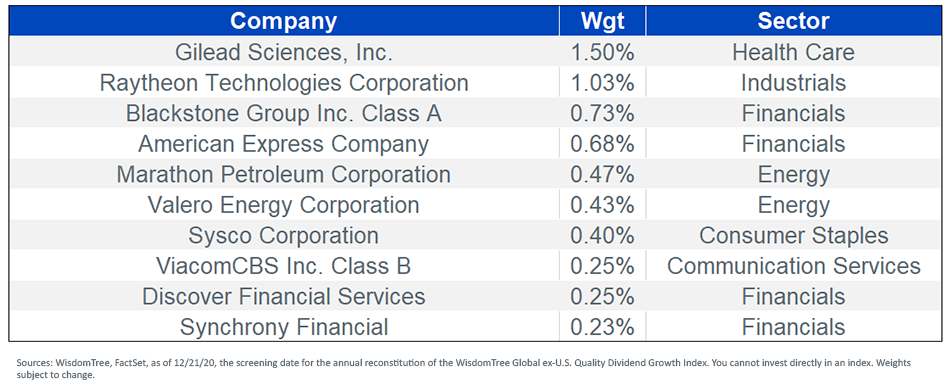

The tables below provide additional detail on the largest additions and drops from the Index.

Top 10 Adds

Top 10 Drops

At a time when many are concerned about valuations of speculative stocks, WisdomTree believes a focus on higher-quality stocks that pay dividends is a tried-and-true formula for long-term returns.

With the record valuation discounts we see from the launch of this quality index, we think 2021 is a particularly opportune time for this strategy.

Important Risks Related to this Article

There are risks associated with investing, including possible the loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.