How Much Tesla Do You Own?

It’s official. Elon Musk’s auto company—or tech company, or alternative energy company—is in the S&P 500 Index.

With the stock having multiplied eightfold in 2020 alone, Tesla entered the index on December 21, at a 1.6% weight.

There are several WisdomTree ETFs that do not hold Tesla. Here are two:

The WisdomTree U.S. Quality Dividend Growth Fund (DGRW)

The WisdomTree U.S. LargeCap Dividend Fund (DLN)

In addition to Tesla, other market darlings such as Amazon, Facebook, Netflix and Google-parent Alphabet are also out of DGRW and DLN—because of these stocks’ non-existent dividends.

I worked in private banking for 11 years. When we bid for new business, a competitor’s brokerage statement would land on my desk with a thud. It was a common scenario to be looking at an XYZ Corp executive’s $20 million portfolio, of which $17 million was in XYZ stock.

Step one in these situations was to look under the hood at the funds comprising the other $3 million and figure out how much more XYZ was actually in the portfolio.

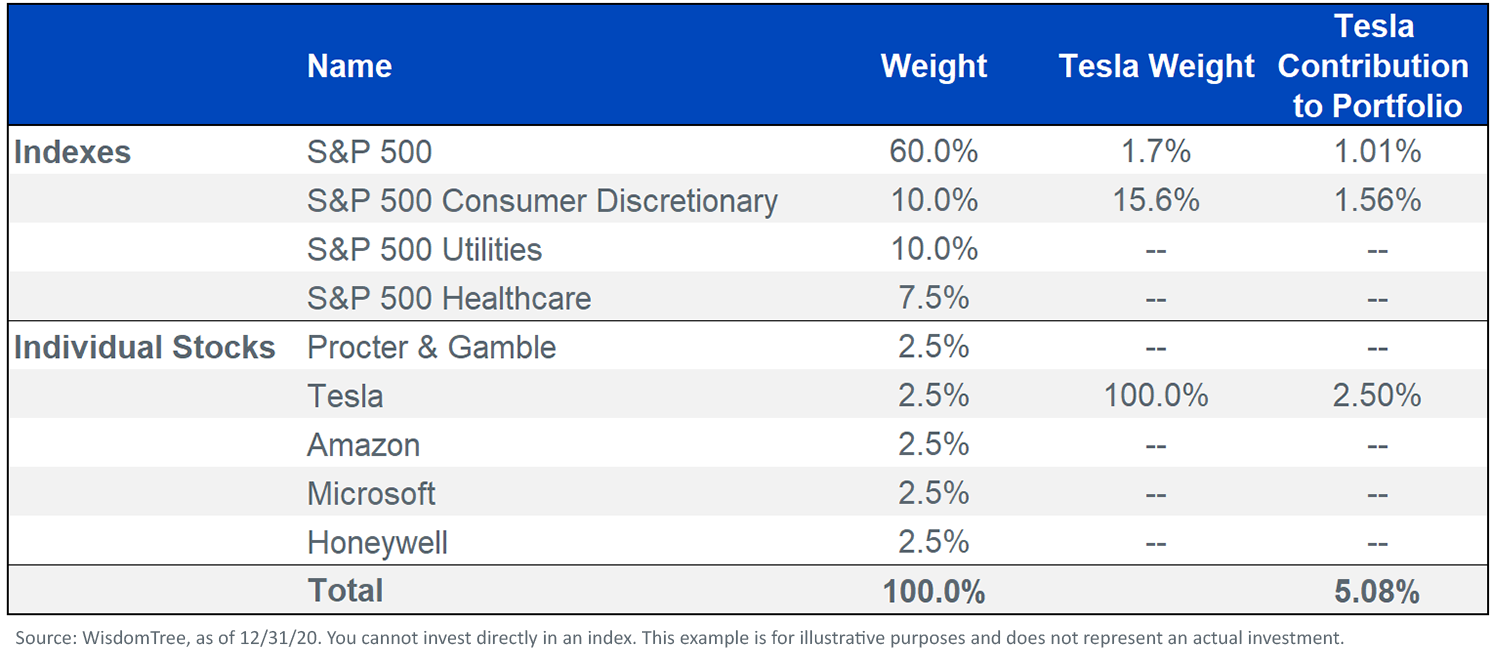

Let’s do the same for Tesla’s influence on this seemingly innocent sample portfolio.

Figure 1: Tesla in a Sample Asset Allocation

For definitions of indexes in the chart, please visit our glossary.

For definitions of indexes in the chart, please visit our glossary.

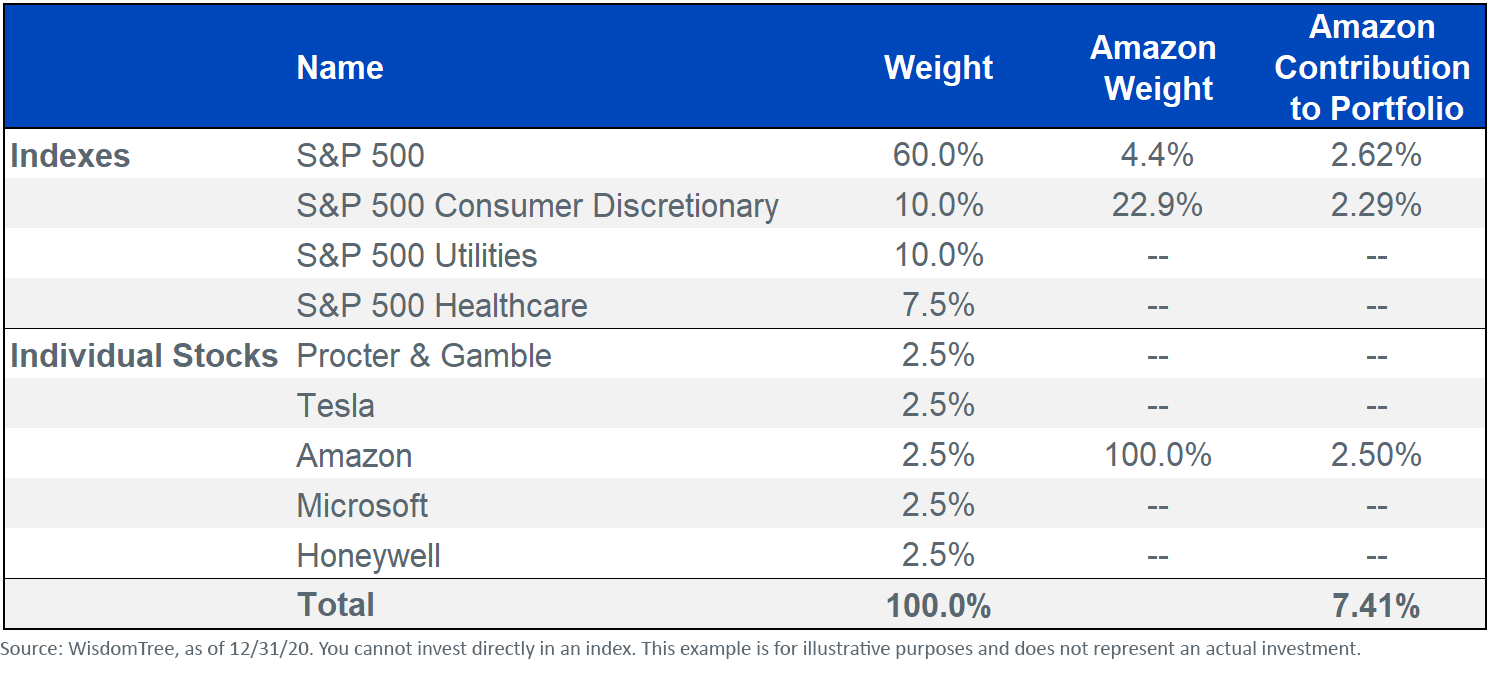

Tesla is not the only problem. Say hello to Amazon.

Figure 2: Amazon in the Sample Asset Allocation

I made the individual stock line items equal to 2.5%, but you know they could easily be a lot more. Tesla closed at $83.67 last New Year’s Eve. Just over one year later, it’s an “8-bagger,” a stock that has multiplied itself eight times. For this portfolio, increase the Tesla line item by the additional holdings of the stock inside the S&P 500 and the sector index. Congratulations, a concentrated stock work-out is now on the 2021 “To Do List.”

I made the individual stock line items equal to 2.5%, but you know they could easily be a lot more. Tesla closed at $83.67 last New Year’s Eve. Just over one year later, it’s an “8-bagger,” a stock that has multiplied itself eight times. For this portfolio, increase the Tesla line item by the additional holdings of the stock inside the S&P 500 and the sector index. Congratulations, a concentrated stock work-out is now on the 2021 “To Do List.”

What can be done? At the very least, use tracker funds that do not own the stock.

DGRW is our flagship for large-cap core equity. The “D” in the ticker symbol refers to the ETF’s dividend requirement. No dividend, no allocation, no Tesla.

If your concern is even deeper—that large-cap growth stocks in general are vulnerable—another “D” fund, DLN, is our large-cap value ETF. Like DGRW, it covers a broad swath of firms. Because it owns only dividend payers, it too has nothing allocated to Tesla.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.