Enhancing and Rebalancing Our Core Equity Strategies

In 2006, WisdomTree launched its first family of fundamentally weighted Indexes, challenging the market capitalization-weight status quo.

Allocating weights based on dividends or earnings challenged the efficient market hypothesis by suggesting that rebalancing to fundamentals could enhance returns. Our fundamentally weighted alternative helps manage valuation risk inherent to cap-weighted strategies that give stocks with higher multiples higher weights and allow those stocks to run without rebalancing on relative value.

We weight our Domestic Core Equity Indexes by earnings because we believe it can lower the price-to-earnings (P/E) ratios—a key metric for guiding risk and returns expectations.

Our team is dedicated to research and new factors to improve strategies, and our Domestic Core Equity family has incorporated an extra layer of risk reduction. The enhancements aim to limit exposure to outlying companies whose earnings may not reflect higher risk and lower quality.

The Core of Our Domestic Core Equity Family Is Unchanged

Our Domestic Core Equity family, which includes the WisdomTree U.S. LargeCap, MidCap and SmallCap Indexes, provide broad earnings-weighted exposure to profitable U.S. companies.

The annual rebalancing mechanism still resets weights based on the concept of relative value, which helps maintain a lower P/E ratio, and to ensure investors do not overpay—a topic of importance given the market’s recent run.

Implementing New Risk Constraints

Our risk constraints marry fundamental and technical analyses—utilizing earnings, quality and price information—to provide a more balanced view than a single metric alone.

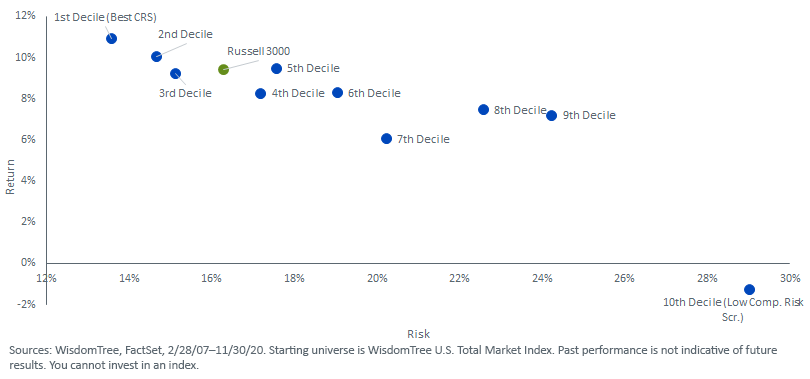

- Composite Risk Scores (CRS) – constructed as 50% quality (12-month static and 3-year trends in profitability metrics) and 50% momentum (6- and 12-month returns adjusted for volatility).

Stocks (profitable or not) are ranked across two distinct U.S. universes, separated by size into a large-/mid-cap group and a small-cap group. The stocks ranking in the bottom 10%, or the worst decile, are excluded from our core equity Indexes, eliminating exposure to companies indicated to be lower quality, lower momentum and higher risk.

WisdomTree U.S. Total Market Index - CRS Deciles - Risk/Return Characteristics (2/28/2007 - 11/30/2020)

- Active Sector Constraints – In addition to our existing 25% sector cap, we are introducing +/- 5% active sector constraints. This means sector weights will be limited within 5% of the sector exposure of a market capitalization-weighted version of our core equity Indexes.

- Individual Security Constraints – We are limiting the degree to which our core equity Indexes can be over-/under-weight in individual securities. Relative to the market capitalization-weighted version of our core equity Indexes, the weight of an eligible company will be equal to or between 0.33x and 3x its market cap weight.

2020 Rebalance Results

In mid-December, our Domestic Core Equity Indexes completed their annual reconstitution.

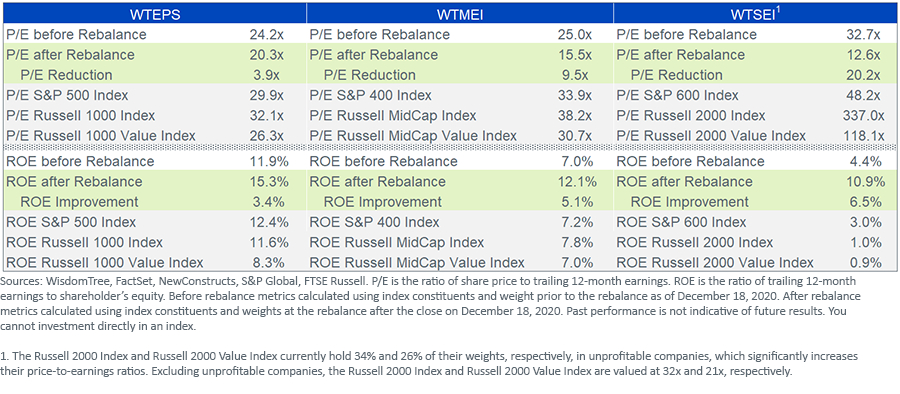

P/E ratios were decreased across the core family for the 14th consecutive year, and all Indexes are currently priced at significant discounts to their benchmarks.

As intended, the combination of earnings weighting and the exclusion of the worst-ranking CRS decile results in our core Indexes exhibiting high-quality characteristics, with aggregate return on equity (ROE) above their benchmarks.

2021 Positioning

2020 was a banner year for expensive, unprofitable stocks. Negative earners and the highest P/E stocks within the Information Technology (e.g., cloud computing stocks Twilio +244% and DocuSign +200%), Consumer Discretionary (e.g., Overstock +580%, Tesla +743%, Etsy +302%) and Communication Services (e.g., Pinterest +253%) sectors were the top-performing subsets of the Russell 3000 Index.1

According to Bloomberg, the 502 unprofitable and cash-burning companies within the Russell 3000 Index have returned 40.6% year-to-date, while the average return of the subset of companies with positive profits and cash flow was only 15.6% on average.2

These groups benefited from the “stay-at-home trade” at the expense of cyclical stocks linked to the reopening of the U.S. economy.

But that may be changing.

Since September 2020, value outperformed growth by 5.3%, as profitable and lower-valuation Financials, Utilities and Materials stocks rebounded.3

Looking ahead into 2021, these valuation-sensitive, earnings-weighted strategies are better positioned for the reopening of the U.S. economy than their market capitalization-weighted peers, and they bring nice valuations to boost.

1Sources: WisdomTree, FactSet, for the period 12/31/19–12/31/20. As of December 31, 2020, WTEPS, WTMEI and WTSEI did not hold Twilio, DocuSign, Overstock or Tesla. As of December 31, 2020, WTEPS held a 0.02% of its total weight in Etsy.

2Sophie Caronello, “It’s Profitable to Be Unprofitable in a Boon for DoorDash: Chart,” Bloomberg, 12/9/20. https://blinks.bloomberg.com/news/stories/QL3DSHT1UM1D. Accessed 12/18/2020.

3As measured by the performance of the Russell 3000 Value Index and the Russell 3000 Growth Index for the period August 30, 2020 to December 31, 2020.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.