How to Access Quality Across the Globe

Across the globe, the quality factor has been among the top performers in 20201.

This strong performance has been driven by companies with high profitability that have maintained their earnings growth trajectory.

The WisdomTree Global ex-U.S. Quality Dividend Growth Index (WTGDXG) selects companies from developed international and emerging markets that score well across measures of profitability like return on equity (ROE) and return on assets (ROA), and that have good earnings growth prospects.

Year to date, WTGDXG has outperformed its benchmark—the MSCI ACWI ex-US Index—by more than 800 basis points (bps), thanks to its quality dividend growth tilt.

Recently, WisdomTree conducted the annual reconstitution for its global dividend indexes—of broad dividends, high dividends and quality dividend growth.

In this post, we provide a review of the reconstitution of the WisdomTree Global ex-U.S. Quality Dividend Growth Index.

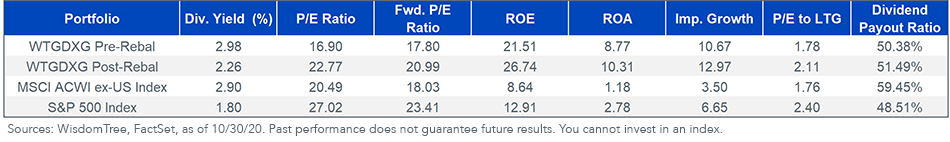

Fundamentals

Fundamentals after our rebalance show a significant increase in quality metrics. ROA improves from 8.77% to 10.31%, and ROE improves over 500 bps from 21.51% to 26.74%.

Along with improved quality metrics, the post-rebalance basket shows higher implied growth as measured by the earnings retention rate times the ROE.

Within its objectives, WTGDXG’s fundamentals show a portfolio with more attractive quality and growth metrics than the MSCI ACWI ex-US Index.

WTGDXG’s lower payout ratio signals its constituents are reinvesting a higher percentage of earnings in growth opportunities and could have more sustainable dividends. These advantages make WTGDXG’s price-to-earnings (P/E) premium seem like a fair trade-off for investors.

Compared to the U.S. market—represented by the S&P 500 Index in the table above—we can see how WTGDXG provides investors with higher growth at cheaper valuations. This basket of global ex-U.S. companies has a more attractive profitability and growth profile, higher dividend yield and lower P/E ratio than the broad S&P 500 Index.

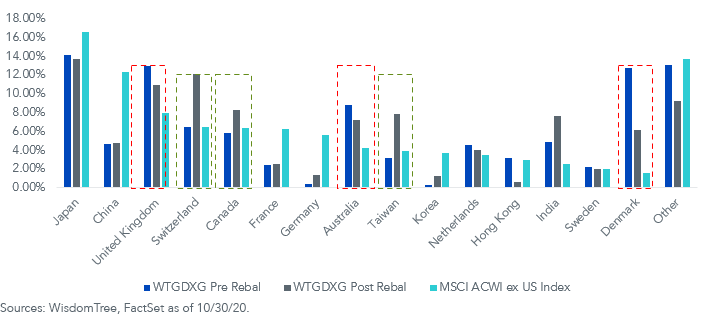

Country and Sector Changes

During this latest reconstitution, Denmark, Australia and the U.K. had notable reductions in their weights relative to the MSCI ACWI ex-US Index. Exposures to Switzerland, Canada and Taiwan were significantly increased.

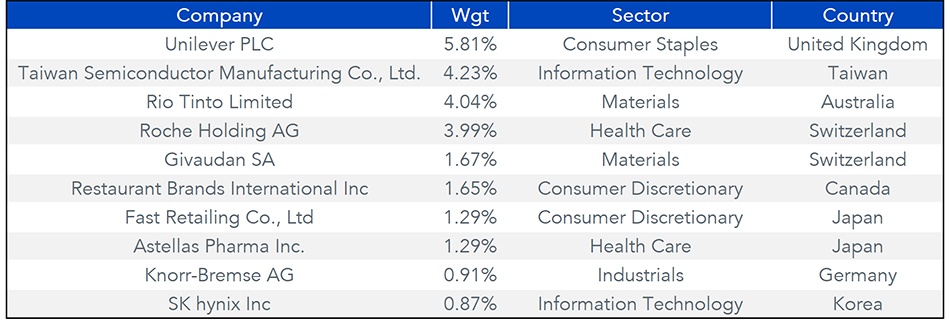

The largest change from a country perspective was Switzerland, whose weight increased 5.68%. This increase was driven by the addition of pharmaceutical giant Roche Holding AG (3.99% weight) and fragrance company Givaudan SA (1.67%). Both companies grew dividend payments in 2020 in the midst of the global Covid-19-related recession.

Taiwan had the second-largest increase, largely attributed to the addition of Taiwan Semiconductor Manufacturing Company—a 4.23% weight.

Country Exposure

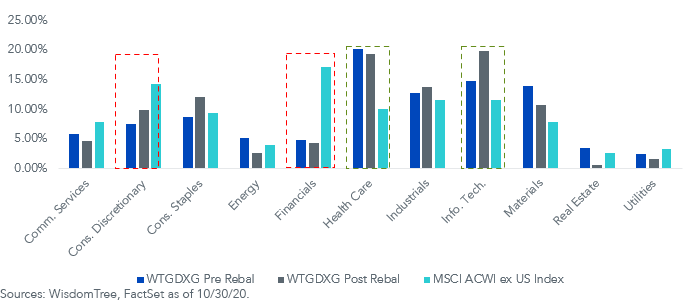

When looking at sector changes, Information Technology had the biggest percentage weight increase, driven by the Taiwanese company along with increased weight to Dutch semiconductor company ASML Holding.

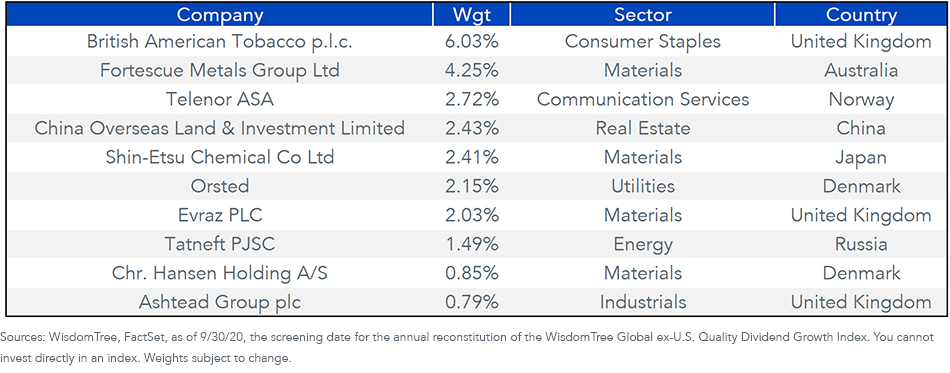

Noteworthy weight reduction came from the Materials sector. Companies with large weight reductions were Australian and Japanese companies Fortescue Metals Group (4.25%) and Shin-Etsu Chemical Co. (2.43%) respectively, along with British company Evraz PLC (2.03%).

Overall sector tilts versus the MSCI ACWI ex-US Index remain consistent as WTGDXG continues with significant underweights in the Financials and Consumer Discretionary sectors while being overweight Health Care and Information Technology.

Sector Exposure

Single-Company Changes

The tables below provide additional detail on the largest additions and drops from the index.

Of the top 10 drops, Evraz Plc (2.03% weight) and Tatneft PJSC (1.49%) were removed based on a new enhanced risk screening, introduced at this rebalance.

WisdomTree’s family of quality dividend growth indexes was designed for dividend sustainability and a growth emphasis. Because constituents are selected based on quality and estimated earnings growth, there is only a modest impact to our quality indexes from these new risk screens.

Top 10 Adds

Top 10 Drops

1Sources: WisdomTree, FactSet as of 10/31/20.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.