Did Value Wake Up Last Week?

There have been so many false dawns for value stocks in recent years that I hesitate to ask:

Was last week the turnaround?

If so, it would mark a switch that is 14 years in the making. The S&P 500 Growth Index’s bout of outperformance relative to the S&P 500 Value Index started in summer 2006. From July 31, 2006 through this past Friday, growth stocks returned 12% annually, a quintupling. S&P 500 Value, in turn, returned less than 7% annually, a return of “just” 156%.

The last couple weeks have seen a perfect storm for Big Tech, the sector that is growth’s driving force. With everyone forced to stay home, why not check in on your Facebook “friends” or watch a movie on Netflix—for the entirety of 2020?

Pfizer and BioNTech’s bombshell announcement that their vaccine demonstrated 90% effectiveness turned “the COVID-19 trade” on its head. With the prospect that this nightmare could go away in 2021, up went hotel stocks, airlines, oil companies—you name it—while most of the Big Tech giants watched the rally from the sidelines.

Facebook, which went into the pre-vaccine weekend changing hands at $293, ended the week at $277. Google-parent Alphabet’s A class of shares were little budged, up just 13 points to $1,772. This was in a week that saw the S&P rally 2.3%, with every non-Tech sector up, some sharply.

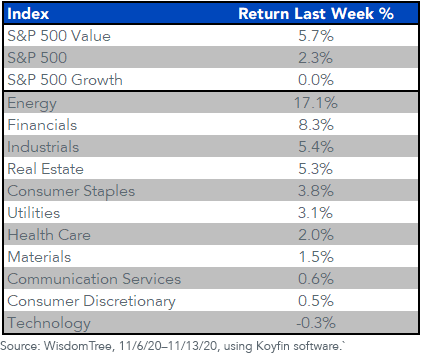

Figure 1: S&P 500 Performance Last Week

The vaccine was far from the only catalyst for value’s sharply higher week amid a tape that refused to reward growth-oriented Consumer Discretionary and Technology companies.

Beijing sent a chill through Tech bones when it announced its desire to check monopolistic power at Tencent, Alibaba and Meituan—that country’s three dynamos.

That development hit the wires in tandem with the EU coming after Amazon for anti-competitive practices, specifically pertaining to its use of vendors’ data to one-up small players in France and Germany. There has been no post-election rally for Jeff Bezos’s brainchild: At $3,128 per share, Amazon has been chopping sideways since July. It may be lost in the chatter amid the market’s November strength, but Amazon is $400 lower than its September peak above $3,500.

Unlike the disappointments in Silicon Valley, the S&P 500 Energy Index surged 17% last week, Financials 8%. Those are the two most quintessentially value sectors out there.

It makes you wonder: Is this it? Was the vaccine news “the thing” that is big enough, bold enough, life-changing enough to upend the market’s dynamics?

If that is the case, open the playbook: Rising interest rates on account of economic reopening would aid the banks. Your road trip to see your sister for Independence Day 2021? It may be on. That means the fuel demand we came to accept as “normal” in 2020 looks very different next year.

Is the 14-year wait for value to take market leadership control from growth finally over?

I will say this: If the market needed a catalyst—a big one—you would be hard-pressed to think of something grander than a COVID-19 vaccine announcement.

Unless otherwise stated, data source is Koyfin, as of November 13, 2020.