Addition by Subtraction: Scoring Dividend Riskiness

Markets discount future cash flows.

But the future is uncertain, so there are countless quantitative models and heuristics that investors use to cope with uncertainty in valuing securities.

WisdomTree’s original dividend Indexes assumed a dividend paid was a sign of corporate health—after all, a company must have profits to pay a dividend—and we assigned the weight of each company to its cash dividends paid, aiming for diversification to mitigate unforeseen tail risks.

But we recognize that some future dividends are in fact more uncertain (riskier) than others. It’s compelled us to remove exposure to the riskiest dividend payers in our Indexes and adjust dividend weights for our core dividends and high-dividend Indexes to account for the likelihood of dividends being maintained or grown.

Current Dividends as Guide

In the U.S., companies tend to size dividend payouts so they can be maintained in good times and bad to avoid the negative signaling associated with a dividend cut.

The implication is that today’s dividend can be viewed as a reflection of management’s confidence in future earnings and dividends.

And with no one having more information about the prospects of the business than its management, there is a fair amount of justification for tethering estimates of fundamental value to a company’s current dividend.

Dividend Stream® Weighting

This rationale—using today’s dividend as an objective measure of value—helped shape WisdomTree’s approach to Dividend Stream weighting broad investable universes. For the WisdomTree U.S. Dividend Index, for example, the roughly 1,400 largest dividend-paying U.S. companies were included in last year’s reconstitution. Constituents were weighted in proportion to their annual cash dividends.

Relative to market cap weighting, this approach naturally tilts toward companies and sectors in more mature businesses—those with higher payouts and lower reinvestment rates. It also means more of a tilt to “value” than “growth.”

While we still believe in the merits of this dividend-weighting approach, there are instances where we believe the trends in profitability (quality) and recent price performance (momentum) of a company can signal the riskiness of a company’s dividend.

To account for the inherent uncertainty in future cash flows, we believe we should discount the value we would otherwise assign to riskier companies that have a lower probability of maintaining/growing dividends and increase the value we would assign to the less risky companies with a higher probability of maintaining/growing dividends.

Composite Risk Scores

We’ve previously discussed the method that WisdomTree has come up with to evaluate the riskiness of a dividend. In short, we designed a composite risk score of 50% quality and 50% momentum to evaluate the safety of companies and their dividend.

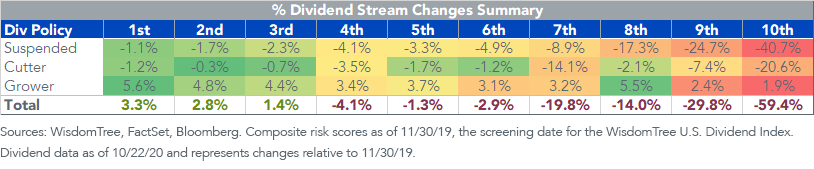

In 2020, a year that’s seen a 6% reduction in the Dividend Stream for the WisdomTree U.S. Dividend Index, companies in the 1st decile on the composite risk score (least risky) have actually grown their dividends by more than 3%. On the other end, companies in the 10th decile (most risky) have reduced their aggregate dividends by nearly 60%.

Dividend Changes Across Risk Deciles

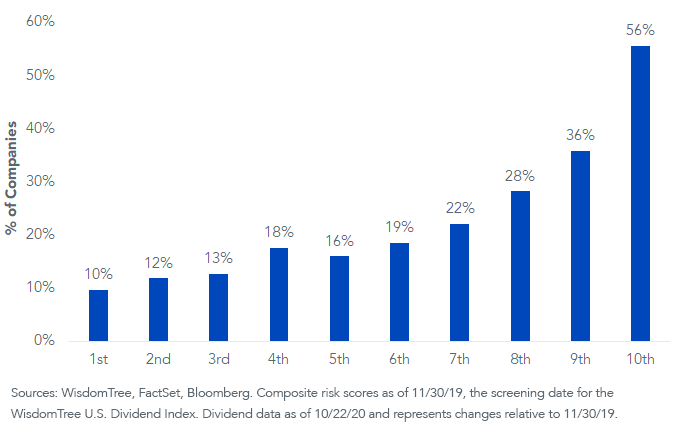

Another way to look at the dividend reductions across risk deciles is to show what percentage of dividend payers in each decile either cut or suspended their dividend this year. The 1st decile had just 10% of companies reduce payouts, whereas the 10th decile had more than half of companies reduce payouts.

Dividend Cuts/Suspensions Across Risk Deciles

We believe this composite risk scoring approach will help tilt away from companies with lower profitability, and thus less capacity to grow their dividends in normal times and more likely to reduce their dividends when the economy slows down—just the time when investors often expect outperformance, not underperformance, from dividend strategies.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.