Enhanced Risk Screening

WisdomTree pioneered fundamentally weighted dividend indexing with the goal of delivering lower volatility, higher income and excess returns relative to comparable market cap-weighted indexes.

And we’re constantly researching potential improvements to our indexes.

We recently developed several enhanced risk screens that we believe can mitigate the impact of “value traps” by screening out companies deemed most at risk of cutting dividends.

Why Now?

A few considerations:

- Live Stress Tests for Dividends: Two “once in a generation” stresses—the 2008 global financial crisis and the Covid-19 pandemic—as well as the acute oil price collapse in 2015-2016 provide a greater sample on how to mitigate tail risks in dividend portfolios.

- Seminal Research: Research published in recent years1,2 has provided insights on how to mitigate risk in value-tilted dividend indexes. Some helped motivate elements in newly launched indexes like our Quality Dividend Growth family and our Multifactor family.

- All-time Low Interest Rates: Mitigating risk in dividend funds is becoming more critical as investors increasingly turn to equities for income as a replacement for all-time low yields on benchmark government treasuries.

Process and Rationale

We aim to mitigate exposure to the riskiest dividend payers in two ways:

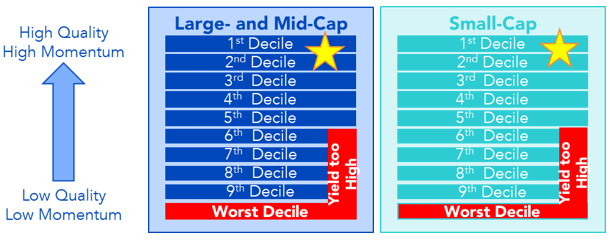

- Screening out companies that rank in the bottom decile of our starting universe of publicly traded companies based on a composite risk score (CRS) of quality and momentum factors.

- Screening out companies that rank in the top 5% by dividend yield and also in the bottom 50% based on the CRS.

First, quality (earnings) is the key driver of dividend sustainability and dividend growth. A company with sagging profits may be able to cover its current dividend by issuing debt or reducing capital expenditures. But in the long run, profitability will dictate whether a company can maintain and grow dividends.

Second, a momentum screen provides an attractive complement to our dividend weighting process that generally gives greater weight to companies with higher dividend yields relative to their market cap weight. When lagging share prices drive yields higher, these companies tend to be the riskiest and least sustainable payers. Momentum is used as a check on companies that have had a precipitous drop in their share price coincide with a higher dividend yield.

In addition to screening out the riskiest decile of companies based on the CRS, we also include a screening of the highest-yielding companies that also have below-average risk scores. Often, prior to a dividend cut, market participants will price a dividend as unsustainable, causing shares to underperform and the yield to skyrocket.

Risk Scores

The CRS of quality and momentum is constructed as follows:

- 50% Quality—Companies are ranked based on trailing 12-month profitability (static quality) as well as trends in profitability over the past three years (dynamic quality).

- 50% Momentum—Companies are ranked by their 6-month and 12-month returns to capture medium- to long-term price trends.

All stocks (dividend payers or not) are ranked on this CRS across six distinct universes: three regions (U.S., developed international and emerging markets) separated between large-/mid-cap and small-caps. This allows for comparing stocks with more “like for like” peers.

The dividend yield rankings are similarly constructing within these six distinct universes. As we show in the charts below, companies in the bottom decile on CRS are removed, as well as the companies in the bottom half of the CRS that are also in the top 5% of the respective universe according to yield.

Weighting Adjustments

In addition to this screening process, which is applied to all of WisdomTree’s dividend indexes, the core dividends and high dividends indexes (i.e., excluding quality dividend growth indexes) adjust dividend stream weights based on the same risk score. Companies ranking in the top two deciles on CRS have their dividend streams increased by 1.5 times.

The purpose of this adjustment is to give greater weight to companies that the risk score indicates are less risky, and thus have better potential to sustain and grow dividends.

Because WisdomTree’s quality dividend growth indexes explicitly select constituents based on criteria of quality and estimated earnings growth, no adjustments are made to that dividend stream weighting.

A Natural Evolution

There continues to be intuitive rationale for giving greater weight to companies with the financial health to pay greater dividends, and clear structural tailwinds for dividend-paying securities in a world of historically low interest rates and aging demographics.

We believe this enhancement can help weed out companies most at risk of cutting dividends, and thus acting as a drag on the portfolio, as well as reducing volatility and down-capture.

We will be sharing more information on this topic on this blog in the coming weeks.

1Robert Novy-Marx, “The Other Side of Value: The Gross Profitability Premium,” Journal of Financial Economics, 2013, vol. 108, issue 1, 1–28.

2Cliff Asness, Tobias J. Moskowitz, Lasse H. Pedersen, “Value and Momentum Everywhere,” The Journal of Finance, June 2013, vol. LXVIII, no. 3, 929–985.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.