What Do You Want? What Do You Want? I Want Disruptive Growth, You Betcha!

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these model portfolios.

Rise up gather round

Rock this place to the ground…

Rock on Rock on

Drive me crazier, no serenade

No fire brigade, just pyromania, come on

What do you want, what do you want?

I want rock ‘n’ roll, you betcha

Long live rock ‘n’ roll…

(From “Rock of Ages” by Def Leppard, 1983. My personal favorite “Big Hair” band of the 1980s… pour some sugar on me…)

A word that has gained importance in the global economy is “disruptive.” What that means in an economic and investment sense is twofold. It can mean either (a) companies that are “disrupting” preexisting industries (e.g., Uber1 vs. taxis or Netflix vs. movie theaters) or (b) new industries that are breaking new ground on how we will work and live going forward (e.g., cloud computing, human genomics and online gaming).

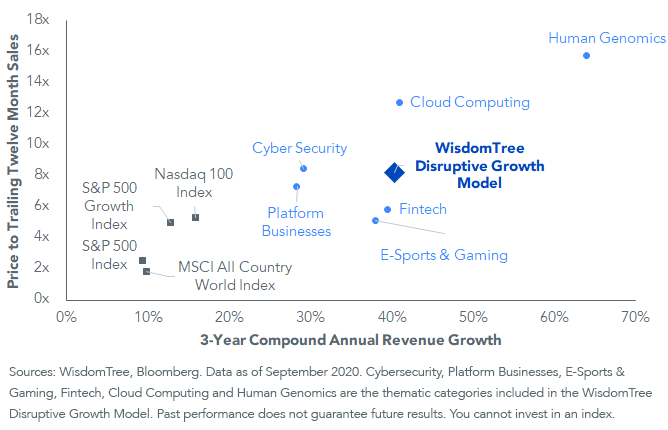

In either case, the companies that populate these “spaces” have shown some of the highest growth rates in the world over the past several years, whether measured by sales growth or valuations, and investors have reacted accordingly.

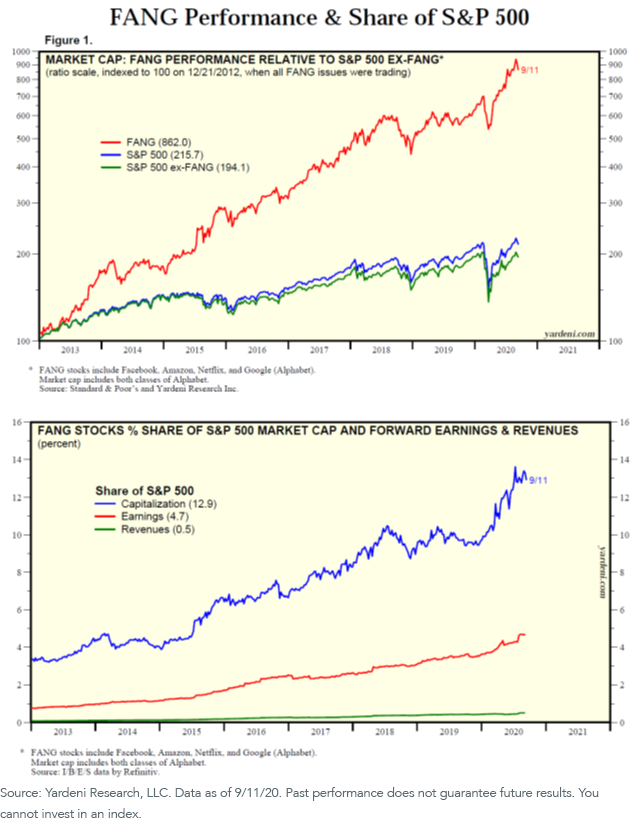

As a simple but defining example, consider the performance of the “FANG” stocks (Facebook, Amazon, Netflix and Alphabet (Google))2 relative to the broader S&P 500 Index over the past seven years.3 These four stocks currently constitute roughly 13%–14% of the entire market capitalization of the S&P 500 Index. If we tossed in Apple and Microsoft4, the gap would be wider. Some folks do include Apple and refer to “FAANG,” but no one has figured out to include Microsoft and still come up with a cool acronym:

In response to advisor demand and in recognition that “disruption” is more likely to be a longer- term trend and not just a fad, WisdomTree recently launched a “Disruptive Growth” Model Portfolio. It is a combination of six ETFs that (a) invest in companies in six very different but all “disruptive” industries, (b) collectively contain companies that have shown extraordinary growth rates over the past several years and (c) have relatively low position overlap to each other:

Growth vs. Valuation

For definitions of terms in the chart, please visit our glossary.

We have tried to create a diversified “go go growth” Model Portfolio for advisors who have end clients seeking this level of “juice” in their portfolio.

The portfolio currently is allocated across the following positions:

- WCLD: The WisdomTree Cloud Computing Fund, which seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted Index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers;

- PLAT: The WisdomTree Growth Leaders Fund, which seeks to track the investment results of high-growth, mid- and large-cap companies leveraging platform-based business models;

- A third-party ETF that focuses on financial technology innovation;

- A third-party ETF that focuses on human genomics;

- A third-party ETF that focuses on cybersecurity; and

- A third-party ETF that focuses on e-sports and online gaming.

As with all WisdomTree Model Portfolios, this portfolio (a) is “open architecture” and contains both WisdomTree and third-party strategies, and (b) carries no strategist fee5.

Advisors should know that many of the companies in these ETFs are “high beta” and currently carry very high valuations. This portfolio probably will also have higher volatility than a more traditional diversified portfolio.

Advisors, if you have clients seeking to engage in the “market disruption” theme from an investment perspective, we believe the WisdomTree Disruptive Growth Model Portfolio is worth considering.

1As of 9/28, PLAT and WCLD currently holds 1.3% and 0% of Uber respectively.

2As of 9/28, PLAT current holds 7.22% of Facebook, 8.8% of Amazon and 8.14% of Google (Alphabet) and WCLD does not hold any of these companies.

3Chart source: Yardeni Research, LLC, as of 9/11/20.

4As of 9/28, PLAT currently holds 8.74% Microsoft and 0% of Apple and WCLD holds neither Microsoft nor Apple.

5Although WisdomTree does not charge a strategist fee, there may be a “platform fee” depending on how advisors access the Model Portfolio.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

PLAT: There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty; these risks may be enhanced in emerging, offshore or frontier markets. Technology platform companies have significant exposure to consumers and businesses, and a failure to attract and retain a substantial number of such users to a company’s products, services, content or technology could adversely affect operating results. Technological changes could require substantial expenditures by a technology platform company to modify or adapt its products, services, content or infrastructure. Technology platform companies typically face intense competition, and the development of new products is a complex and uncertain process. Concerns regarding a company’s products or services that may compromise the privacy of users, or other cybersecurity concerns, even if unfounded, could damage a company’s reputation and adversely affect operating results. Many technology platform companies currently operate under less regulatory scrutiny but there is significant risk that costs associated with regulatory oversight could increase in the future. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WCLD: There are risks associated with investing, including possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.