How to Avoid Unintentional Currency Bets

Let’s say we erase all legacy biases, start with a clean slate and face the following choice:

Investment A: International Stocks

Investment B: International Stocks plus Currency

The vast majority of investors would likely choose International Stocks only. It seems simpler.

Yet to achieve Investment A, investors must put on a currency hedge that seems exotic. It’s like you’re being forced to make an active call on the direction of the U.S. dollar in foreign exchange markets.

Perception vs. Reality

The reality is that unhedged international strategies carry a second layer of risk and exposure courtesy of foreign exchange fluctuations. By not hedging currency risk, you are implicitly making a bet on an underlying currency, whether you realize it or not. Currency-hedged strategies have the goal of isolating returns to stock performance in their local markets, with no additional risk or movement from directional changes in local currencies. That is what most stock investors want in the first place, even if they don’t realize it.

By utilizing unhedged strategies, most investors inherently express bearish views on the dollar in perpetuity since the source of returns from their unhedged international strategy is attributed to stock and currency performance. That may not be their intention, but that is what they’re getting.

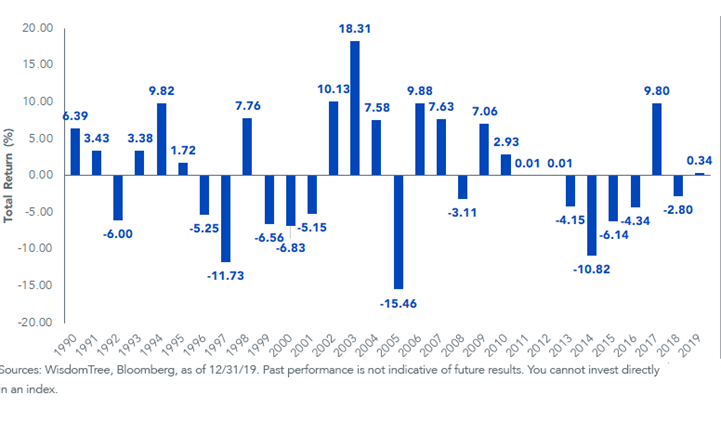

Looking at calendar-year returns of currency exposure in the MSCI EAFE Index, we see over the last 30 years there was approximately a 50/50 chance for currency moves up or down, with the average, absolute change being about 6.7%.

There is widespread agreement that expected returns from currency moves are zero, since conventional wisdom tells us that no one knows what currencies will do. One of the few guarantees of currency bets, however, is that they will add to the expected risk of international investments.

Why do investors insist on doing that?

Some don’t, and you don’t have to either.

MSCI EAFE Index Calendar Year Returns from Currency

Case Study: Buffett in Japan

Warren Buffett recently purchased five Japanese stocks valued at more than $6 billion. When announcing the purchases, Berkshire emphasized how it’s the ultimate passive and long-term investor.

While international ETF investors often argue that “currency washes out in the long run” to justify keeping exposure to currencies, Buffett implemented a currency hedge such that a sharply depreciating Japanese yen relative to the dollar cannot offset the gains he makes in the stocks.

Buffett implemented a currency hedge by issuing yen-denominated bonds maturing between 2023 and 2060. If the yen depreciates, his debt levels go down, offsetting any losses that come from being long the yen with his stock purchases. Consequently, Berkshire has “only minor exposure to yen/dollar movements.”1

Buffett often has access to preferred deals and opportunities that the common investor does not. But investors of all stripes have access to these same currency-hedging concepts by using currency-hedged ETFs.

WisdomTree pioneered these ETFs more than a decade ago.

The spike in popularity in 2014 and 2015 on central bank policies perhaps gave a misguided impression that currency-hedged strategies were supposed to be “tactical trading” vehicles, reliant on a view of the dollar’s direction.

But that’s not the intention of hedging currency bets.

Buffett is not a tactical investor making a bet the yen is going to depreciate. Rather, he is a stock investor who identified a good investment opportunity and wants to lower the risk his thesis goes astray with an unintentional currency bet on the yen.

Whether for broad international strategies or for specific regions like Japan and Europe, WisdomTree believes investors should consider investing internationally in a lower-risk fashion by removing unintentional currency calls through hedging instruments.

For those interested in WisdomTree’s offering of currency-hedged solutions, we believe the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) can help meet these objectives.

1Source: https://www.berkshirehathaway.com/news/aug3020.pdf

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Hedging can help returns when a foreign currency depreciates against the U.S. dollar, but it can hurt when the foreign currency appreciates against the U.S. dollar.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.