The Cloud IPO Pipeline

Public equity investors in cloud stocks are watching developments from the private markets carefully—particularly as many of the private companies look at valuations in the public markets as a good time to issue shares.

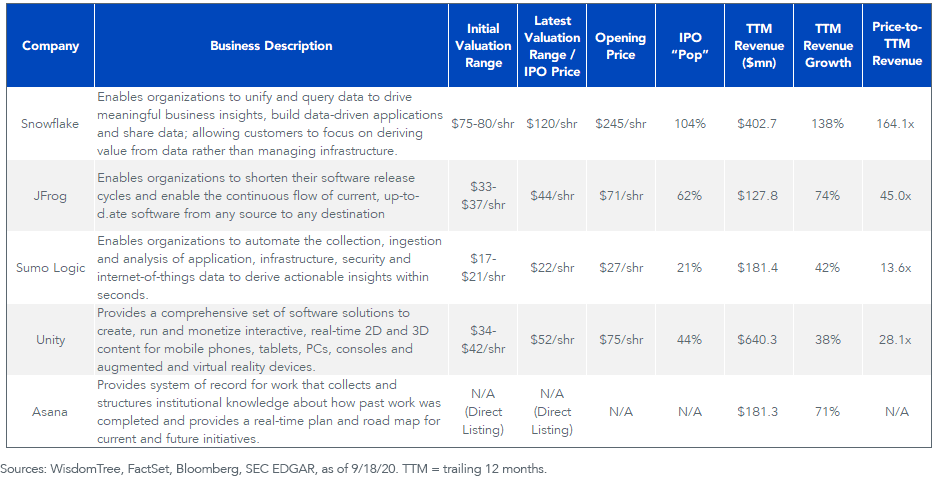

September and August 2020 have been active months for cloud computing initial public offerings (IPO). At the time of this writing, five companies have completed or are nearing the tail end of the IPO process.

Snowflake, a cloud data warehouse provider, was the blockbuster IPO of the week ending September 18. The company priced its offering at $120 per share, raising $3.36bn and valuing the company at approximately $33.5bn.1 Notably, Snowflake’s IPO price was 50% above the midpoint of the initial range estimated just a week prior. The increase in price reflected mounting demand for the company’s public debut, including investments from Berkshire Hathaway and Salesforce.2 Snowflake began trading on September 16 at $245/share, about 100% above its IPO price! As of this writing, Snowflake is valued at 164x trailing 12-month (TTM) sales.

JFrog, Sumo Logic and Unity Software began trading in the same week, but their newly listed shares experienced less of a “pop” than Snowflake’s.3

Given that the median public cloud company valuation is near a five-year high, the influx of IPOs is no surprise—raising capital at potentially premium valuations is attractive for private shareholders.

Bessemer Venture Partners has been tracking developments in the private markets in their Cloud 100 Benchmarks Report4 on an annual basis since 2016. Based on the previous Cloud 1005 lists, 33 of the 204 total private cloud companies have completed public offerings (this includes Snowflake, JFrog and Sumo Logic).

But did all the gains to investors in cloud stocks only accrue to private investors, and was it too late to buy once these companies hit the public markets?

Bessemer’s analysis shows that the IPO route has proven very accretive to public market shareholders—65% of public cloud companies’ current market capitalizations were captured in public markets, with only 35% created while private.

WisdomTree licensed the BVP Nasdaq Emerging Cloud Index from Nasdaq, which tracks the performance of public companies that meet Bessemer’s definition of a pure-play cloud computing company—complete with specific revenue growth thresholds and trading requirements. Companies must be publicly traded for three months before they are eligible for this cloud Index.

The private Cloud 100 list is interesting to watch because it gives a sense of developments in the private market. If these private firms decide to pursue IPOs, it is possible, but not guaranteed, that they could become candidates for inclusion in indexes as publicly traded cloud companies.

"The Cloud 100 has also delivered a meaningful portion of the public cloud software market capitalization, as measured by the BVP Nasdaq Emerging Cloud Index. Twenty-two of the EMCLOUD component companies are Cloud 100 graduates, contributing over $350 billion of market capitalization of the total $1.6 trillion.” –Mary D’Onofrio, Vice President at Bessemer Venture Partners

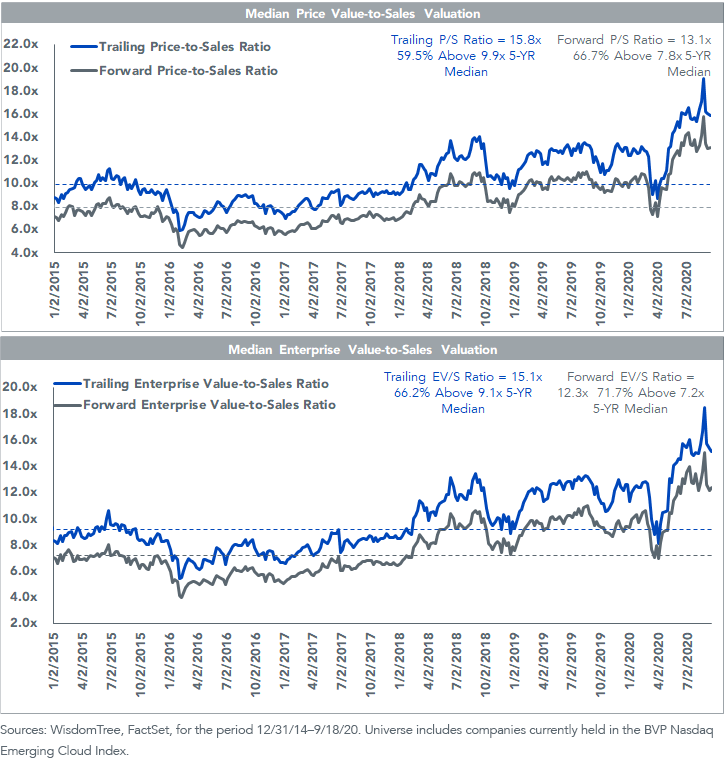

Public Cloud Valuations

Pure-play cloud stocks have notched record multiple expansions since the pandemic-induced trough of March 2020. Current valuations are approximately 60%–70% above their five-year medians.

Private cloud valuations are no different. According to Bessemer, the average valuation of the 2020 Cloud 100 List is $2.7bn, about 60% above the 2019 list’s average.

For definitions of terms in the charts, please visit our glossary.

The rise in public valuations can at least partially be explained by the outsized growth of the cloud industry.

In the first two quarters of 2020, a significant majority of companies in the WisdomTree Cloud Computing Fund (WCLD) delivered higher-than-forecasted revenue growth. The median WCLD constituent generated approximately 27% top-line growth, about 10x the median rate of the Nasdaq 100 Index.6

Realized results, which have showcased the industry’s expansion and defensibility, help to justify a valuation premium; however, the greatest challenge is determining the expectations that are priced in at current multiples.

Valuations appear to reflect continued strength in top-line growth over at least the next 12 months. The median WCLD constituent is forecasted to deliver 20% revenue growth over the next 12 months, well above the 6% forecast for the Nasdaq 100 Index.7 Some may argue that the deceleration to 20% growth forecasted over the next 12 months from 30% over the trailing 12 months is a red flag, but that 10 percentage point gap between realized and forecasted growth has persisted for the last five years, perhaps because consensus estimates have proven too conservative.

Beyond forecasted top-line growth, it’s unclear what expectations may already be reflected in today’s multiples. Over the medium- to long-term horizon, three potential positive catalysts that are top of mind include: 1) broad profitability across the industry; 2) industry consolidation via M&A (mergers and acquisitions); and 3) broad capital return through dividends or buybacks.

Positioning for Growth in the Cloud Industry

With a full roster of IPOs, public markets have a full plate of cloud companies to digest—can they do it?

Positive performance for the IPOs launched the week of September 18 provides an initial indication of “yes.” History also suggests “yes,” and that there could be more launches before the end of 2020. Based on Bessemer’s Cloud 100 lists alone, there were 13 and 10 cloud IPOs in 2018 and 2019, respectively.

Importantly, Bessemer views the success of the recent IPOs as a favorable indicator.

“The performance of recent cloud IPOs, including Snowflake and JFrog, speaks to the incredible public market demand for cloud software, and we are bullish about the prospects for the cloud IPOs and direct listings in the backlog.” –Mary D’Onofrio, vice president at Bessemer Venture Partners

Over the long term, we view growth of the public cloud universe, both in count and total market capitalization, as a positive development. We have high conviction that the application of cloud technology has hardly penetrated its total addressable market. Bessemer has predicted that cloud will become the underlying connectivity source of our global economy, leaving room for companies to enter new industry verticals and geographies.

As of this writing, the total market capitalization of publicly traded cloud companies, as measured by the BVP Emerging Cloud Index, stands at $1.6tn. Bessemer predicts that the public cloud benchmark will have reached $2tn by the release of the 2021 Cloud 100 list.

Investors can potentially position for the evolution of the cloud industry with the WisdomTree Cloud Computing Fund. WCLD seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted Index designed to measure the performance of emerging public companies.

1As of August 31, 2020, the WisdomTree Cloud Computing Fund (WCLD) did not hold Snowflake. WCLD seeks to track the performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index. The Index and, accordingly, WCLD require companies to meet a number of requirements for potential inclusion, including requirements around exchange listing, minimum volume, minimum capitalization and revenue growth.

2As of August 31, 2020, WCLD held 2.3% of its weight in Salesforce; it did not hold Berkshire Hathaway.

3As of August 31, 2020, WCLD did not hold JFrog, Sumo Logic, Unity or Asana.

4D'Onofrio, Mary. “The Cloud 100 2020 Benchmarks Report.” · Bessemer Venture Partners, 16, September. 2020

5“Cloud 100.” · Bessemer Venture Partners, www.bvp.com/cloud100.

6Sources: WisdomTree, FactSet, as of 9/18/20.

7Sources: WisdomTree, FactSet, as of 9/18/20.

Important Risks Related to this Article

Past performance is not indicative of future results. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Nasdaq® and BVP Nasdaq Emerging Cloud Index℠ are registered trademarks and service marks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”), and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

THE INFORMATION SET FORTH IN THE BVP NASDAQ EMERGING CLOUD INDEX IS NOT INTENDED TO BE, AND SHALL NOT BE REGARDED OR CONSTRUED AS, A RECOMMENDATION FOR A TRANSACTION OR INVESTMENT OR FINANCIAL, TAX, INVESTMENT OR OTHER ADVICE OF ANY KIND BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS DOES NOT PROVIDE INVESTMENT ADVICE TO WISDOMTREE OR THE FUND, IS NOT AN INVESTMENT ADVISOR TO THE FUND AND IS NOT RESPONSIBLE FOR THE PERFORMANCE OF THE FUND. THE FUND IS NOT ISSUED, SPONSORED, ENDORSED OR PROMOTED BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS MAKES NO WARRANTY OR REPRESENTATION REGARDING THE QUALITY, ACCURACY OR COMPLETENESS OF THE BVP NASDAQ EMERGING CLOUD INDEX, INDEX VALUES OR ANY INDEX-RELATED DATA INCLUDED HEREIN, PROVIDED HEREWITH OR DERIVED THEREFROM AND ASSUMES NO LIABILITY IN CONNECTION WITH ITS USE. BESSEMER VENTURE PARTNERS AND/OR POOLED INVESTMENT VEHICLES, WHICH IT MANAGES, AND INDIVIDUALS AND ENTITIES AFFILIATED WITH SUCH VEHICLES, MAY PURCHASE, SELL OR HOLD SECURITIES OF ISSUERS THAT ARE CONSTITUENTS OF THE BVP NASDAQ EMERGING CLOUD INDEX FROM TIME TO TIME AND AT ANY TIME, INCLUDING IN ADVANCE OF OR FOLLOWING AN ISSUER BEING ADDED TO OR REMOVED FROM THE BVP NASDAQ EMERGING CLOUD INDEX.