Achieving Transparency & the Four Ps of Due Diligence, Part I

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have direct access to these model portfolios.

A recent Ignites post1 summarized the findings of a comprehensive Morningstar survey2 on the explosive growth in model portfolio adoption by financial advisors and wealth managers. It highlighted some of the opportunities that come from the increased use of model portfolios, as well as some of the obstacles and hesitations to even greater adoption.

We’ve written before about the many opportunities for advisors that come with model portfolios, so we will summarize them here:

- A greater ability to focus on core competencies

- More time for serving and finding clients

- A more consistent investment experience for the end client

- Greater scale and efficiency, all of which can help advisors “build their book” or increase their enterprise value

But what about the obstacles? The Ignites post summarizes them nicely, citing the Morningstar report: “There are no clear standards on how managers report track records and ongoing performance for their paper portfolios, according to a recent report from the Chicago-based fund tracker. This places the onus on advisors to step up their due diligence and rely less on track records and more on their understanding of the processes and people behind the models.”

To summarize, advisors need to focus on due diligence, and model portfolio providers need to focus on transparency. In this blog post and our next one, we will tackle each issue separately. First up is due diligence.

The “Four Ps” of Due Diligence

If you speak to due diligence (DD) professionals, you will find that almost all of them apply a similar process to evaluating investments. They may call them different things, but they all focus on the following:

- People: Who is managing the model portfolio? What is their experience, expertise, tenure and historical track record?

- Philosophy: What is the investment thesis? How does this strategy expect to generate returns? Does it make sense? Do we believe that it can succeed consistently over full market cycles?

- Process: How is the investment thesis implemented and managed? What are the risk management protocols? How are buy, sell and rebalancing decisions made? Is there historical evidence that the process is disciplined and consistent over time?

- Performance: What is the long-term performance over full market cycles? Is the performance consistent with the investment thesis? Does the strategy “work” when it is supposed to and “struggle” when we expect it to? Do the risk/return characteristics of this strategy justify its fees?

Note that “performance” is the fourth and last of the decision criteria. This is because most DD professionals believe that if the first three Ps are in place and appropriately managed, performance will naturally follow.

So how do the WisdomTree Model Portfolios stack up to this 4P process?

People: The professionals managing the WisdomTree model portfolios have decades of experience in managing multiasset model portfolios. We have been managing live models at WisdomTree since 2013. There are multiple areas of expertise throughout the team, including asset allocation, asset class specialization and quantitative analysis. More than 20 research professionals are dedicated to monitoring and managing our model portfolios.

This team also collaborates with Dr. Jeremy Siegel, professor at The Wharton School and special advisor to WisdomTree.

Philosophy: We build model portfolios targeting multiple specific investment objectives, but those model portfolios all have several common characteristics, which, in combination, represent our overall investment philosophy:

- They tend to be global in nature. We are a global shop, and we believe in global diversification.

- They are open architecture, meaning they include both WisdomTree and third-party strategies. This allows us to take a “core/satellite” portfolio construction approach that we believe optimizes outperformance potential.

- They are diversified on both the asset class and risk factor levels, which we believe may improve performance consistency over full market cycles.

- They are all ETF-based in an attempt to optimize fees and taxes.

- None of our model portfolios incurs a strategist fee3.

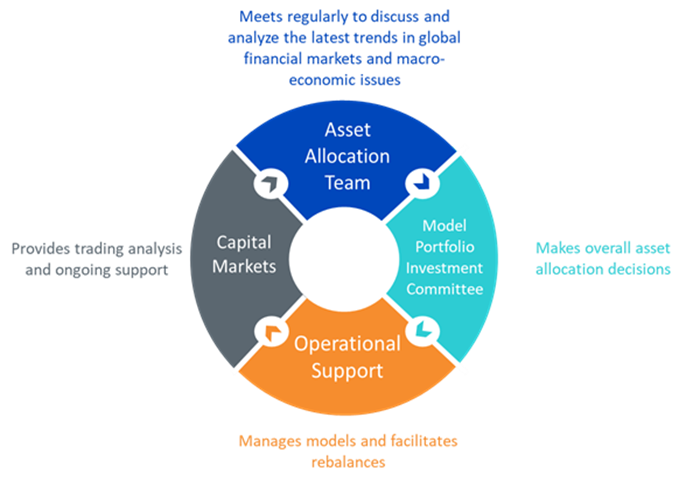

Process: Our model potrfolios are run in an institutional manner. It begins with our Asset Allocation (AA) Team, which consists of most of the global research professionals with our parent company and its subsidiaries, in both the US and London. This team meets twice monthly for a wide-ranging discussion of the global macroeconomic and investment landscape. Out of these meetings comes the WisdomTree “house view.”

The Model Portfolio Investment Committee (IC) is a subset of the AA Team, representing the team’s more senior and experienced members. The IC is the voting body for the model portfolios. It meets monthly, discusses model portfolio performances and contemplates potential changes to the model portfolios. It also discusses potential new model portfolios and more strategic issues.

If the IC approves any changes, they are communicated to our Operations and Capital Markets4 teams for execution at month-end. All changes are then made publicly available in a variety of formats.

This picture illustrates the “flow” of the portfolio management process:

Performance: All WisdomTree models are evaluated against market benchmarks appropriate to the given portfolio’s investment mandate. Performance is updated monthly and made publicly available in a variety of formats.

In summary, we believe that our institutional approach to managing model portfolios would pass the 4P test for most DD professionals.

In our next blog post, we will tackle the other potential obstacle to increased advisor adoption of model portfolios: transparency.

1Source: Jackie Noblett, “Model Market’s Explosive Growth Muddied by Data Gaps,” Ignites, 8/13/20.

2Source: “2020 Model Portfolio Landscape,” Morningstar.

3While WisdomTree does not charge a strategist fee, advisors may have to pay a platform fee, depending on how they access the models.

4Or to the various trading platforms and/or advisors who access the models by way of third-party platforms.

Important Risks Related to this Article

There are risks involved with investing, including possible loss of principal.WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only. They are not intended to provide, and should not be relied on, for tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client. They should consider the end client’s financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not indicate an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, is subject to change and may not be altered by an advisor or other third party in any way.