Fed’s Gonna Let the Economy Run ‘Hot, Hot, Hot’

While Powell & Co. didn’t necessarily telegraph the Jackson Hole announcement regarding the Federal Reserve’s (Fed) new policy framework, enough hints seemed to have been laid out of late suggesting this outcome should not be surprising. Nevertheless, I’ve watched the Fed for more than 30 years, and this new policy framework does represent a noteworthy shift in how monetary policy is now going to be delivered. Basically, the Fed is definitively stating that official policy can let the economy run “hot, hot, hot” in order to achieve its average inflation goal over time.

Let’s back up a minute to clarify my opening thoughts. As I blogged last week, Powell’s speech at this year’s Jackson Hole conference was going to be watched very closely by the money and bond markets to see if any hints regarding the Fed’s policy framework review would be dropped. In reality, Powell didn’t drop any hints, but rather the bombshell itself, formally announcing that, going forward, monetary policy “seeks to achieve inflation that averages 2 percent over time.” In other words, to quote the Fed statement: “Following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

Forward guidance will be an integral policy tool going forward in order to try and manage expectations (how long will the overshoot last?), and hopefully, volatility as well.

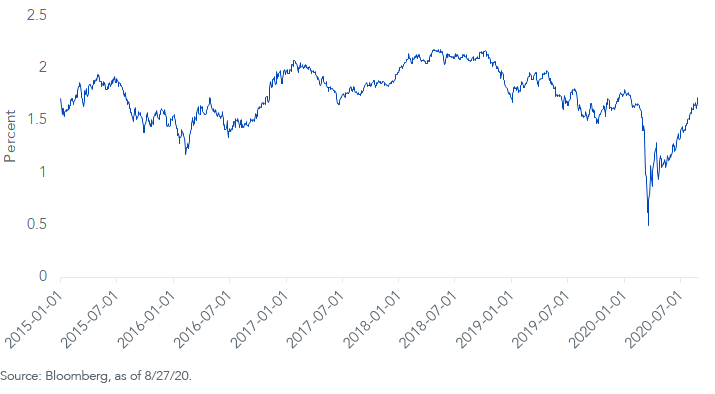

10-Year Breakeven Inflation Rate

What does that mean? Well, considering inflation has been undershooting the Fed’s target for quite some time, monetary policy is now set to let economic conditions produce an overshoot of inflation in order to achieve its “average 2% target.” The U.S. Treasury (UST) market is certainly paying attention. Look at how 10-year breakeven spreads (the UST market’s inflation expectation gauge) have performed since hitting a bottom back in March.

What can investors expect? While rates can still stay historically lower for longer, I expect the Treasury yield curve to steepen, led by rising UST 10-year yields moving above the 1% threshold, and perhaps retracing back up to the 1 ¼%–1 ½% range later next year (assuming no further pandemic-related setbacks).

How Should Fixed Income Investors Position Their Portfolios?

- Fixed income investors should consider: a) utilizing short duration strategies within their portfolio; and b) focusing on Treasury floating rate notes (FRNs) instead of TIPS (real yields, aka TIPS yields, can still rise)

- Position credit over rates in model portfolios with a more specific focus on core-plus solutions. This would include a high-yield sleeve that focuses on quality, which could potentially benefit from this “new” monetary policy approach.

Unless otherwise stated, all data sourced is Bloomberg, as of August 27, 2020.