I’ve Got Friends in Low Places

Well, I guess I was wrong

I just don’t belong

But then, I’ve been there before

Everything’s all right

I’ll just say goodnight

And I’ll show myself to the door

Hey, I didn’t mean

To cause a big scene

Just give me an hour and then

Well, I’ll be as high as that ivory tower

That you’re livin’ in

’Cause I’ve got friends in low places

Where the whiskey drowns

And the beer chases my blues away

And I’ll be okay

I’m not big on social graces

Think I’ll slip on down to the oasis

Oh, I’ve got friends in low places…

(From “Friends in Low Places,” performed by Garth Brooks, 1990)

We recently wrote about the investor demand for “low volatility” positions within their portfolio. Let’s update our chart from that blog for year-to-date (it ain’t pretty):

For definitions of indexes in the chart, please visit our glossary.

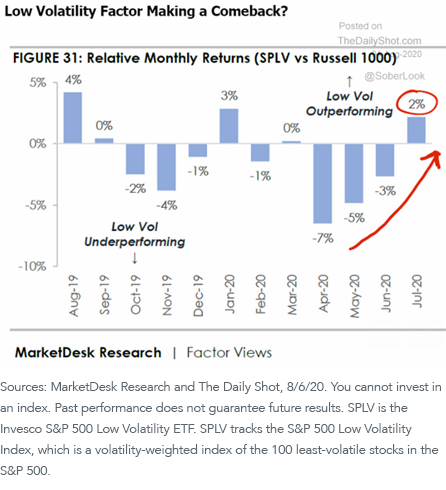

If we broaden our horizons (i.e., compare “low vol” to the Russell 1000 Index instead of the S&P 500, which is dominated by the mega-cap tech stocks), however, “low vol” seems to be making a bit of a comeback.

Furthermore, despite relatively anemic relative performance, investor demand for “low volatility” positions within their portfolios seems to be increasing, given the rise in overall market volatility due to the ongoing coronavirus pandemic and corresponding economic uncertainty. First, let’s illustrate the potential “regime change” in volatility:

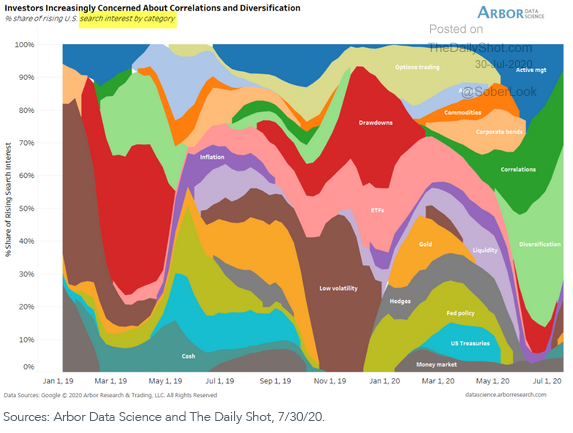

Now, let’s examine how investors are reacting to this potential volatility “regime change.” This next chart somewhat resembles a surrealist painting, but it illustrates an interesting point—investors increasingly are seeking “diversification” within their portfolios:

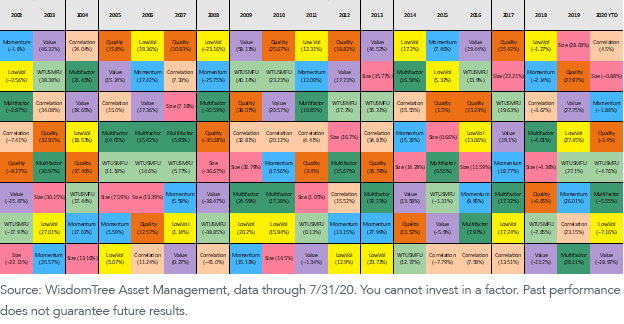

Finally, let’s remind ourselves of the importance of factor diversification as well as asset class diversification when attempting to build a truly diversified portfolio. Just like asset classes, risk factors rotate in and out of favor. In this busy “risk factor performance quilt,” focus your eyes on the dark green “multifactor” index box—notice how it tends to “cluster” around the middle, suggesting more consistent and stable historical performance relative to the other, more individual, risk factors:

All of this focus on “low volatility” diversification brings us to what we think might be an interesting WisdomTree solution set—our U.S., EAFE (Europe, Australasia and the Far East) and Emerging Markets (EM) multifactor strategies. All of these strategies screen for multiple risk factors, including quality, value, momentum and low correlation relative to the broader market.

The result is a “low vol” strategy (or, more specifically, a strategy that seeks to lower overall portfolio volatility by increasing the risk factor diversification), but at much more attractive valuations than the much-sought-after “low volatility” strategies.

As a point of comparison, as of mid-August a very popular ETF that tracks the performance of the S&P 500 Index currently trades at a price-to-earnings (P/E) ratio of ~24.9%. Another popular ETF that tracks the performance of the S&P 500 Low Volatility Index currently trades at a P/E ratio of ~23.3%—barely a discount for an Index that includes the hyper-valued mega-cap tech stocks.

But the WisdomTree U.S. Multifactor Fund (USMF) currently trades at a P/E ratio of ~18.2%—and it also carries lower valuations on a price/sales, price/cash flow and price/book basis. Additionally, the securities within USMF show significantly higher quality characteristics (e.g., return on equity, return on assets and leverage) than those other two ETFs.

The bottom line? If you are seeking smarter diversification within your overall portfolio, the WisdomTree multifactor strategies may be able to help you get there without overpaying for the benefit of “low volatility.”

Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment losses.

There are risks associated with investing, including possible loss of principal. Investing in a Fund exposed to particular sectors increases the vulnerability to any single economic, political or regulatory development. This may result in greater share price volatility. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.