A Biden Victory Could Be Bullish for China

Federal officials just busted open the back door of the Chinese consulate in Houston, accusing it of being a “hub of spying.” So maybe it’s time to buy Chinese stocks.

Say what?

In “normal” times, a deterioration in Sino-U.S. relations of this order might lead the news cycle for weeks. But then again, this is 2020, a year when The New York Times can drop UFO hints that don’t even make it to the “trending” list on Twitter.

Here is a thesis. The market’s playbook goes something like this: “As goes Joe Biden, so go Chinese stocks.”

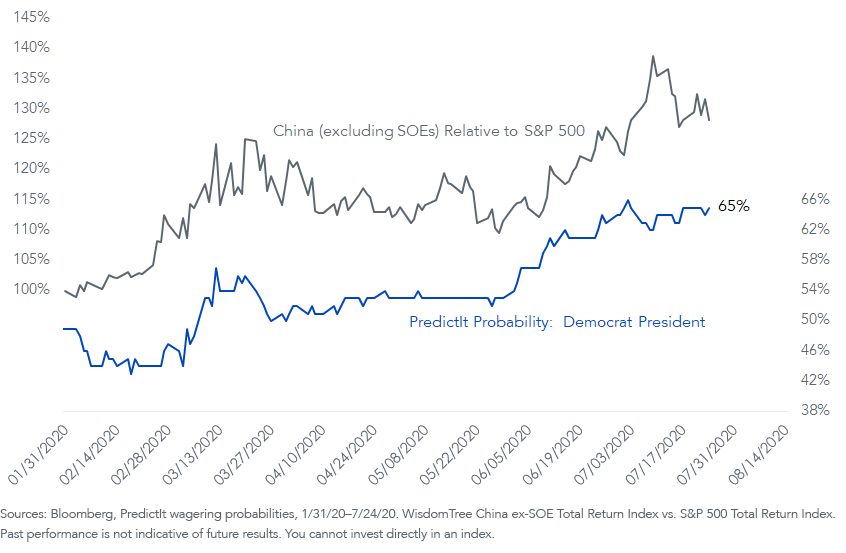

Figure 1 shows the performance of the WisdomTree China ex-State-Owned Enterprises Index relative to the S&P 500, along with Biden’s victory probability on PredictIt, the gambling site. Wager $65 on Biden, and it will pay $100 (a $35 profit) if he prevails. If you are wrong, you lose the $65.

If the blue line in the chart keeps going up, clear to 100%, does the black line move in lockstep?

Figure 1: Performance of Chinese Stocks vs. the S&P 500

Trump’s game plan? Go hard on China—as hard as possible—every day between now and November. Nothing stirs up votes for an incumbent like an external threat. It’s hard to see images of Houston’s fire department putting out the flames from China’s burned documents and not understand why Trump’s tactical strategy is a game of hardball.

Meanwhile, Joe Biden has to play a different hand: don’t mess this up. Don’t say anything too wild, sit tight, smile for the cameras and ride this thing out for just a few more months —if the polls are correct, of course.

The Democratic challenger has maintained a lead of at least 49 to 42 in the RealClearPolitics average every day since June 8; the margin currently stands at 50.6% to 41.3%.

This is not to say that Joe Biden is some shrinking violet when it comes to China, ready to lay down to Beijing. The words “China” or “Chinese” appear 30 times in his 6,500-word tome on the “Made in All of America” section of his campaign page. Compare that to the combined appearances of Mexico, Canada, Europe and Japan: zero. But even so, he has to proceed with caution; no need for blunders. It is Trump who has a strategy of saber-rattling the loudest in the hopes of swinging votes.

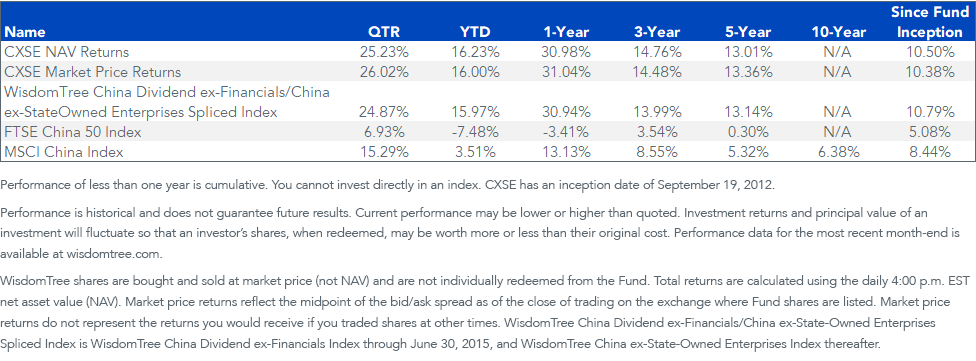

I looked up the top 10 China ETFs by assets under management, and our net expense ratio was the lowest, at 0.32%. The second-lowest was 0.59%.

If you are thinking Trump wins, maybe hold off on China.

But if you see victory for Biden, it could be the play.

Figure 2: CXSE Performance

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in China, including A-shares, which include the risk of the Stock Connect program, thereby increasing the impact of events and developments associated with the region that can adversely affect performance. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The Fund’s exposure to certain sectors may increases its vulnerability to any single economic or regulatory development related to such sectors. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.