Mid-Year Asset Allocation Outlook: It’s All Right, I Think We’re Gonna Make It

I know, I know what’s on your mind

And I know it gets tough sometimes

But you can give it one more try, to find another reason why

You should pick it up, and try it again

Cause it’s all right—I think we’re gonna make it,

I think it might just work out this time

It’s all right—I think we're gonna make it

I think it might work out fine this time…

Time and time again I see people so unsure like me

We all know it gets hard sometimes

(But) You can give it one more try, find another reason why

You should pick it up,

(Yeah) You should kick it up, and try it again

Cause it’s all right—I think we’re gonna make it

I think it might just work out this time

(Yes) It’s all right—I think we’re gonna make it

I think it might work out fine this time…

(From “All Right,” by Christopher Cross, 1983)

Despite the disruptions caused by the pandemic in the first half of the year, our outlook from an asset allocation perspective has not changed from what it was at the start of the year.

It follows four main themes:

1. Stocks over Bonds: The fact is that nothing looks attractively valued right now, across the capital spectrum. But we still believe that equities offer better performance potential over the remainder of this year and into 2021.

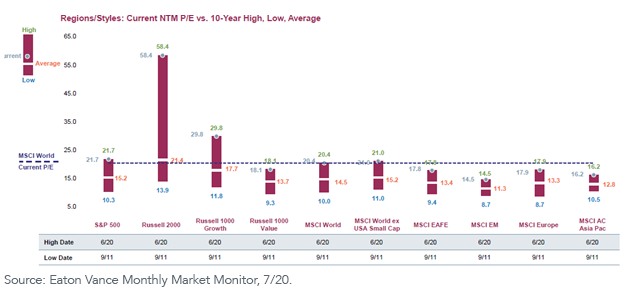

The market bounce back in the second quarter brought equity valuations back to the dizzying levels we saw before the pandemic hit.

For definitions of terms in the chart, please visit our glossary.

Markets have already discounted the horrible first half and are expecting horrible earnings news from Q2. But they are also pricing in (a) an anticipation of earnings improvement as we finish 2020 and head into 2021, and (b) the continuation of massive monetary and fiscal stimulus.

As we go to publication, the consensus is that we will see at least another $1 trillion in fiscal stimulus over the summer. There will be deep differences between the two parties as to how to allocate and implement that additional stimulus. But we believe there is enough common ground for a bargain to be struck.

Given the strong tailwinds of ongoing monetary and fiscal stimulus and a slowly recovering global economy, combined with our muted outlook for rates and credit, we still favor equities over bonds for both total return and current income potential.

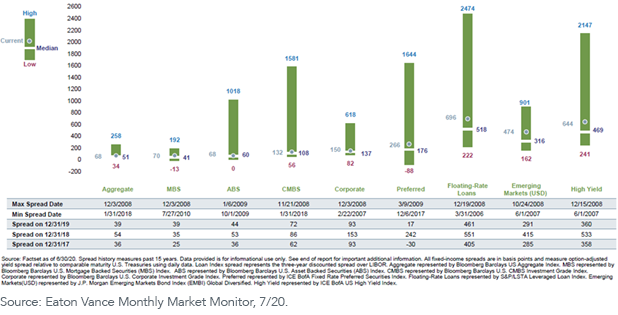

2. Shorten Duration, Over-Weight Credit and Be Selective: On the rates and credit front, we believe that interest rates will grind slowly higher as the economy recovers. But that is on a comparative basis, as they are at or near all-time lows. From an absolute rate level, our outlook remains “lower for longer.”

In the current yield and duration environment, even small increases in yield can trigger price losses exceeding projected annual coupon payments. These current valuations position Treasuries as a hedge against extreme events but not as a resilient investment for an entire cycle.

Given our general outlook for economic recovery and unprecedented Federal Reserve support, we prefer spread risk in corporate and mortgage-backed securities over interest rate risk and are thus under-weight duration in our portfolios. We are over-weight corporate debt and securitized debt at the expense of Treasuries. We are also positioned for further steepening in the Treasury curve, given our belief that rate increases will be concentrated in longer maturities.

In more aggressive portfolios, we would suggest small allocations to either emerging market local debt or corporate debt. Each exposure would enhance and diversify income levels. Several EM countries still have room to cut monetary policy rates, potentially generating additional bond gains for local debt.

3. U.S. over non-U.S.: From a global asset allocation perspective, and compared to the MSCI ACWI, we recommend staying (1) over-weight to the U.S., (2) slightly under-weight to developed international and (3) slightly over-weight to emerging markets.

There has been talk recently about the potential for some degree of the “mutualization” of eurozone debt, making it easier for the less economically strong southern countries (especially Italy) to access the capital markets. This has the potential to be a game changer for the eurozone, as it struggles to recover from a virus-induced recession. It may ultimately influence our outlook for Europe and the overall developed international markets.

But we continue to believe that the structural deficiencies of the European economy (high taxes and entitlements, low labor mobility, high unemployment among the young, rapidly changing demographics, an oppressive regulatory regime, etc.) will be a drag on economic and earnings growth potential for the foreseeable future.

While the pandemic has not played itself out in the emerging markets (especially Russia, Mexico and India), we believe a slowly recovering global economy (especially China) bodes well for the EM sector. At the same time, the U.S. dollar has fallen fairly steadily since late March—a trend that we believe will continue, albeit in fits and starts. If we are correct, this will provide an additional tailwind for EM and other non-U.S. risk assets.

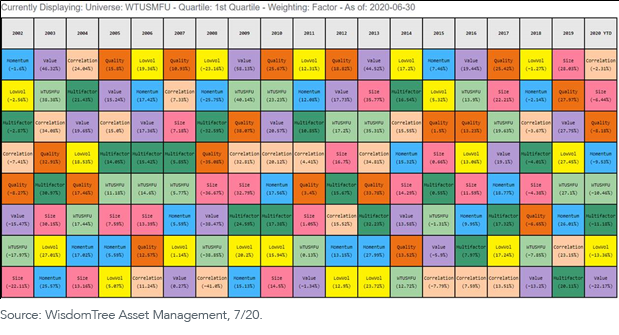

4. Maintain Risk Factor Diversification: In addition to the more traditional asset class diversification, we are big believers in risk factor diversification.

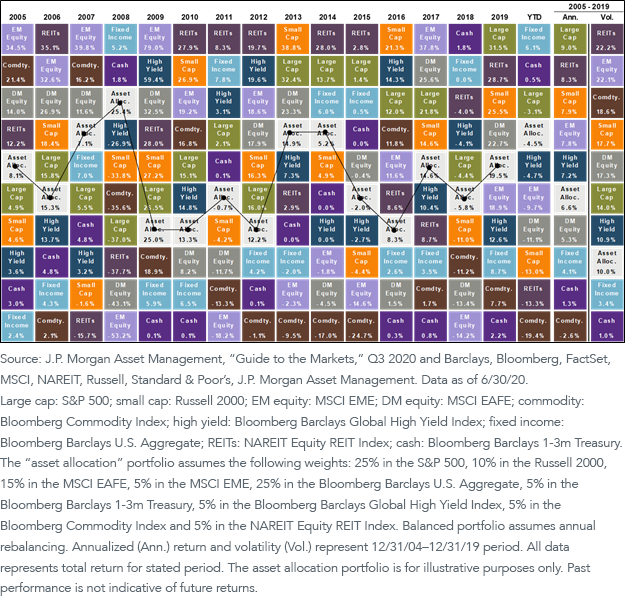

Many investors are familiar with the traditional asset class “performance quilt” highlighting the benefits of a diversified portfolio:

A concept that some investors may be less familiar with is that risk factors, just like asset classes, also rotate in and out of favor:

A core investment tenet at WisdomTree is that by maintaining both asset class and risk factor diversification, advisors and investors have the potential to achieve a more consistent performance profile over time—something that may be increasingly important as we head into what we believe will be a much more volatile market environment.