Value and Risk Mitigation

The value investment style has not protected investors this year—at least not in terms of lower drawdowns.

From the S&P 500’s February 19 peak, value has lagged growth by over 20%.1

But there may be a way value could help mitigate risk going forward—by sidestepping increasing valuation risks.

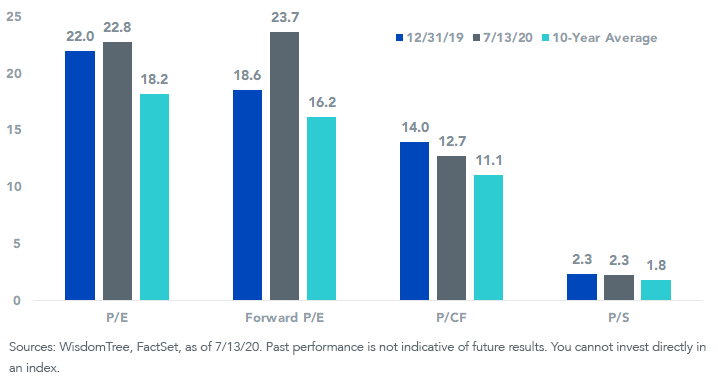

S&P 500 Valuations

Projection vs. Protection

Legendary value investor Ben Graham wrote, in his classic text The Intelligent Investor, that there are two basic approaches to forecasting in security analysis: one focused on projection, the other on protection.

The projection approach aligns with the thinking of many growth investors, while protection aligns with value investing.

Protection can be thought of as finding investments with a margin of safety. For example, an investment in a company with a higher dividend yield could mean realizing more value in hand sooner.

It is unlikely this approach will score an investment in the next Apple. But it may help mitigate losses from blow-ups like the late 1990s tech bubble.

Value in Hand: Bank Dividends

Financials entered the year as the sector with the highest total shareholder payouts. These payouts took a significant hit in March when the biggest banks suspended share buybacks.

The Federal Reserve (Fed) released its bank stress test results on June 25. This test has key implications for bank capital distributions.

By most accounts, the announcement was mixed for the industry, skewing toward slightly positive.

Most importantly, there was no wholesale dividend payout ban for the industry.

Wells Fargo was the only bank that announced a cut in its third-quarter dividend—a widely expected outcome and the first such cut for a major bank since the global financial crisis.

A few takeaways:

- Most banks scored very well on their capital levels (positive impact—capital levels unlikely to constrain dividends near term)

- Payout restrictions for Q3 that halted buybacks, dividends capped at Q2 levels and dividends capped based on earnings2 (neutral impact—while the details may have been a surprise, the overall result was pretty much expected)

- The banks will have to resubmit their capital plans at some point later this year (negative impact—more uncertainty for payouts)

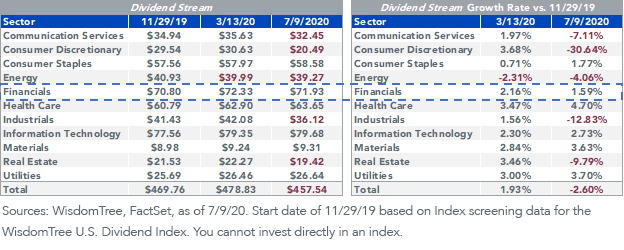

Despite their underperformance this year, Financials have modestly increased their indicated dividends since the end of last year.

For now, dividends for the sector appear safe, providing a key level of near-term valuation support.

WisdomTree U.S. LargeCap Dividend Index

Financials for Risk Mitigation

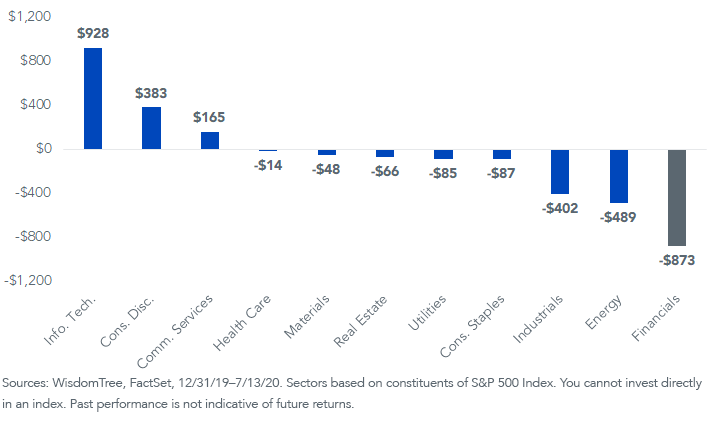

Financials companies are often favored by value investors because of their low multiples. This year, it has been the sector with the greatest amount of its market capitalization wiped out.

JPMorgan and Wells Fargo have had the biggest market cap losses in the world as lower interest rates and increasing loan loss provisions hurt bank profitability.3

YTD Change in Sector Market Cap ($bn)

There is no shortage of near-term risks the biggest banks face. Just to name a few:

- Lower for longer—Lower interest rates hurt bank net interest margins.

- Economic re-opening uncertainty—Banks are one of the most pro-cyclical industries, making them more dependent on a smoother reopening of the economy.

- Democrat in the White House looking more likely—Democrats tend to be tougher on bank regulation.

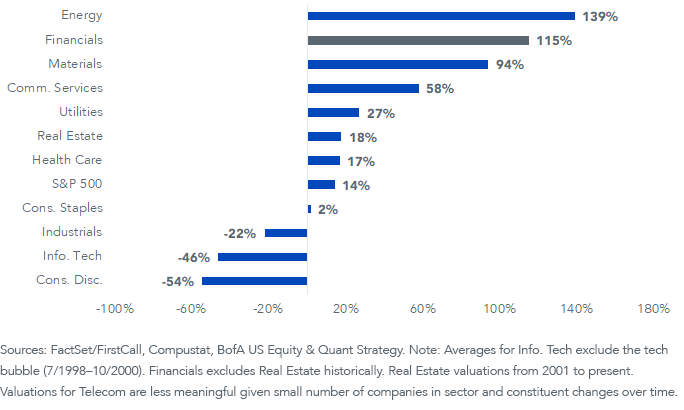

For quantitively driven value investors, these risks appear to be fully reflected in valuations. According to Bank of America Research, the sector’s current price-to-book relative to the S&P 500 Index is 0.34, well-below its historical average of 0.72. If the sector were to re-rate back to its average relative price-to-book, that would imply 115% upside.

Certain high growth sectors like Consumer Discretionary and Information Technology would have significant negative returns if they re-rated down to their historical relative price-to-book multiples.

Relative Valuation (vs. S&P 500) by Sector (based on data from 1986 to 5/31/20)

A quote from Graham reminds us how to think about the current murky outlook for Financials:

If [the enterprising investor] followed our philosophy in this field he would more likely be the buyer of important cyclical enterprises—such as steel shares perhaps—when the current situation is unfavorable, the near-term prospects are poor, and the low price fully reflects the current pessimism.4

For today’s investors, Graham’s reference to steel shares can be replaced with Financials shares.

Conclusion

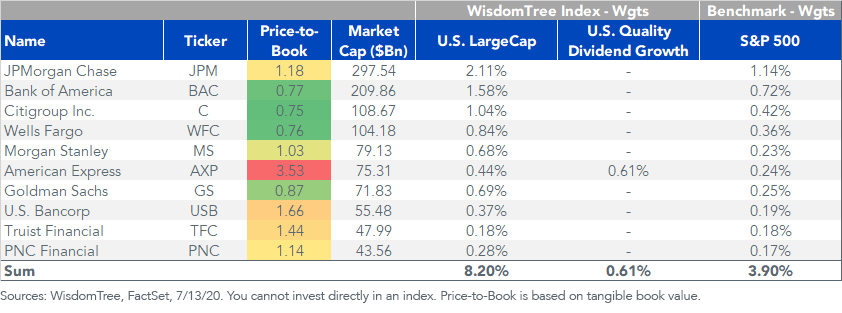

Among WisdomTree’s fundamentally weighted Indexes, the WisdomTree U.S. LargeCap Index has the greatest over-weight to the largest banks.

The Index holds roughly 500 of the largest profitable companies by market cap and weights companies by their earnings.

The WisdomTree U.S. Quality Dividend Growth Index, an Index of about 300 quality dividend payers, holds only American Express (AXP) of all the largest bank holding companies.

The performance differential of these two Indexes will be driven in large part by the prospects of the banking sector. The sector’s near-term fortunes likely hinge on the path of the coronavirus, with a long-term case centered around attractive relative valuations.

Ten Largest U.S. Bank Holding Companies

1Source: Bloomberg, 2/19/20–7/13/20. Russell 1000 Value Index total returns relative to Russell 1000 Growth Index total returns.

2Q3 payout restrictions: 1. No share repurchases 2. No increases in dividends from 2Q20 levels 3. A “modified payout ratio” formula will be used for guiding dividends. Even if a bank remains above its capital buffers, its payout will be capped at 100% of the average of the prior four quarters’ net income.

3Robert Armstrong, “Prospering in the pandemic: the corporate losers,” Financial Times, 6/22/20.

4Benjamin Graham, “The Intelligent Investor,” pg. 383, 2003.