What the World Needs Now Is Income, Sweet Income

This article is relevant to financial professionals who are considering offering asset allocation model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF model portfolios, please inquire with your financial professional. Not all financial professionals have access to these model portfolios.

What the world needs now is love, sweet love

It's the only thing that there's just too little of

What the world needs now is love, sweet love,

No, not just for some but for everyone.

(From “What the World Needs Now,” written by Burt Bacharach and Hal David, performed by Dionne Warwick, 1965)

From a global pandemic perspective, we could easily substitute Vaccines, Sweet Vaccines into this blog title and it would be as relevant. But this is an investment blog.

If you have read the blogs of my WisdomTree colleague Kevin Flanagan, or listened to the weekly Market Volatility Update series of conference calls conducted by Wharton Professor and WisdomTree Special Advisor Dr. Jeremy Siegel, you know that we are of the opinion that interest rates are going to be low for a long time. Which is not to suggest they will not go up from their current levels (we think they will, at least nominally), but we think relatively low real rates will be with us for quite a while.

This has profound implications on the ability of a traditional 60/40 (60% equity/40% fixed income) portfolio to generate current income. At the same time, our national demographics are evolving—we are getting older as a nation—and a large majority of investors face a retirement that could be longer than they anticipated. Even a “normalized” rise in interest rates would not be sufficient to fund retirement without a higher contribution from equities (either through yield or capital appreciation) in most portfolios.

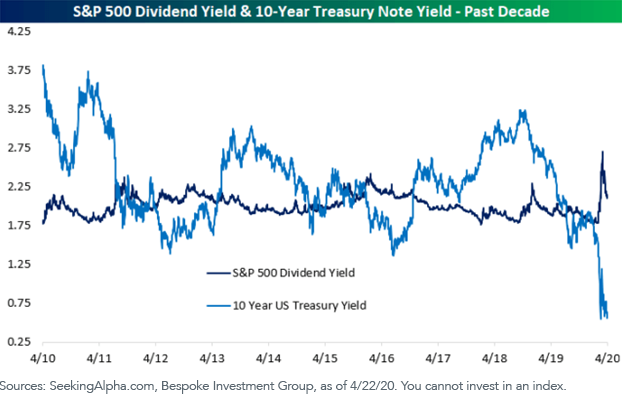

Consider this recent comparison between the yield on the S&P 500 index and the 10-Year U.S. Treasury:

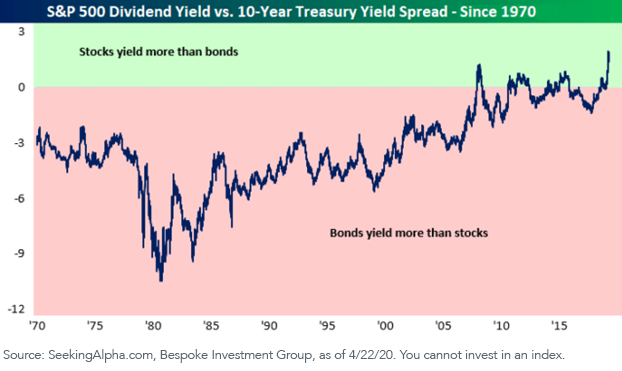

This difference between the yield on the S&P 500 and the 10-Year U.S. Treasury is both unusual and the highest it has been in more than 40 years:

Advisors can attempt to enhance income by taking on greater duration or credit risk, but that may not be optimal if they view the fixed income allocation as the “safe” portion of the portfolio.

In the face of this anticipated lower-for-longer interest rate regime, WisdomTree manages three yield-focused model portfolios. The models attempt to generate enhanced current income by way of equities and other asset classes, while respecting the hedging aspect of the fixed income portfolio.

The first is the WisdomTree Global Dividend Model, which is a globally diversified all-equity portfolio designed to maximize current dividend yield while managing risk.

The second is the WisdomTree Global Multi-Asset Income Model, which attempts to maximize income while managing risk by using equities, income strategies and other less traditional sources of current income (e.g., preferreds, MLPs, and option-based strategies).

Finally, we offer our newly launched Siegel-WisdomTree Longevity Model, developed in close collaboration with Wharton Professor Dr. Jeremy Siegel. It was designed explicitly as an attempt to “build a better mousetrap” than the traditional 60/40 portfolio with respect to current income generation and an improved longevity risk profile by allocating more heavily to yield-focused equities.

As a reminder, all WisdomTree model portfolios are diversified by asset class, risk factor and sector, are open architecture (i.e., they include both WisdomTree and third-party investment strategies), and charge no portfolio strategist fee.

In closing, we believe we have entered a new market regime, one marked by increased volatility, potentially lower equity and bond market returns, and lower interest rates. In this new environment, what the world needs now are solutions that can help solve specific advisor objectives and pain points.

WisdomTree’s outcome-focused model portfolios are designed to do exactly that, and no, not just for some, but for everyone.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Diversification does not eliminate the risk of experiencing investment losses. Using an asset allocation strategy does not assure a profit or protect against loss.

This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice. This material is not intended to be a recommendation or advice by WisdomTree. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds, and WisdomTree is also entitled to receive a fee from certain model platform providers for licensing model portfolios.

WisdomTree Asset Management, Inc., is an investment advisor registered with the Securities Exchange Commission, and a wholly owned subsidiary of WisdomTree Investments, Inc.

For financial professionals: In the event that you subscribe to receive a WisdomTree Model Portfolio, you will receive investment ideas from WisdomTree in the form of a model portfolio. The information is designed to be utilized by you solely as a resource, along with other potential sources you consider, in providing advisory services to your clients. WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for your clients’ accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a model portfolio or any securities included therein for any of your clients. WisdomTree does not have investment discretion and does not place trade orders for any of your clients’ accounts. Information and other marketing materials provided to you by WisdomTree concerning a model portfolio—including holdings, performance and other characteristics—may not be indicative of your client’s actual experience from investing in one or more of the funds included in the model portfolio. The model portfolios, allocations and data are subject to change.

For end users: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. The model portfolios, allocations and data are subject to change.

Jeremy Siegel serves as Senior Investment Strategy Adviser to WisdomTree Investments, Inc., and its subsidiary, WisdomTree Asset Management (“WTAM” or “WisdomTree”), and serves on the Asset Allocation Committee of WisdomTree, which develops and rebalances WisdomTree’s model portfolios. In serving as a consultant to WisdomTree in such roles, Mr. Siegel is not attempting to meet the objectives of any person, does not express opinions as to the investment merits of any particular securities, and is not undertaking to provide and does not provide any individualized or personalized advice attuned or tailored to the concerns of any person.