When Will I Be Loved? In Defense of the Endowment Model (Again)

I’ve been cheated, been mistreated

When will I be loved

I’ve been put down, I’ve been pushed ’round

When will I be loved…

I’ve been made blue, I’ve been lied to

When will I be loved

(From “When Will I Be Loved,” written and performed by The Everly Brothers, 1960, covered by Linda Ronstadt, 1975)

Like asset classes and risk factors, the “endowment model” rotates in and out of favor. What do we mean by the “endowment model?” In the context of individual investors, we believe it means:

- Broad and global diversification;

- Intelligent use of active vs. passive investment strategies (i.e., a cost/benefit optimization of active management fees or, in WisdomTree’s phrase, “Modern Alpha®”);

- A prudent use of nontraditional or lower-correlation investments in an attempt to improve overall portfolio diversification;

- A long-term time horizon; and

- Investment discipline through full market cycles.

From the mid-1990s until the great financial crisis (GFC) of 2007–2009, the endowment model was all the rage, as university endowment funds like Yale and Harvard racked up impressive performance numbers due to their then cutting-edge approach to investing. The wealth management industry raced to democratize and incorporate some of these investment ideas into their own client portfolios.

Following the GFC, however, the endowment model fell out of favor, as many of those same universities faced liquidity squeezes that pushed performances down. If you were not as illiquid as an endowment, however, the approach still made sense for many investors.1

But then the great central bank rally began in earnest, and from roughly 2013–2019, a new phrase came to be associated with the endowment model: deworsification. Essentially, investors who had anything in their portfolios except U.S. stocks and bonds saw reduced performance.

“Ride the beta wave” became the new investment mantra, and the endowment model for anyone beside the endowments essentially disappeared.2

Well, that regime may be ending. The dramatic market volatility over the past several months has many investors seeking, once again, to incorporate less-traditional or lower-correlation strategies into their portfolios.

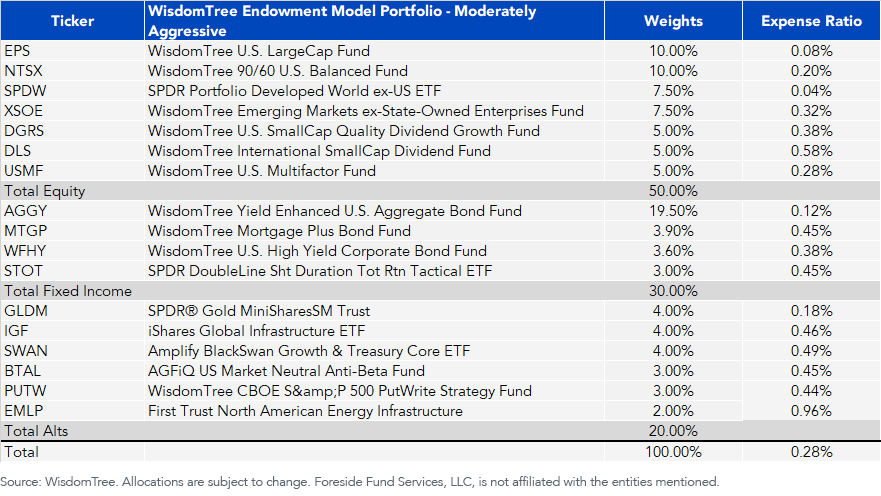

At WisdomTree, we never lost faith in the potential benefits of an endowment model approach (for the right investor), and we have an asset allocation model portfolio called, explicitly, the “Endowment Model.” As of March 31, 2020, this model was allocated as follows:

We believe some aspects of this portfolio are worth highlighting:

- The portfolio is globally diversified and, as with all WisdomTree model portfolios, it is “open architecture” and incorporates both proprietary and third-party investment strategies;

- The portfolio consists of both cap-weighted and factor-tilted ETFs, as we seek to optimize the costs and benefits of both passive and active management strategies;

- The portfolio incorporates WisdomTree’s 90/60 U.S. Balanced Fund (NTSX). This ETF uses the inherent leverage of futures contracts to gain a more capital-efficient exposure to a traditional “60%/40%” stock/bond allocation3; and

- This increased capital efficiency leaves “room” in the portfolio to allocate to potential lower-correlation strategies. As of March 31, 2020, these “alternatives” included real assets such as gold, master limited partnerships and infrastructure, as well as nontraditional volatility management strategies designed to potentially lower the equity beta profile of the overall portfolio.

As we work our way through the coronavirus pandemic and then into eventual recovery (hopefully in the second half of the year), we believe that we will have entered a new market regime that will be marked by increased long-term volatility. Advisors who seek lower-correlated potential sources of returns, as well as broader diversification in their client portfolios, may want to give the WisdomTree Endowment Model a look.

This approach to disciplined, long-term investing may, once again, be loved.

1In fact, in 2010, I wrote an article entitled, “In Defense of the Endowment Model,” which appeared in the May/June edition of the IMCA Investments & Wealth Monitor (pp. 32–36).

2For those who are interested, there is an annual survey of endowment performances conducted by the National Association of College and University Business Officers (NACUBO). The performances for the most recent fiscal year (July 1, 2018–June 30, 2019) are summarized here: https://www.nacubo.org/Press-Releases/2020/US-Educational-Endowments-Report-5-3-Percent-Average-Return-in-FY19.

3Investors often rely on the diversification potential of a 60% stock/40% bond portfolio in their asset allocation. NTSX incorporates this same logic to enhance the risk-return profile of a large-capitalization U.S. equity portfolio. Similarly, it can also be used as a 1.5x levered 60/40 strategy. NTSX seeks total return by investing 90% of its assets in the 500 largest U.S. stocks by market capitalization and 10% in short-term fixed income, and it targets a 60% notional exposure to U.S. Treasury futures.

Important Risks Related to this Article

Investors and their advisors should consider the investment objectives, risks, charges and expenses of the funds included in any model portfolio carefully before investing. This and other information can be obtained in the fund’s prospectus by visiting: www.wisdomtree.com for WisdomTree Funds; www.ishares.com for iShares Funds; www.us.spdrs.com for SPDR Funds; www.agf.com for AGFiQ Funds; www.amplifyetfs.com for Amplify ETFs; and www.ftportfolios.com for First Trust Funds. Please read the prospectus carefully before you invest in a fund. WisdomTree Asset Management, Inc., does not endorse and is not responsible for or liable for any content or other materials made available by other ETF sponsors. Investors should read the prospectus carefully before investing.

This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice. This material is not intended to be a recommendation or advice by WisdomTree. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds, and WisdomTree is also entitled to receive a fee from certain model platform providers for licensing model portfolios.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only; iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”); State Street Global Advisors Funds Distributors, LLC, is the distributor for some registered products on behalf of the advisor; AGFiQ Funds are distributed by Foreside Fund Services, LLC; Amplify ETFs are distributed by Foreside Fund Services, LLC; First Trust Advisors LP is an affiliate of First Trust Portfolios LP, the Fund’s distributor. Foreside Fund Services, LLC, is not affiliated with the entities mentioned.

WisdomTree Asset Management, Inc., is an investment advisor registered with the Securities Exchange Commission, and a wholly owned subsidiary of WisdomTree Investments, Inc.

For financial professionals: In the event that you subscribe to receive a WisdomTree Model Portfolio, you will receive investment ideas from WisdomTree in the form of a model portfolio. The information is designed to be utilized by you solely as a resource, along with other potential sources you consider, in providing advisory services to your clients. WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for your clients’ accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a model portfolio or any securities included therein for any of your clients. WisdomTree does not have investment discretion and does not place trade orders for any of your clients’ accounts. Information and other marketing materials provided to you by WisdomTree concerning a model portfolio—including holdings, performance and other characteristics—may not be indicative of your client’s actual experience from investing in one or more of the funds included in the model portfolio. The model portfolios, allocations and data are subject to change.

For end users: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. The model portfolios, allocations and data are subject to change.

For NTSX, there are risks associated with investing, including possible loss of principal. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models, and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning, and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.