Value…Huh! (Good God, Y’all) What Is It Good for?

War…huh!

What is it good for?

Absolutely nothing

Say it again

War…huh! (good god, y’all)

What is it good for?

Absolutely nothing…

(From “War,” performed by Edwin Starr, 1969)

So, what’s up with value investing? We discuss value investing quite a lot at WisdomTree, as it is the core of many of our fundamental investment beliefs and many of our products and solutions.

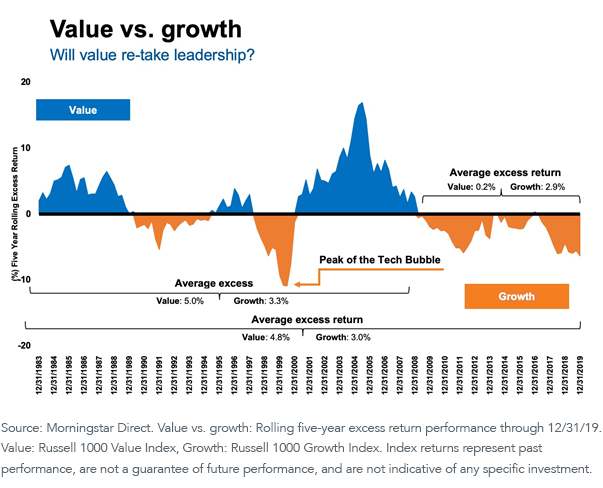

We’ve wondered if the decade-long underperformance of value relative to growth was an anomaly or “the new normal,” and we’ve highlighted just how long this current value underperformance has lasted:

We are not the only ones to look deeply into this issue—a variety of industry experts have weighed in on the subject.1

Most seem to agree that value is not dead, but it certainly has been “resting” for a while. Or, as with Spinal Tap, is its appeal just becoming more selective?

Different researchers come to different conclusions, but there does appear to be general agreement around several broad themes:

- Price-to-book (P/B) ratio is no longer a sufficient value metric. While it is considered one of the foundational ideas behind value investing, going back to the work of value “gurus” Graham and Dodd2 and French and Fama3, there is general agreement that P/B is no longer sufficient for identifying attractive companies. Technology advancements, increased productivity, a reduced requirement for “brick & mortar” facilities, and other issues affecting “intangible” enterprise value means the traditional P/B metric may not accurately capture or identify true “value” stocks. WisdomTree incorporates a variety of other valuation metrics, as well as quality metrics, to try and better identify true “value” stocks while avoiding “value traps.”4

- The reduction in the number of publicly traded companies, and the corresponding rise in private equity, has not helped value investors. While this phenomenon should not be overstated in terms of its impact on performance, many value managers agree that the decline in the number of publicly traded companies has reduced the opportunity for finding attractive investments. Put differently, there is some level of “poaching” identified value companies by private equity firms before the full longer-term value has been realized.

- The “valuation of value companies” has fallen. Growth has outperformed value for so long that many investors simply will not pay the same multiple for a value company that they will for a growth company. Some analysis suggests that this “cheapening” of value stocks relative to growth stocks explains substantially all of value’s underperformance over the past decade or more.5

- Value investing historically worked best during a rising interest rate, economic recovery market regime. Some value investors argue, therefore, that we should not be surprised by value’s underperformance for the past 10 years—a period of sluggish economic growth and low interest rates.

On the positive side, what many value investors also agree on can be summarized as follows:

- While determining what is or is not an attractive value may have changed and will continue to evolve, “value investing” is not dead, despite its chronic underperformance in recent years.

- The historical rotation of growth and value suggests long periods of relative out- or underperformance (see the chart above). If value should “rotate” back into favor (as it seemed to be doing starting in Q4 of 2019 before being crushed by the economic shutdown), it may show an extended period of outperformance.

- The very “cheapening” of value stocks relative to growth stocks (the “valuation of value”) makes them currently look extremely attractively priced. It is always important to remember the central tenet of value investing—your potential performance on any investment is a direct function of how much you pay for it today.

- Value investing historically has performed best as the economy enters recovery. We have unleashed an unprecedented amount of monetary and fiscal stimulus in an attempt to stabilize the capital markets and the current virus-induced economic recession. We maintain our optimism that the virus will be manageable over time and that our economy will recover. No one knows for sure what the nature of that recovery will be, but if it is even remotely commensurate with the amount of stimulus we are applying, it could prove to be a very positive environment for value investing.

So, back to our original question: “Value…huh! What is it good for?” Given (a) our belief in the mean reversion of markets, (b) the current extreme valuation differentials between growth and value stock, and (c) the economic environment we believe we will soon be entering, we think the answer may be: Quite a lot, for quite a while.

1See, for example:

A. Cliff Asness, “It’s Time for a Venial Value-Timing Sin,” AQR, 11/7/19.

B.Scott Opsal, “Price-to-Book: The King is Dead,” The Leuthold Group, 3/2/19.

C. Rob Arnott, Campbell Harvey, Vitali Kalesnik, and Juhani Linnainmaa, “Reports of Value’s Death May Be Greatly Exaggerated,” Research Affiliates, January 2020.

D. Jamie Catherwood, “The Factor Archives: Value,” O’Shaughnessy Asset Management, February 2020.

EJames Paulsen, “Broader Market Leadership? You Gotta Bring the HEAT!,” The Leuthold Group, 4/29/20.

2Benjamin Graham and David Dodd, Security Analysis, Whittlesey House/McGraw-Hill Book Co., 1931.

3See, for example, Kent Womack and Ying Zhang, “Understanding Risk and Return, the CAPM, and the Fama-French Three-Factor Model,” 2003 (https://www.researchgate.net/publication/228169038_Understanding_Risk_and_Return_the_CAPM_and_the_Fama-French_Three-Factor_Model).

4Registered advisors can access the WisdomTree Digital Portfolio Developer Tools for help in comparing different products and solutions.

5Rob Arnott, Campbell Harvey, Vitali Kalesnik, and Juhani Linnainmaa, “Reports of Value’s Death May Be Greatly Exaggerated,” Research Affiliates, January 2020