Factor Diversification and Why It Matters in a New Market Regime

For definitions of terms in the chart, please visit our glossary.

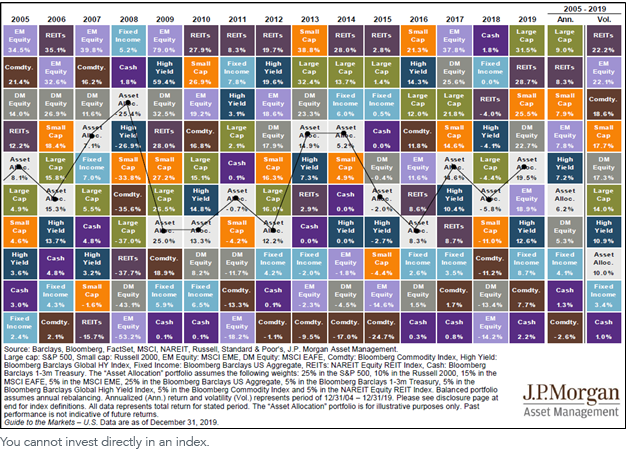

The well-intentioned point of these “performance quilts” is to illustrate how difficult it is to predict which asset classes will perform best at any given time, thereby highlighting the importance of asset class diversification within a portfolio (the light gray boxes labeled “Asset Alloc.” in the above chart).

But is asset class diversification sufficient for building more robust portfolios? We think it is a necessary condition, but investors and advisors can build better portfolios by also considering risk factor diversification.

Asset classes—or, more specifically, the securities that fall within a given asset class—can be thought of (somewhat simplistically) as convenient little bundles of specific risk factors. Because of this, however, seemingly diversified asset class portfolios do not always deliver the expected level of protection during disruptive markets (as we are witnessing firsthand right now)—they are often exposed to similar or comparable risk factors.

Consider the simple example of large-cap U.S. stocks, emerging markets (EM) stocks and high-yield bonds. These are all very different asset classes, but they all have highly correlated risk factor profiles. (Specifically, they are all heavily influenced by the equity risk factor.)

So when a disruptive market event occurs, they tend to fall together. The logical conclusion of this avenue of thought is that better diversification might be achieved by allocating across risk factors as well as across asset classes.

A “risk factor performance quilt,” similar to the more familiar “asset class quilt” and incorporating a variety of the risk factors embedded in different WisdomTree ETFs, looks like this:

For definitions of terms in the chart, please visit our glossary.

Just focusing on the “swirling” color pattern alone illustrates that risk factors, like asset classes, rotate in and out of favor, and that more diversified risk factor exposures may build in the potential for more consistent performance.

As we have discussed, we believe asset allocation model portfolios will increase in importance, especially in the wake of this terrible coronavirus pandemic. First, we believe that many advisors will want to rethink their approaches to both investing and running their practices, and model portfolios can help with both. Second, we also believe, despite our continued optimism that this terrible time will pass, that the 10-year “perpetual beta rally” in the global markets may have come to an end, and we now are entering a new and much more volatile (some might say “normal”) market regime.

This is why WisdomTree Model Portfolios are diversified at both the asset class and risk factor levels. It is also an important reason why all our models are “open architecture” and include non-WisdomTree products. We believe this allows us to build diversified risk factor exposures that optimize the potential for delivering on our investment mandates in a robust, more consistent fashion.

Risk factor diversification is not yet a “household phrase” in the investment management industry, at least not to the same extent as asset class diversification. But, given the rapid evolution of factor-based solutions, including WisdomTree Model Portfolios and ETFs, combined with what we believe will be a new, much more volatile market regime going forward, we anticipate a dramatic increase in awareness and adoption.

Important Risks Related to this Article

There are risks involved with investing, including possible loss of principal. Using an asset allocation strategy does not ensure a profit or protect against loss.

This content is for information only and is not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should it be considered or relied upon as a recommendation by WisdomTree regarding the use or suitability of any model portfolio or any particular security. The financial advisor is solely responsible for making investment recommendations and/or decisions with respect to its clients without input from WisdomTree, including with respect to investing in accordance with any model portfolio or any particular security. WisdomTree is not acting in an investment advisory, fiduciary or quasi-fiduciary capacity to any financial advisor or its client and is not providing individualized investment advice to any financial advisor or its client based on or tailored to the circumstances of any individual financial advisor or its individual client.

This content has been prepared without regard to the individual financial circumstances and objectives of any investor, and the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Investors and their advisors should consider the investor’s individual financial circumstances, investment time frame, risk tolerance level and investment goals. Investors should consult with their own advisors before engaging in any transaction. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a model portfolio’s allocations will provide positive performance over any period. The model portfolios are provided “as is,” without any warranty of any kind, express or implied. Information and other marketing materials provided to you by WisdomTree or any third party concerning a WisdomTree Model Portfolio, including allocations, performance and other characteristics, may not be indicative of an investor’s actual experience from an account managed in accordance with a model portfolio’s strategy.

This content, and any assistance provided as described herein, including portfolio construction and asset allocation stress testing, assessments, discussions, output or other assistance (whether by WisdomTree personnel or digital tools) (the “Assistance Tools”), are for information only, and no material or Assistance Tools are intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice. This content and the Assistance Tools are intended for use only by a financial advisor as a resource in the development of a portfolio for the financial advisor’s clients.