Spinning Wheel

What goes up must come down

Spinnin’ wheel got to go ’round

Talkin’ ’bout your troubles it’s a cryin’ sin

Ride a painted pony let the spinnin’ wheel spin

You got no money and you got no home

Spinnin’ wheel all alone

Talkin’ ’bout your troubles and you, you never learn

Ride a painted pony let the spinnin’ wheel turn

(From “Spinning Wheel” by Blood, Sweat & Tears, 1968)

Boxer Mike Tyson is credited with saying, “Everyone has a plan until they get punched in the face.” For many investors this lesson has become all too real. Heading into early February, the economy was chugging along, the global markets were generally positive and it seemed relatively easy to stick to long-term investment plans

But then the coronavirus hit, followed quickly by the self-induced global economic shutdown and corresponding market collapse. Two punches in the face, indeed.

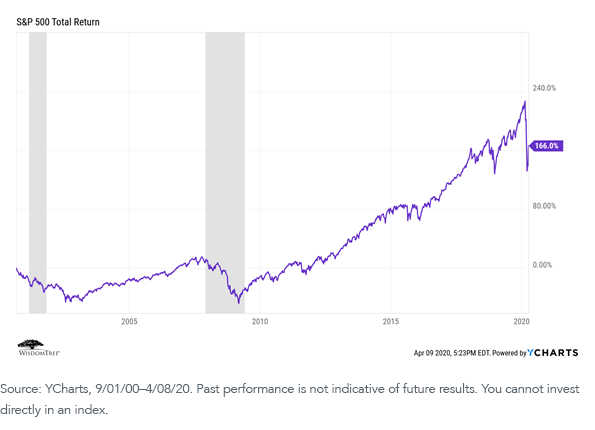

How bad has it been? A little historical perspective is helpful. The following chart illustrates the total return performance of the S&P 500 Index since September 1, 2000:

From a long-term perspective, the above chart looks to be upward-trending, marked by periodic significant downturns (i.e., the tech bubble recession and the great financial crisis, both marked by gray bars, and the current “coronavirus lockdown”).

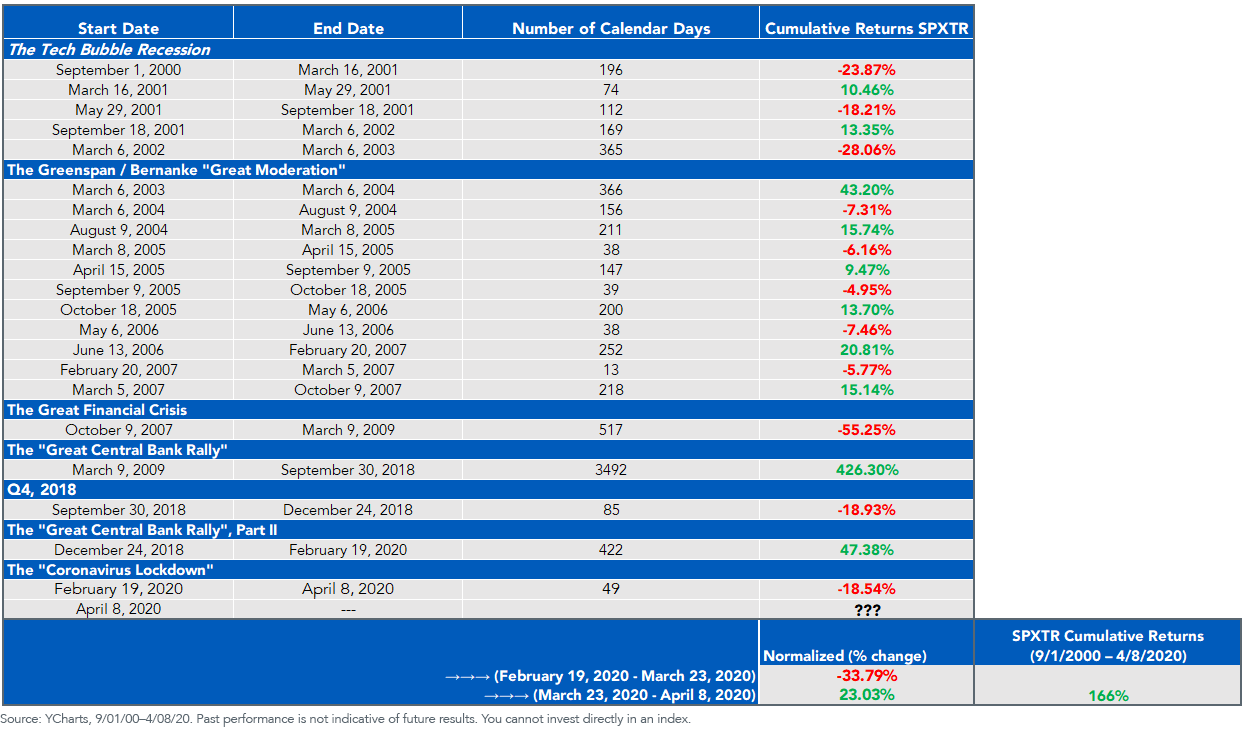

But a more granular look tells a different story. What we see is a rolling series of rallies and declines, with no definable rhythm, length or magnitude:

Note that, even though we captured the date range from February 19 to April 8 of this year as a one-period decline of 18.54%, it is more accurately characterized as two sub-periods: February 19 to March 23: down 33.79%, and March 23 to April 8: up 23.03%.

What can we learn from this? Despite being punched in the face, here are a few lessons we might apply:

- Maintain discipline in your long-term investment plan. As we’ve discussed before, individuals tend to be very bad market timers. As the above chart and data suggest, an investor who was able to maintain discipline and stay invested in the market over the almost 20 year period from September 1, 2000 – April 8, 2020 realized a very nice return (+166%).. Given the lack of market predictability and pattern, however, an investor trying to time exits and entries to the market likely failed, probably miserably.

- Use market volatility to your advantage. Instead of being paralyzed by market volatility, lean into it to consider potential changes to your portfolio:

- Have you been holding off making the move from mutual funds to the more attractive ETFs? Now may be a great time to consider that move.

- Want to stay fully invested (as you should) but harvest tax losses to generate tangible “tax alpha” within your portfolio? That is what market disruptions are for.

- Can you use the current market environment to re-examine and potentially upgrade your asset allocation and portfolio construction, to bring them into better alignment with your long-term objectives and your projected market outlook?1

- In recognition that markets do cycle and that different factors and asset classes have historically outperformed during periods of economic and market recovery, is the current market presenting you with some interesting opportunities?

- If you’ve been sitting in cash, are current valuations attractive enough to get you back into the market?

In closing, we recently came across a webpage from sail maker North Sails that summarized sailing tips for navigating through squalls and storms. We were struck by some of the advice, which seemed very appropriate for how we might react to the current health and market “storm” (emphasis added):

The first decision before an approaching storm is the toughest: Run for cover, or head out to open water for sea room?...While running for cover would seem the preferred choice, the danger lies in being caught in the storm, close to shore, with no room to maneuver or run off…

Although everyone will remember it differently years later, a long, wet, cold sail through a storm can be miserable. As skipper, you need to make the best of it: watch over your crew, offer relief or help to those who need it, and speak a few words of encouragement to all. “This is miserable, but it will end.”

Take the time to marvel at the forces of nature, and at your ability to carry on in the midst of the storm. Few people get to experience the full fury of a storm. It may not be pleasant, but it is memorable.

While misery and discomfort can eventually lead to fatigue, diminished performance, and even danger, do not mistake one for the other. Distinguish in your own mind the difference between misery and danger. Don’t attempt a dangerous harbor entrance to escape misery; that would compromise the safety of the boat and crew, just to avoid a little discomfort.

1As a reference source, you can review the asset allocations and security selections for the WisdomTree Model Portfolios via our website (free registration required).

Important Risks Related to this Article

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided on this site are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.