WisdomTree International Multifactor: Not the Low Volatility You’re Used to…

“Everybody has a plan until they get punched in the mouth.”

-“Iron” Mike Tyson

To say that recent performance in global markets has been humbling would be an understatement. While the world grapples with the challenges of the global pandemic, we’ve continued to focus on the things we can control. One theme that we think will increasingly come into focus later this year is the idea of risk management and re-examining where and how investors generate returns. While beta had been a great trade on the way up, it’s been equally unpleasant on the way down. This is why we believe a multifactor approach to markets could make sense, particularly in the developed international space.

While we apply it globally, our methodology seeks to provide investors with balanced exposure to factors such as value, quality, momentum and low correlation to drive returns in excess of the market.

On top of the stock selection, we are also firm believers in the ability of our dynamic currency model to determine the appropriate levels of currency risk to manage volatility and boost returns.

While our research shows that developed market currencies tend to mean revert, they unquestionably add volatility to international portfolios. Therefore, our currency model aims to balance the alpha potential of timing currencies correctly with the volatility reduction benefits of being hedged when risk is not in favor. Below, we try to explain the key drivers of our strategy’s return in some of the most volatile periods since 2008.

Implicit Tilt to Low Volatility

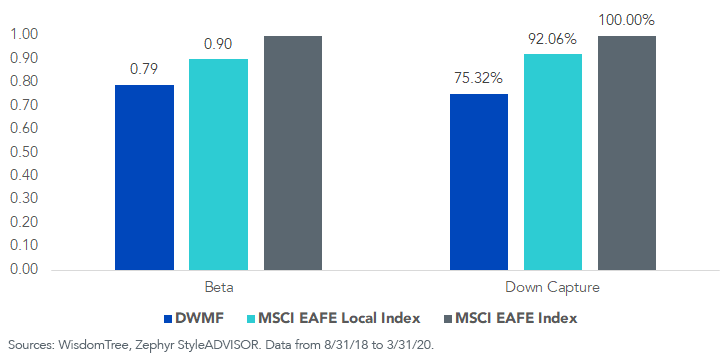

Since its inception in August 2018, WisdomTree International Multifactor Fund (DWMF), while down approximately 12%, has outperformed the MSCI EAFE Index by more than 3% annualized at NAV and has had a beta of 0.791 versus the index. In risk-adjusted terms, DWMF’s Sharpe ratio also exceeds that of the broad market index2. For standardized performance of DWMF, please click here.

Despite not using low volatility as an explicit stock-selection factor, we do believe it can improve a strategy’s risk-adjusted characteristics and therefore use it as part of the weighting mechanism. Furthermore, some of our factor definitions, like risk-adjusted momentum, reward lower volatility companies and implicitly tilt DWMF toward the low volatility factor. (For more on our multifactor methodology, please refer to this piece.)

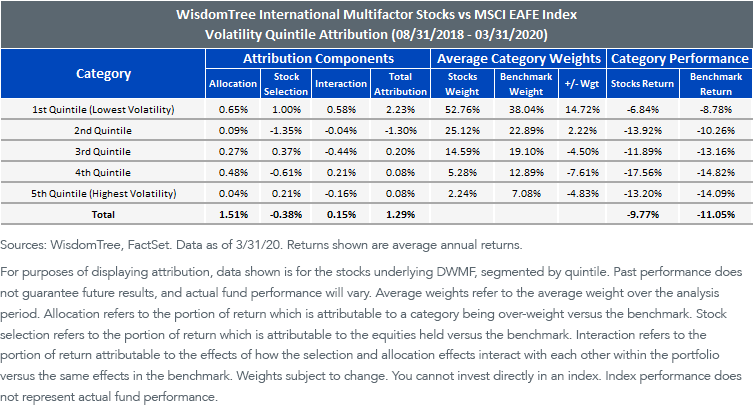

In the performance attribution analysis below, we can show that as of March 31, 2020, the stocks underlying DWMF, segmented by quintile, have contributed 129 basis points (bps) to the total outperformance. It’s also worth highlighting that, as a result of its methodology, DWMF has been consistently over-weight in the lowest volatility quintile, which has been the best-performing category in the developed international universe. At the same time, the methodology has resulted in it being under-weight in the higher volatility quintiles, which in turn have lagged the market.

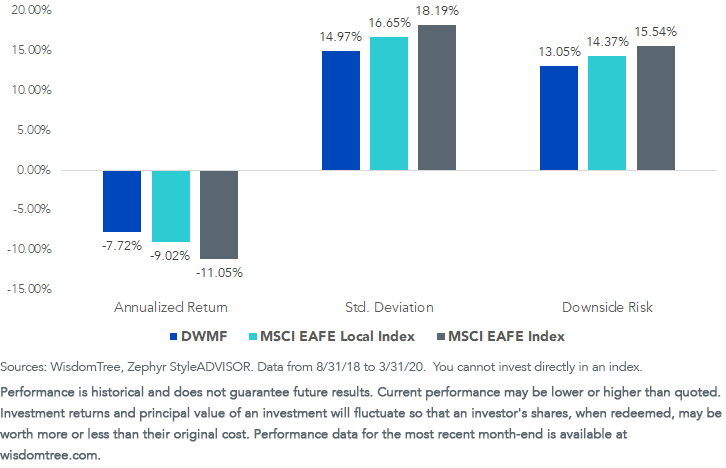

In terms of risk management, DWMF shows a 3% improvement in standard deviation compared to the broad benchmark, along with lower downside risk3. This can be attributed to the implicit low volatility tilt in the stock selection and the dynamic currency hedge overlying the stock position.

Return & Risk Characteristics

Over the past 19 months, the U.S. dollar (USD) has slightly strengthened versus a basket of global currencies.4 Therefore, the MSCI EAFE Local Index has outperformed its USD version. DWMF’s dynamic currency hedge has also contributed positively to relative performance versus both the MSCI EAFE and MSCI EAFE Local Indexes. DWMF also shows attractive downside protection versus both versions of the MSCI EAFE Index.

Beta & Down-Capture

Balanced Exposure vs. Low Volatility Strategies

Finally, DWMF provides investors with a low volatility tilt while maintaining more consistent country and sector exposures compared to the broad MSCI EAFE universe, thanks to its balanced factor exposure and its embedded +/- 5% sector and country bands.

While it has provided comparable results during the most recent period, traditional low volatility methodologies tend to have more significant sector and country deviations. Both the MSCI EAFE Minimum Volatility and S&P BMI International Developed Low Volatility Indexes are significantly over-weight in defensive sectors and under-weight in cyclical sectors, while also being under-weight in France, Germany and the UK in favor of Japan and Switzerland.

1Sources: WisdomTree, StyleADVISOR as of 3/31/20.

2Sources: WisdomTree, StyleADVISOR. DWMF Sharpe Ratio: -0.66; MSCI EAFE Index Sharpe Ratio: -0.73, as of 3/31/20.

3Downside risk measures volatility in periods where return is below the mean. It addresses shortcomings of standard 4deviation, which makes no distinction between upside deviations and downside deviations.

4Source: Bloomberg, as of 3/31/20.

Important Risks Related to this Article

Investing involves risk, including possible loss of principal. Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability or geographic events that adversely impact issuers of foreign securities. Derivatives used by the Fund to offset exposure to foreign currencies may not perform as intended. There can be no assurance that the Fund’s hedging transactions will be effective. The value of an investment in the Fund could be significantly and negatively impacted if foreign currencies appreciate at the same time that the value of the Fund’s equity holdings falls. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models, and the models may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.