Hedging Market Uncertainties in 2020

Well, the stock market crashed.

The S&P 500 reached bear market territory when it dropped to 2,702 on March 11. And so far, the pain hasn’t stopped. It is currently changing hands at 2,300.

What now?

We have a potential hedge for those who want to creep into stocks but don’t want full market exposure.

Five Years vs. Five Months

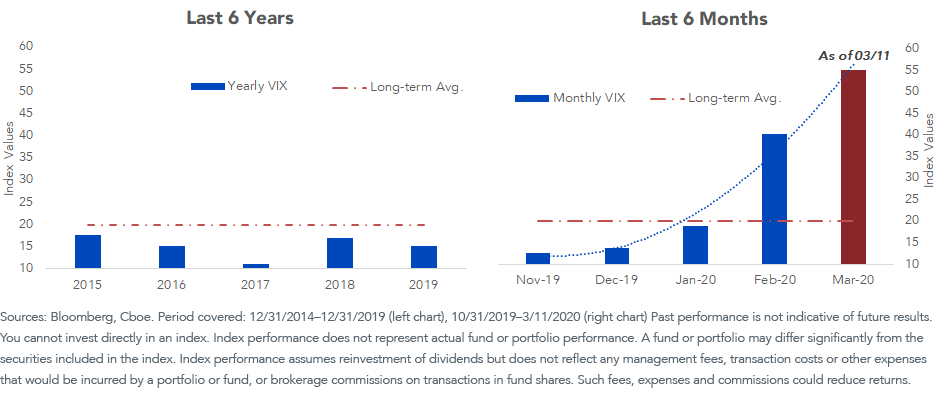

The Cboe Volatility Index (VIX) had been calm. Now it’s exploded—it reached 2008 mortgage crisis levels in recent days:

Volatility Index (VIX)

Will Volatility Stay High?

The VIX futures curve is particularly interesting right now.

Normally, volatility expectations for the future are higher than they are for the present, because we know more about today than tomorrow. For example, you probably have a better idea of today’s lunch than what you’ll eat tomorrow, so the “lunch VIX” for tomorrow is usually higher. The same concept applies to all forecasting. Don’t you have a better idea of the winner of the presidential race for 2020 than for 2024?

All this means that the VIX quote for autumn is usually higher than for March or April.

But sometimes it’s not.

That’s called “contango”—with the normal condition called backwardation. Just as it would be with the lunch example, contango is rare.

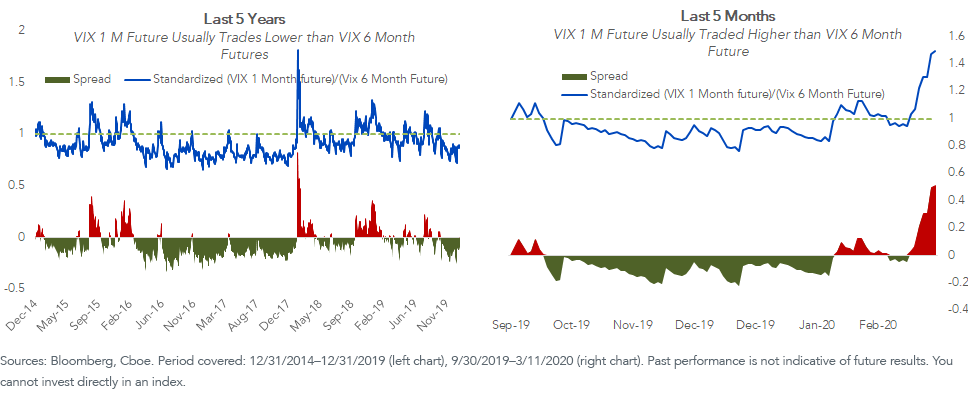

The left side of figure 2 shows the one-month VIX quote divided by the six-month VIX in the months before the market went crazy.

Out of 1,260 trading days, only 8% witnessed near-term volatility that was higher than six-month volatility. When it did, it was generally when the market panicked. That’s what we see on the right side for the past few weeks.

Writing Puts When No One Else Is Writing Puts

Can investors mitigate high volatility?

Sometimes avoiding high volatility by selling put options—giving the buyer the right to sell a security back to you at a predetermined price—can be fruitful for investors concerned about wild markets.

Here’s how it works.

Suppose the S&P 500 is at 2,500.

An investor can sell—or “write” —put options that expire a month from now with the preset strike price also at 2,500. Selling those at-the-money puts allows the seller to pocket a premium.

When volatility is high, the premium is high. Say the VIX is sky high, like it is today, and the premium is worth 5% of notional capital. If the S&P stay flat for a month and closes at 2,500, great—the options seller pockets our 5%. If it goes up, we don’t participate in the gain, but we still have our 5%.

The way money is lost is if the market goes down. Suppose we write the puts, pocket the 5%, and then a 1987-style stock market crash of 22% occurs in one session. In that case, we’re down 17%, because we still get to keep our 5% premium. So it’s still better than the market’s return.

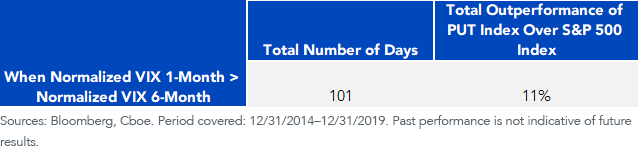

When Normalized VIX 1-Month is Greater Than Normalized VIX 6-Month

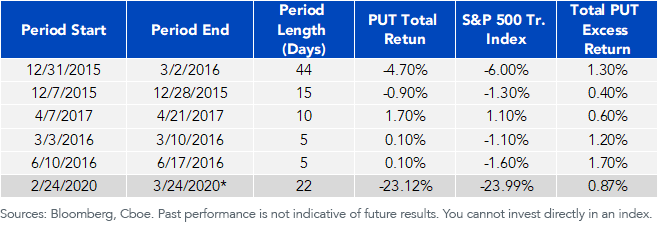

In the table below I show the five longest periods of “front-month” VIX quotes that were higher than ones that are six months out.

In all those periods, the Cboe S&P 500 PutWrite Index (PUT) outperformed the S&P 500.

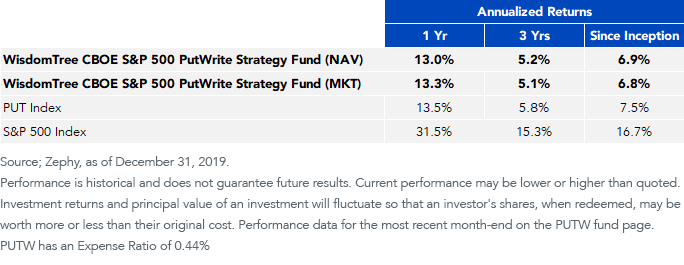

We’re in that situation again. Fortunately for investors, they now have the ability to potentially capitalize on these market dislocations via the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW) which tracks the PUT Index before fees and expenses.

Will PUTW outperform? Maybe, maybe not.

But on S&P puts written right now, the option seller is in a market as volatile as on “Bloody Friday,” October 24, 2008, the worst month of the global financial crisis. PUT closed that session at 737.96, grinding down to 647.73 on March 9, 2009, the day the S&P 500 bottomed. It then rallied for a decade.

Make no mistake: when the market declines, PUTW will decline as well. But the question is: how much? Let the premium be your guide.

Outperformance by PUT during Worst 5 VIX Inversion Periods and Current Periods

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund will invest in derivatives, including S&P 500 Index put options (“SPX Puts”). Derivative investments can be volatile, and these investments may be less liquid than securities, and more sensitive to the effects of varied economic conditions. The value of the SPX Puts in which the Fund invests is partly based on the volatility used by market participants to price such options (i.e., implied volatility). The options values are partly based on the volatility used by dealers to price such options, so increases in the implied volatility of such options will cause the value of such options to increase, which will result in a corresponding increase in the liabilities of the Fund and a decrease in the Fund’s NAV. Options may be subject to volatile swings in price influenced by changes in the value of the underlying instrument. The potential return to the Fund is limited to the amount of option premiums it receives; however, the Fund can potentially lose up to the entire strike price of each option it sells. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

The Cboe S&P 500 PutWrite Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and CBOE and has been licensed for use by WisdomTree. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademarks Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by WisdomTree. Cboe® is a trademark of the Chicago Board Options Exchange, Incorporated, and has been licensed for use by SPDJI and WisdomTree. The WisdomTree CBOE S&P 500 PutWrite Strategy Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates or the Chicago Board Options Exchange, Incorporated, and none of such parties make any representation regarding the advisability of investing in such product(s), nor do they have any liability for any errors, omissions or interruptions of the Cboe S&P 500 PutWrite Index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.