A Critical Two Weeks for the Coronavirus in Japan

Is the coronavirus a “normal” health scare or something genuinely disruptive? The next two weeks will be key.

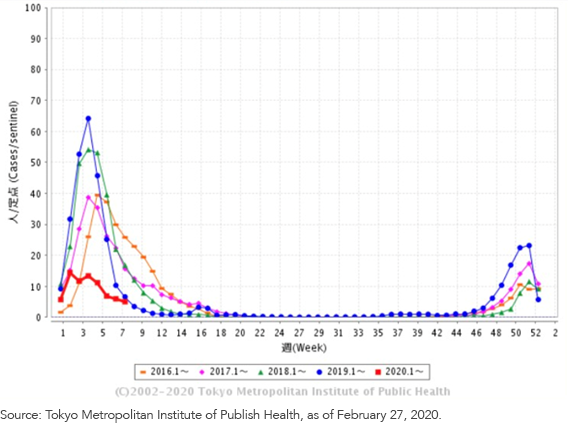

Why? In Tokyo, government leaders are focused on the empirical data tracking cases of influenza (the conventional, seasonal illness), which typically start declining between weeks 9 and 12 of the year, i.e., between the weeks of February 24 and March 16. So far, the trend looks encouraging, as shown below—this year, we’re actually doing better than normal, due to heightened public awareness.

Flu Cases in Tokyo

Although the chart contains some Japanese, it is still easy to understand with an explanation. The vertical axis shows the number of reported influenza cases in Tokyo at various reporting sentinels during each week of the year, while the horizontal axis shows each of the 52 weeks. Each of the colored lines tracks the number of weekly cases over the past four years, with the red line showing the data through the first seven weeks of 2020.

By week 7, the number of flu infection cases this year is much lower than in years past, especially when compared to 2016, 2017 and 2018. Heightened awareness of the coronavirus and corresponding precautions (such as hand sanitizing, wearing masks, etc.) may help explain this year’s reduction. Though it is still too early to be sure, the number of deaths caused by virus-related infectious respiratory diseases this year may be much lower than in previous years, ironically as result of the coronavirus scare.

The chart illustrates this point: that cases begin to decline dramatically in weeks 9 through 12. If we assume that the coronavirus has a similar trajectory as the seasonal flu, then we’d expect cases to begin dropping from this point on.

However, if the infection data does start to deviate from the annual pattern in the coming weeks, there may be real cause for concern, resulting in more drastic public policy measures as well as genuine economic policy changes. No doubt this pattern is similar around the world. When all is said and done, we’ll soon know whether we are still living in a normal world or whether something genuinely disruptive is at work. If, as I suspect, it is the former, we’ll get a strong “buy the dip” signal in the coming two weeks.