A Small (Cap) Comeback

U.S. small caps are mounting a comeback. Just a little, at least.

After lagging the S&P 500 Index by almost 650 basis points (bps) from January through August, the Russell 2000 Index surged into the year-end, outperforming by 112 bps for the last four months of the year.

The outlook for small caps has been turning up from sell-side research analysts too, despite some lagging performance to start the year. The main reason for bullishness: a potential reacceleration in global growth after months of anxiety over an inverted yield curve and global trade wars—both major factors favoring large-cap, quality companies in 2019.

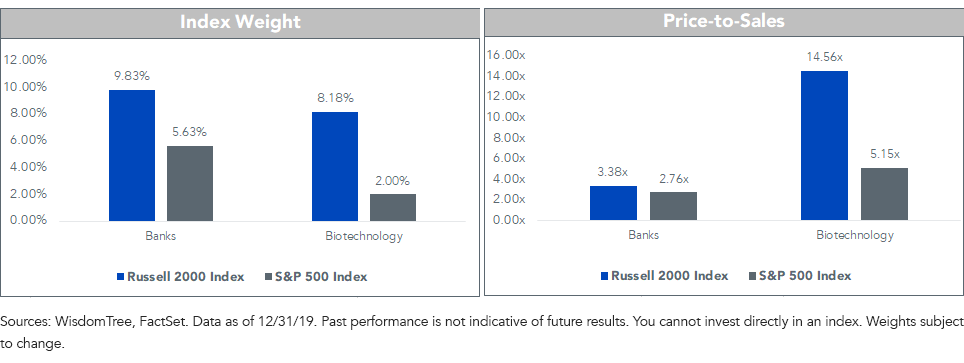

But, as a recent Barron’s cover story pointed out, the broad Russell benchmark emphasizes “money-losing biotech stocks” and regional banks.1 That’s an unattractive bet for some investors. And, after a stretch of recent outperformance for biotechnology, price-to-sales multiples look rich at over 14 times.

While some investors look for active managers to navigate such risks in this more inefficient market, there are passive indexes worth consideration.

For definitions of the Indexes in the chart, please visit our glossary.

Small Cap Quality

The WisdomTree U.S. SmallCap Quality Dividend Growth Index (WTSDG) completed its annual rebalance in December.

Its current exposure to unprofitable biotech companies? 0%.

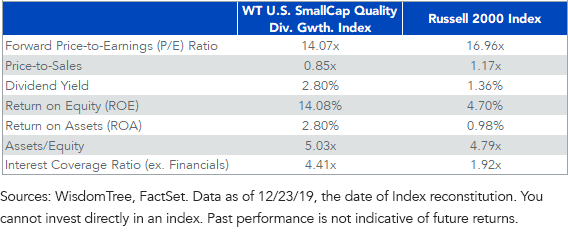

WTSDG is constructed with a combined focus on growth and quality. Companies from the small-cap universe of dividend-paying stocks are ranked through a combination of their long-term earnings growth expectations and their return on equity (ROE) and return on assets (ROA). The top 50% of companies with the most favorable fundamental scores are selected for inclusion and then weighted by their indicated cash dividends.

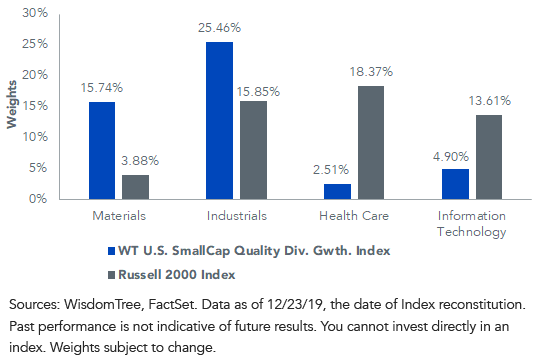

From a sector perspective, the Index is overweight cyclicals like Materials and Industrials, and underweight sectors with low profitability and low dividend payments like Health Care and Information Technology.

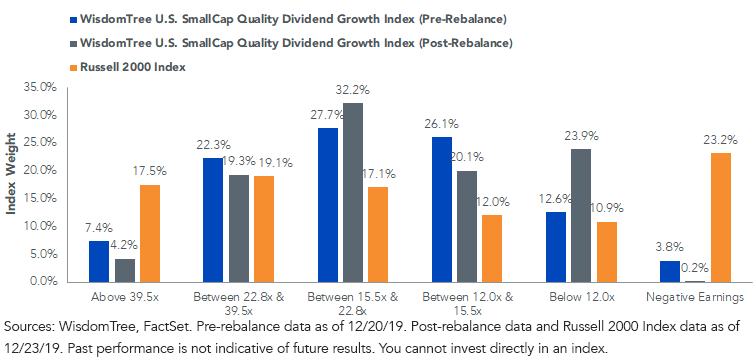

Despite its screen on long-term earnings growth expectations, the Index’s methodology favors companies with current profitability over the lottery-ticket type companies with low or no profits that tend not to pay dividends (about half of Russell 2000 constituents do not pay dividends).

Top Two Sector Overweights & Underweights

The overweight to cyclical sectors results in lower valuations on price-to-earnings and price-to-sales, and dividend weighting produced a yield advantage of over 140 bps, as of the December rebalance. The screen on quality can be seen in higher profitability ratios (ROE and ROA), as well as a significant improvement in WTSDG’s interest coverage ratio.

Conclusion

Small caps can help investors capitalize on a potential global growth reacceleration, while a screen on quality can protect from some of the riskiest companies should a volatile late-stage environment reappear.

After a gain of more than 25% for the broad small-cap index, we think now is as good a time as any for investors to consider the benefits of a fundamentals-based rebalancing process.

Comparing the grey and blue bars below, we can see the tilt toward lower P/E companies and away from negative earners at the annual rebalance for the WisdomTree U.S. SmallCap Quality Dividend Growth Index.

Despite the passive nature of the rules-based annual rebalance, the significant differences in fundamental exposures for WTSDG relative to the Russell 2000 Index and its 85% active share suggest this may present an attractive Modern Alpha® alternative to a traditional active manager or the market cap-weighted index.

Price-to-Earnings Quintiles

1Avi Salzman and John Coumarianos, “Small-Cap Stocks Are Breaking Out. Here Are 10 Investments Poised to Win.” Barron’s, Dec. 6, 2019.