WisdomTree’s New Equity Income Evolution: Composite Risk Scoring

One of WisdomTree’s first strategies originally focused on higher dividend-yielding U.S. stocks. It ranked a universe of dividend-paying equities by dividend yield and then selected the top 30%.

The original WisdomTree U.S. High Dividend Index aligned with research conducted by Professor Siegel for his 2005 book, The Future for Investors.

Professor Siegel broke down the performance of the S&P 500 dividend-paying stocks into quintiles. Stocks with the highest dividends had a positive impact on performance—while also reducing risk.

Introducing a New Composite Risk Scoring

One challenge with focusing on stocks in the top 30% of yields is that some securities could be considered “value traps,” or “cheap for a good reason.”

Sometimes the highest-yielding companies have seen their share prices precipitously drop due to risk factors and poor outlooks for future profitability, which could then lead to future dividend cuts.

In the past, we have relied on diversification to limit exposure to these names.

But new research we’ve conducted on a composite risk scoring methodology gives us a reason to add a new risk filter to our high-dividend screening and weighting process.

New Risk Management Process

First, the top 30% of eligible dividend-paying companies are initially selected, as has been the process in the past.

However, under the new approach, these companies are then screened across three factors (value, quality and momentum), each meant to quantify a specific risk.

- The value factor is designed to lower weight to companies deemed expensive by other traditional measures of valuation

- The quality factor is designed to lower weight to companies with poor profitability metrics or declining measures of profitability

- The momentum factor is designed to lower weight to companies that have a high yield but only because their stock prices are declining

We use this composite score to help exclude companies that are signaling higher risk on other measures, so we refer to this as a composite risk score. The overlap of companies that pass the dividend yield screen AND score in the bottom 20% based on this composite risk scoring will be removed from the Index.

Higher Risk Companies Underperformed

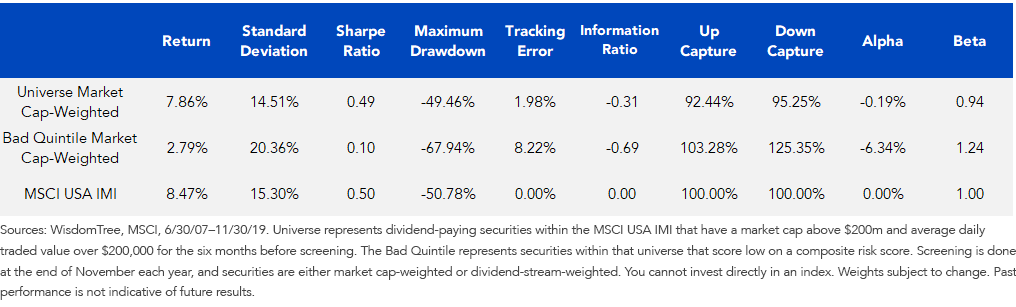

Companies scoring low on the composite risk score have underperformed the broader markets and did so with much higher risk and higher tracking error relative to the benchmark.

For definitions of terms and Indexes in the chart, please visit our glossary.

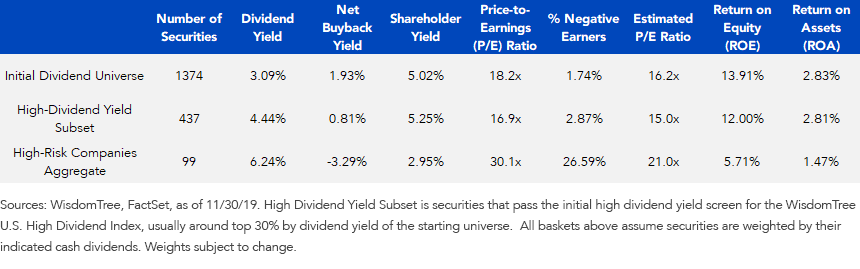

As of the most recent annual screening at the end of November 2019, there was also some noticeable difference in the fundamentals of these higher risk companies. There were 99 companies excluded as a result of the additional composite risk score. Looking at the chart below, you can see that while the excluded companies had substantially higher dividend yields, other metrics were much less favorable. The aggregate trailing P/E ratio for these excluded companies was 30x earnings, driven by the fact that more than one-quarter of the basket has negative trailing earnings. Looking at a standard quality metric like return on equity, we also saw substantially lower values. These companies also were net share issuers, diluting existing shareholders by issuing 3% of new shares outstanding.

Fundamentals Comparison: Initial Dividend Universe

For definitions of terms in the chart, please visit our glossary.

How Index Weighting Pushes Weight Toward Potentially Lower Risk Firms

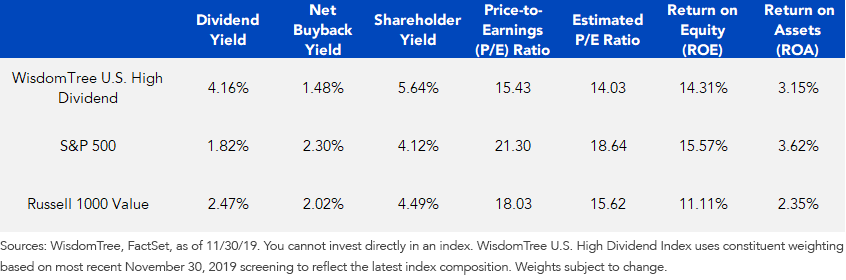

Since its inception in 2006, the WisdomTree U.S. High Dividend Index has employed a process that weights companies on the basis of their indicated cash dividends. The new approach takes this as a baseline but incorporates the same composite risk scoring mechanism that we discussed earlier in this piece to adjust the initial dividend weighting. After the initial screening, companies selected that rank in the top one-third within the composite risk scoring framework would see their weights increase by 50%, whereas companies in the bottom one-third would see their weights decrease by 50%1. It is in this way that the existing constituents see their weights adjusted to better reflect differences in relative risk. On a fundamental basis, you still get a noticeably higher dividend yield through the selection and weighting, but it’s slightly lower due to the exclusion of higher-risk companies. With this exclusion and weighting, though, you achieve a more favorable shareholder yield, return on equity and return on assets.

Index Fundamentals Comparison

Conclusion: From High Dividend Yield to More Sustainable High Dividend Yield

Over the course of the more than 13 years that the WisdomTree U.S. High Dividend Index has been in live calculation, the tools available for application within equity index construction have evolved. We believe that this new approach better reflects the tools of risk mitigation available to index providers currently, while at the same time delivering on the desire for a basket of U.S. equities with higher levels of dividend yield.

1Companies ranking in the middle third by composite risk score will not have their dividend stream adjusted for weighting purposes.