What Happens When You Dynamically Hedge Currency in an International Portfolio

U.S. dollar (USD) strength has persisted this year, and recent global central bank action has left some investors unsure about the path of currency exchange rates.

We believe managing currency exposure can help increase returns and limit volatility. In 2016 we launched the WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM), which aims to capture more than three-quarters of the volatility reduction achieved by fully hedging currency exposure, while seeking to add excess returns over fully hedged, half-hedged or unhedged strategies over long cycles.

Since its inception and during a strong-dollar environment, DDWM’s dynamic currency hedge has added 92 basis points (bps) and 544 bps of excess returns over a half-hedged and unhedged portfolio1, respectively. Please click here for standardized performance of DDWM.

Currency Exposure Can Add Uncompensated Risk

History shows currency exposure has increased the volatility of broad-based international equity portfolios over long periods, and without adding to expected returns. In the chart below we can see that in the last 20 years, currency exposure (in green) has added volatility on top of a fully hedged exposure (in blue) in the developed international equity market.

Developed International Equity Volatility 9/30/1999–9/30/2019

For definitions of Indexes in the chart, please visit our glossary.

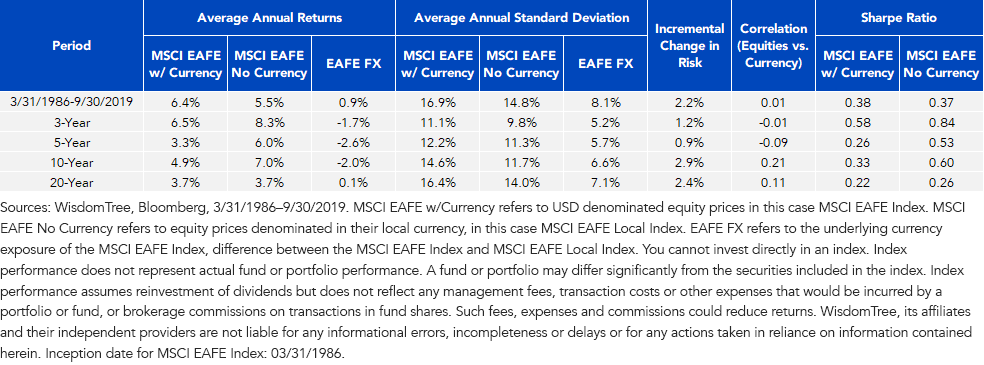

In terms of returns, as seen in the fourth column in the table below, currency exposure has added or detracted from performance, depending on the time period.

Currency exposure may have added to backward-looking returns over some periods, but there is no reason to believe foreign currencies will always rise going forward. That is one reason WisdomTree believes currency exposure offers uncompensated risk in the long term.

Dynamic Hedged Equity as Long-Run Core Allocation

WisdomTree’s dynamic currency hedging approach focuses on the three most important factors and determinants of exchange rate movements: carry, momentum and value.

- Carry (interest rate differentials or the cost of hedging): Higher interest rate currencies tend to outperform low interest rate currencies.

- Momentum: The tendency for the spot rate to appreciate following prior appreciation.

- Value: Seeks to profit from the mean-reverting nature of exchange rates at longer time horizons around “fair value,” as measured by purchasing power parity (PPP).

These signals inform currency hedge ratios, depending on where a currency is in its cycle, how expensive it is to hedge and the current trajectory of the currency.

DDWM combines our dividend-weighted approach to international markets with the dynamic hedging approach that seeks to hedge currencies when the environment is most suitable.

Given the nature of the signals, we believe the best benchmark is a 50% hedged approach, where investors can hedge half of their currency exposure.

Dynamic Currency Hedge: Boost Returns or Limit Volatility

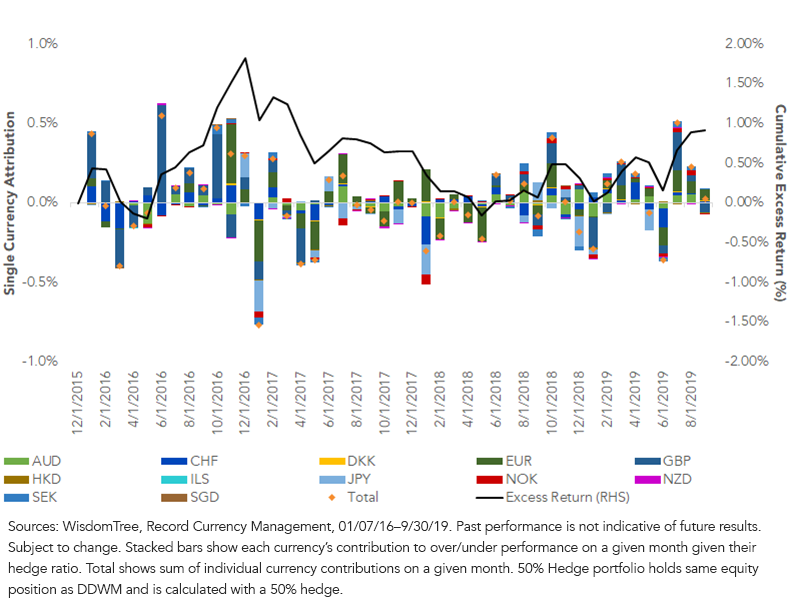

Since DDWM’s inception in 2016, its dynamic currency hedge has added close to 92 bps of performance against a 50% hedged portfolio2.

As seen below, the total monthly contribution of the dynamic hedge signal (orange marker) has fluctuated between +/- 50 bps, on average. That achieved volatility reduction while potentially adding excess returns. The black line plotted on the right-hand side axis shows that since DDWM’s inception, the dynamic hedge has consistently added to returns. The main contributors to excess performance were the British pound (GBP) and euro (EUR), while the main detractor was the Japanese yen (JPY).

Attribution: Dynamic Hedge vs. 50% Hedge

Since DDWM’s inception in January 2016, the dynamic hedging approach has implied GBP weakness versus the USD, given interest rate differentials, negative momentum in the currency pair and decreased purchasing power. DDWM’s exposure to GBP-denominated stocks has been hedged 72.96% of the time, on average. This hedge has proven positive as the GBP has weakened more than 15% versus the USD over the last 44 months. Signals on the EUR have not been as one-sided as the GBP. The average hedge ratio for DDWM’s euro exposure has been 57.4%, affected by interest rate differentials and the currency pair momentum.

Despite the EUR strengthening 1.83% versus the USD, the dynamic approach has managed to capture periods of weakness, thus adding value. DDWM’s average hedge ratio of 63.3% to its JPY exposure has proven to be a detractor as JPY has strengthened by more than 8% versus the USD despite its interest differentials and purchasing power signaling weakness.

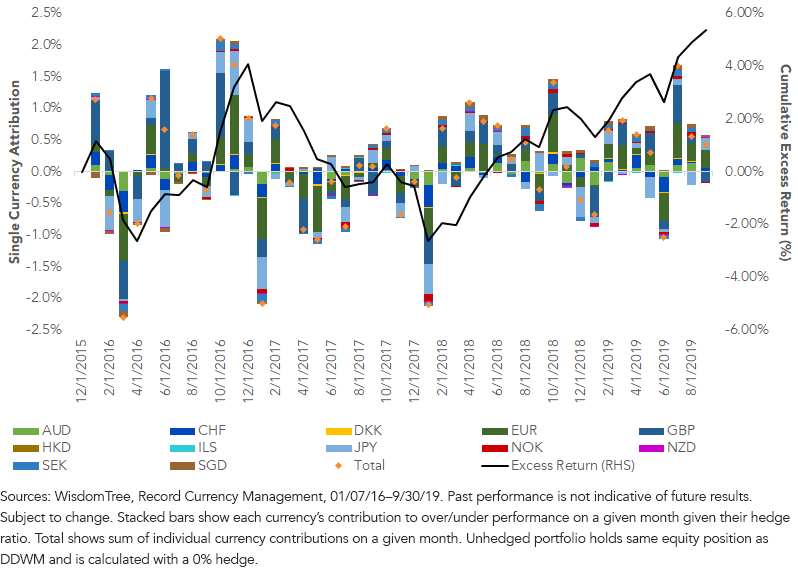

Given recent USD strength, DDWM’s dynamic currency hedge has added even greater excess return versus an unhedged portfolio3—5.44% since its inception.

As seen below, the total monthly contribution of the dynamic hedge signal (orange marker) consistently fluctuated between +/- 100 bps, which achieved volatility reduction while helping protect against larger currency moves. The main contributors to excess performance were the Singapore dollar (SGD), GBP and EUR, while the main detractor was the JPY.

Attribution: Dynamic Hedge vs. Unhedged

Regardless of benchmark, we believe a dynamic approach to managing currency risk can be a significant source of value to international exposures over market cycles.

After 3 years of live returns, DDWM has been able to add value through security selection as well as through its dynamic currency approach.

Unless otherwise stated, data sources are WisdomTree, Record Currency Management, as of 09/30/19.

1Portfolios hold same equity position as DDWM and are calculated with a 50% hedge or 0% hedge respectively.

2Portfolio holds same equity position as DDWM and is calculated with a 50% hedge.

3Portfolio holds same equity position as DDWM and is calculated with a 0% hedge.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund invests in derivatives in seeking to obtain a dynamic currency hedge exposure. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Derivatives used by the Fund may not perform as intended. A Fund that has exposure to one or more sectors may be more vulnerable to any single economic or regulatory development. This may result in greater share price volatility. The composition of the Index underlying the Fund is heavily dependent on quantitative models and data from one or more third parties, and the Index may not perform as intended. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.