What Is the Highest-Yielding Treasury Security?

Right now, floating rate notes are the highest-yielding Treasury security, at 2.19%.

The rally in the U.S. Treasury (UST) market has created a rather interesting investment backdrop. As you already may have heard, with yields coming down across the maturity spectrum, curves have either flattened or have become inverted, leaving investors with some important decisions to make in their fixed income portfolios. Before I get into the investment aspect of the process, let’s first take a look at how the Treasury’s maturity lineup stands as of this writing.

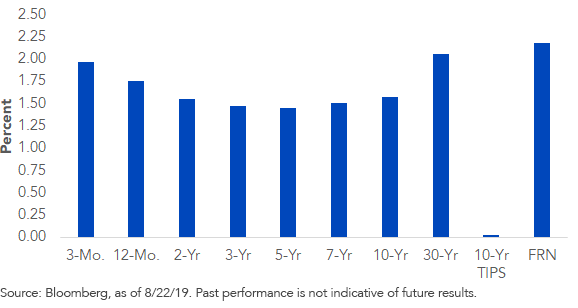

U.S. Treasury Yields

The accompanying graph highlights the widely watched Treasury maturity spectrum, ranging from the 3-Month bill on out to the 30-Year bond. And for good measure, I threw in the 10-Year Treasury Inflation-Protected Securities (TIPS) to go along with the floating rate note (FRN). This way, investors can get an up-close look for themselves at the various yield disparities.

Without a doubt, some of the widest yield dispersion is occurring versus the 2- to 10-Year part of the curve. The FRN yield is roughly 60–70 basis points (bps) above the levels that exist for that sector. The spread versus the 3-Month bill is out over 20 bps, and even compared to the 30-Year bond, FRNs have more than a 10 bps advantage.

The most noteworthy differential exists versus TIPS. In this instance, the spread ballooned out to more than 200 bps for both the 5- and 10-Year TIPS maturities. In fact, the 10-Year TIPS yield is just barely over 0, at 0.03%.

Conclusion

From an investment backdrop, I keep going back to the shape of the Treasury yield curve and what investors are being compensated for. Given the flat/inverted nature of the curve, in my opinion, investors are not being rewarded for taking on too much duration risk. This is especially true in areas such as TIPS. While I know it may seem like a stretch to think that rates are going to go up again at this juncture, investors may want to consider the risks/rewards of their fixed income positioning. Treasury yields tend to leave little, if any room, for surprises. UST FRNs are currently the highest-yielding security in Treasury-land, with a duration of one week, providing investors with both income potential in a historically low rate environment and also offering a hedge against 'fixed' coupon securities, especially if the Fed is not as aggressive cutting rates as the market currently anticipates. The WisdomTree Floating Rate Treasury Fund (USFR) offers investors a means of investing in the UST FRN space.

Unless otherwise stated, data source is Bloomberg, as of August 22, 2019.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.