WisdomTree’s European Barbell Strategy

European equities have really been out of favor. Flows to European stocks dried up in 2017 and 2018 as the S&P 500 Index was the best (only) game in town, powered by the large-cap technology companies that Europe frankly lacks.

But new leadership at the European Central Bank (ECB) is motivating a fresh look at the policy tools available for the central bank, and WisdomTree believes European markets will find support over the coming 12 to 18 months.

What is the best exposure to Europe for a more bullish view?

In a previous blog post, we highlighted how European multi-nationals in the WisdomTree Europe Hedged Equity Fund (HEDJ) neutralize exposure to the euro while also under-weighting banks, which have been stung by slow economic growth and negative interest rates.

The European Barbell

For those who desire exposure to firms that are oriented to the local economy, we recommend a WisdomTree European Barbell: 50% exposure to European small-caps through the WisdomTree Europe SmallCap Dividend Fund (DFE), combined with 50% in HEDJ.

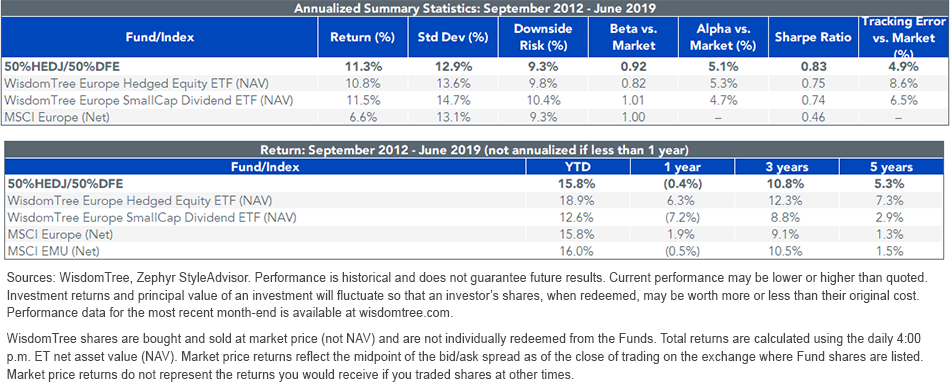

Over the last seven years (the start of which coincides with the repositioning of HEDJ to focus on euro-traded companies), small-cap European companies have outperformed large-caps, as represented by the MSCI Europe Index, by approximately 500 basis points (bps) per year—a dramatic spread. The beginning of this period also coincides with Mario Draghi’s famous speech in which he said that the ECB would do “whatever it takes” to support the eurozone, which helped ignite risk assets higher.

DFE exhibits higher beta and risk levels than HEDJ, because small-caps are more closely tied into the local and cyclical part of Europe’s economy. However, the 50/50 barbell with HEDJ interestingly had lower overall volatility than the broad MSCI Europe Index and a .92 beta to MSCI Europe but 470 basis points of average annual outperformance.

For standardized performance of each Fund mentioned in the table, please click their respective tickers: HEDJ, DFE.

Small-Cap Attribution

With growth in Europe having been slow over the last seven years, why did small-caps outperform large-caps by so much—particularly during a time when small-caps had dreadful performance in the U.S.?

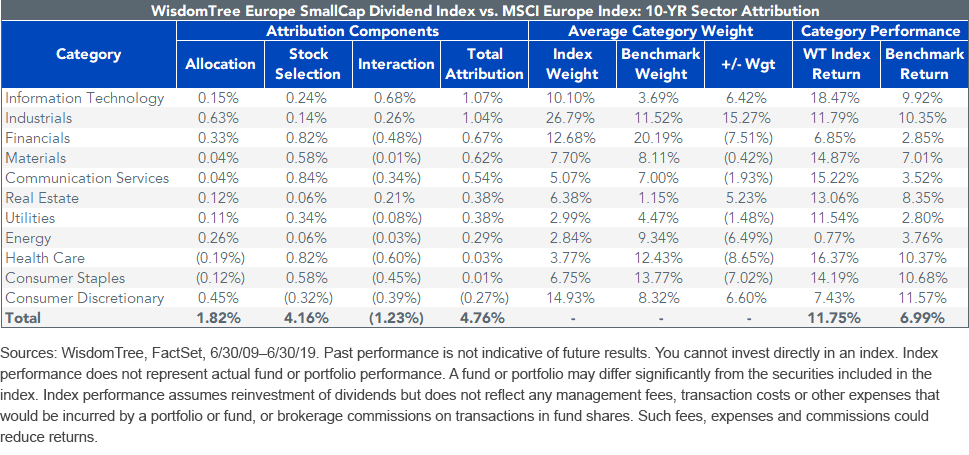

Going back 10 years in Europe, small-caps had more technology exposure than large-caps—about 3x as much, on average. Technology contributed over 100 of the 500 bps of DFE’s outperformance relative to the MSCI Europe Index.

Less exposure to large-cap banks also led to dramatic stock selection outperformance in the Financials sector for DFE relative to MSCI Europe.

More exposure to Industrials as well as the better performance of those stocks was another key contributing factor—demonstrating how cyclical improvement can help this basket in the future.

Attractive Fundamentals

While the historical returns of the WisdomTree European Barbell present a very compelling case for the past seven years, what about its future prospects?

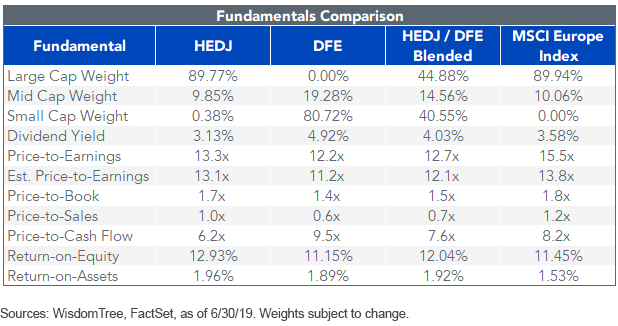

Historical outperformance did not lead to extended multiples, causing fear of mean reversion.

Due to WisdomTree’s dividend-weighted, relative value rebalancing process, the WisdomTree European Barbell maintains a strong value tilt and advantage at the present time.

We emphasize the current 12–13x price-to-earnings (P/E) ratios of both HEDJ and DFE, compared to 15.5x for MSCI Europe.

Even better, these discounts do not come with a sacrifice in overall portfolio quality metrics—the WisdomTree European Barbell exhibits both a higher return on equity (ROE) and return on assets (ROA) compared to the MSCI Europe Index.

Summarizing the case:

- HEDJ’s focus on multinationals and global companies makes it well positioned for a bottoming of global growth conditions as China stimulates its economy, and as other central banks loosen monetary policy and have globally coordinated lower rates.

- DFE compliments HEDJ nicely with the more cyclical, local European economy exposure of small-caps, higher betas to growth of Europe, as well as overall attractive fundamental characteristics and past return profiles.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As these Funds can have a high concentration in some issuers, the Funds can be adversely impacted by changes affecting those issuers. Due to the investment strategy of these Funds they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.