No Heavy Lifting Required

When looking at the money and bond markets these days, they almost seem to be saying to the Federal Reserve (Fed), “Would you please cut rates already?” Even though the economic data doesn’t warrant an urgent rate cut, the policy makers have put themselves in a very difficult situation by having to make a move. In other words, the bond market is the tail wagging the Fed dog. Against this backdrop, I continue to advocate a solution for fixed income investors in which no heavy lifting is required: the barbell strategy.

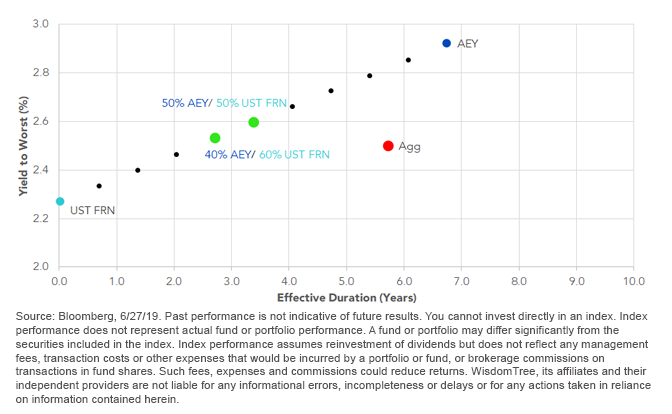

As the reader may recall, we began writing about this approach last summer. We utilize Yield Enhanced (AEY) and U.S. Treasury floating rate (UST FRN) strategies and comparing the results to the widely followed Bloomberg Barclays U.S. Aggregate Index (Agg) benchmark. At first, the combination centered around a 70% AEY and 30% UST FRN blend, but during 2019, this ratio has continued to be adjusted due to the decline in intermediate yields and the resulting flattening of the yield curve.

Yield to Worst and Effective Duration Comparison Enhanced Yield/UST FRN vs. Aggregate

The accompanying graph now illustrates the combination of either 50% AEY/50% UST FRN or 40% AEY/60% UST FRN as the newest pairings. Here are the respective results compared to the Agg:

50% AEY/50% UST FRN: +9 basis points (bps) in yield; -2.34 years in duration

40% AEY/60% UST FRN: +3 bps in yield; -3.01 years in duration

Conclusion

The WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY), which seeks to track the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index, and the WisdomTree Floating Rate Treasury Fund (USFR), which seeks to track the Bloomberg U.S. Treasury Floating Rate Bond Index, can be utilized as the two ends of the barbell. The strategy laid out in this blog post offers a strategic solution designed to help fixed income investors navigate the waters that loom ahead without making a high conviction bet on where rates are headed in the seemingly ever-changing interest rate landscape.

Unless otherwise stated, data source is Bloomberg, as of June 27, 2019.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. The value of an investment in the Funds may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Funds’ portfolio investments. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for a discussion of risks.