Risk vs. Return in International Portfolios

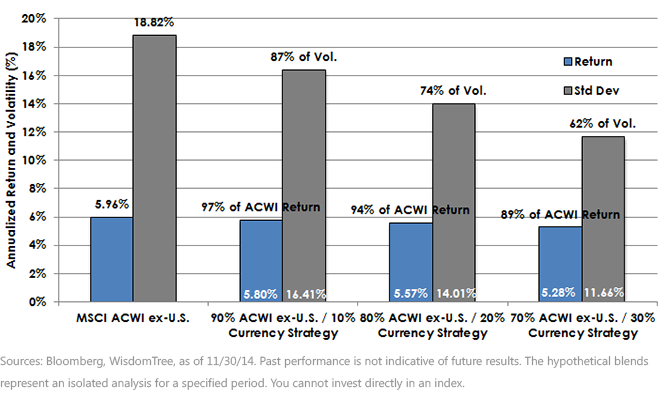

Interestingly, even though the volatility of the dollar bull strategy was significantly higher than cash over this period, it actually reduced overall portfolio risk to a greater degree due to its negative correlation (-0.71) with international equities.4 In our view, the real value of bullish dollar strategies in the current market environment is for investors with long-term international holdings. Given that many of these legacy positions may have large unrealized capital gains, a bullish dollar currency strategy can help reduce volatility from currency markets while maintaining existing exposure. In our analysis over the last 10 years, investors would have been able to capture a large portion of the upside, while significantly reducing volatility. As illustrated in the chart above, a 20% allocation to a currency strategy would have been able to capture 94% of total returns while reducing volatility by 26%.

In our view, a blended approach to managing currency risk can help investors navigate increasingly uncertain markets. With volatility of many asset classes rising, deploying currency hedging strategies may represent one way investors can enhance risk- adjusted returns.

1Source: Bloomberg, as of 11/30/14.

2Refers to the three-month U.S. Treasury bill. Source: Bloomberg, 12/31/03–12/31/07.

3Source: Bloomberg, as of 1/15/15.

4Source: Bloomberg, as of 11/30/14.

Interestingly, even though the volatility of the dollar bull strategy was significantly higher than cash over this period, it actually reduced overall portfolio risk to a greater degree due to its negative correlation (-0.71) with international equities.4 In our view, the real value of bullish dollar strategies in the current market environment is for investors with long-term international holdings. Given that many of these legacy positions may have large unrealized capital gains, a bullish dollar currency strategy can help reduce volatility from currency markets while maintaining existing exposure. In our analysis over the last 10 years, investors would have been able to capture a large portion of the upside, while significantly reducing volatility. As illustrated in the chart above, a 20% allocation to a currency strategy would have been able to capture 94% of total returns while reducing volatility by 26%.

In our view, a blended approach to managing currency risk can help investors navigate increasingly uncertain markets. With volatility of many asset classes rising, deploying currency hedging strategies may represent one way investors can enhance risk- adjusted returns.

1Source: Bloomberg, as of 11/30/14.

2Refers to the three-month U.S. Treasury bill. Source: Bloomberg, 12/31/03–12/31/07.

3Source: Bloomberg, as of 1/15/15.

4Source: Bloomberg, as of 11/30/14.Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.