What Does India’s Rate Cut Mean for Indian Stocks?

Effect of Cuts in the Indian Repo Rate on the Indian Equity Markets

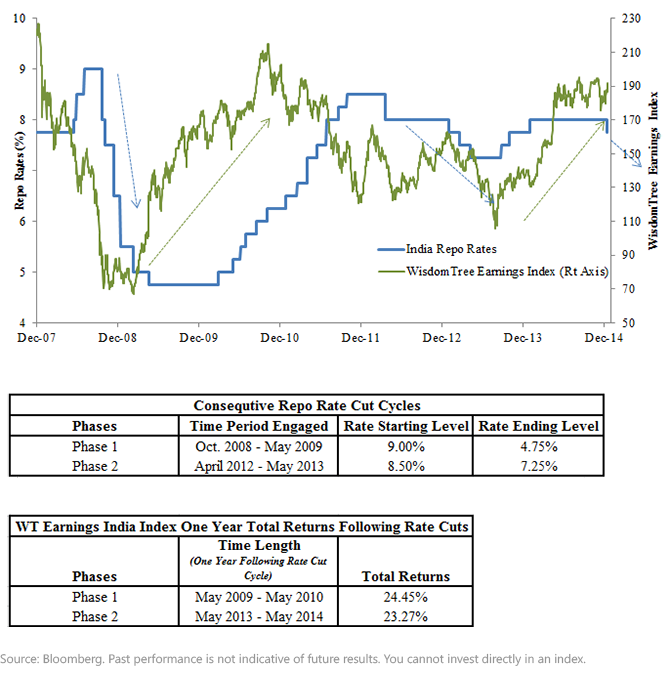

Since the peak of the financial crisis, the Reserve Bank of India (RBI) has broadly engaged twice, in consecutive rate-cut cycles. Phase 1 started in October 2008 and lasted through May 2009, while Phase 2 started in April 2012 and ended in May 2013. The one-year total returns for the WisdomTree India Earnings Index after each rate cut cycle were robust, advancing 24.5% and 23.3% respectively, as shown in figure 2 and the following tables.

Figure 2: WisdomTree India Earnings Index Total Returns vs. Rate Cuts in India

Effect of Cuts in the Indian Repo Rate on the Indian Equity Markets

Since the peak of the financial crisis, the Reserve Bank of India (RBI) has broadly engaged twice, in consecutive rate-cut cycles. Phase 1 started in October 2008 and lasted through May 2009, while Phase 2 started in April 2012 and ended in May 2013. The one-year total returns for the WisdomTree India Earnings Index after each rate cut cycle were robust, advancing 24.5% and 23.3% respectively, as shown in figure 2 and the following tables.

Figure 2: WisdomTree India Earnings Index Total Returns vs. Rate Cuts in India

For standardized performance of the WisdomTree India Earnings Index, click here.

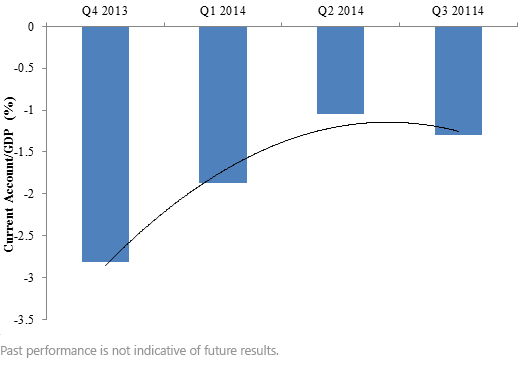

Lower oil prices are also helping to contain India’s current account deficit, one of the factors that has historically impacted the value of the Indian currency. Over the last several quarters, India’s current account deficit as a percentage of gross domestic product (GDP) has been cut nearly in half.

Figure 3: India's Current Account as Percentage of GDP

For standardized performance of the WisdomTree India Earnings Index, click here.

Lower oil prices are also helping to contain India’s current account deficit, one of the factors that has historically impacted the value of the Indian currency. Over the last several quarters, India’s current account deficit as a percentage of gross domestic product (GDP) has been cut nearly in half.

Figure 3: India's Current Account as Percentage of GDP

If India has embarked on a multimonth period of interest rate cuts, such accommodative monetary policy could be a bullish catalyst for the Indian economy and the Indian equity market. The stage is now set for Finance Minister Arun Jaitley to present a reform-friendly budget next month. Should the new Indian government be able to propose and enact new pro-growth economic policies, look to see more interest in—and money flowing into—Indian stocks.

Unless otherwise noted, data source is Bloomberg, as of 1/15/2014.

1Source: Bloomberg, as of Q4 2014.

If India has embarked on a multimonth period of interest rate cuts, such accommodative monetary policy could be a bullish catalyst for the Indian economy and the Indian equity market. The stage is now set for Finance Minister Arun Jaitley to present a reform-friendly budget next month. Should the new Indian government be able to propose and enact new pro-growth economic policies, look to see more interest in—and money flowing into—Indian stocks.

Unless otherwise noted, data source is Bloomberg, as of 1/15/2014.

1Source: Bloomberg, as of Q4 2014. Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Investments focused in India are increasing the impact of events and developments associated with the region, which can adversely affect performance. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.