Is Your Index Capturing Dividend Growth?

For definitions of terms and indexes in the charts, visit our glossary.

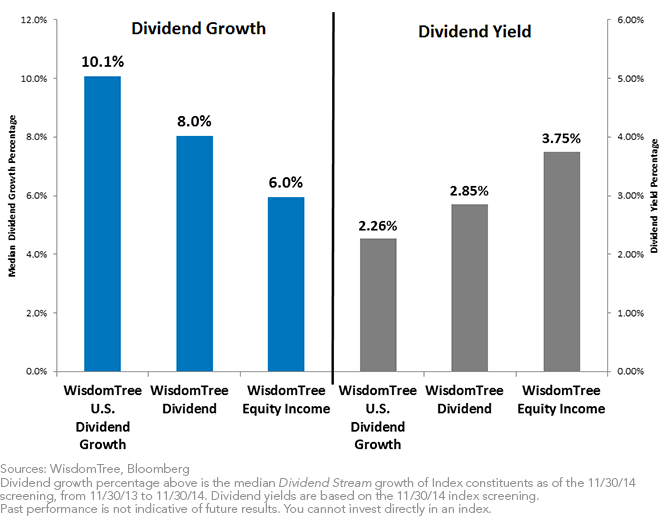

• Dividend Growth Index Recorded Higher Growth Than Broad Index—The WisdomTree U.S. Dividend Growth Index (WTDGI) saw more than 2% higher Dividend Stream growth over the period than the broader WisdomTree Dividend Index.

• Dividend Growth Index Saw Higher Growth Than Yield-Focused Index—WTDGI displayed a 4 percentage point advantage over the WisdomTree Equity Income Index (WTHYE) in dividend growth. Although WTHYE’s median dividend growth lagged over the period, it is important to remember that WTHYE screens for securities with higher dividend yields instead of focusing on future growth potential, so the Index will typically have a higher dividend yield than WTDGI.

• Dividend Yield Differentials Are Narrower—Compared with the dividend growth differentials. The yield difference between WTDGI and WTHYE is less than 1.5%, but the dividend growth difference was over 4.0%. This is important to note because, if this difference holds up going forward, it could signal that dividend growers could be a more attractive option than higher yielders. Considering that total returns, assuming valuations remain constant, are essentially the starting dividend yield plus the growth of dividends, it makes sense to maximize the sum of these two numbers.

Conclusion

There is no question that investors have been drawn to the idea of dividend growth—potentially even more than in the past—due to a potential rise in interest rates. While there is no way to know with certainty what will happen in the future, I believe that our dividend growth methodology shows that it can help identify stocks with above-average prospects for dividend growth—as it did at the last rebalance. I believe that this dividend growth potential will become even more important if we see a rise in interest rates in the future.

For definitions of terms and indexes in the charts, visit our glossary.

• Dividend Growth Index Recorded Higher Growth Than Broad Index—The WisdomTree U.S. Dividend Growth Index (WTDGI) saw more than 2% higher Dividend Stream growth over the period than the broader WisdomTree Dividend Index.

• Dividend Growth Index Saw Higher Growth Than Yield-Focused Index—WTDGI displayed a 4 percentage point advantage over the WisdomTree Equity Income Index (WTHYE) in dividend growth. Although WTHYE’s median dividend growth lagged over the period, it is important to remember that WTHYE screens for securities with higher dividend yields instead of focusing on future growth potential, so the Index will typically have a higher dividend yield than WTDGI.

• Dividend Yield Differentials Are Narrower—Compared with the dividend growth differentials. The yield difference between WTDGI and WTHYE is less than 1.5%, but the dividend growth difference was over 4.0%. This is important to note because, if this difference holds up going forward, it could signal that dividend growers could be a more attractive option than higher yielders. Considering that total returns, assuming valuations remain constant, are essentially the starting dividend yield plus the growth of dividends, it makes sense to maximize the sum of these two numbers.

Conclusion

There is no question that investors have been drawn to the idea of dividend growth—potentially even more than in the past—due to a potential rise in interest rates. While there is no way to know with certainty what will happen in the future, I believe that our dividend growth methodology shows that it can help identify stocks with above-average prospects for dividend growth—as it did at the last rebalance. I believe that this dividend growth potential will become even more important if we see a rise in interest rates in the future.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.