How Flexible Is Your Alternative Exposure?

For definitions of indexes in the chart please visit our glossary.

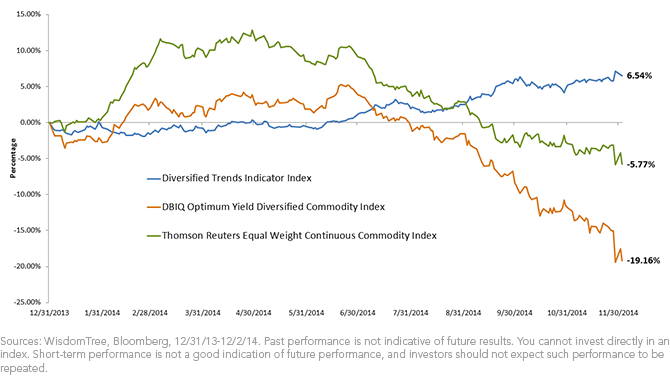

• Exposure to Oil Had a Large Impact on Returns—Because oil has declined so dramatically year-to-date, by over 32%, the larger an index’s exposure to oil, the lower the overall return.1 The DBIQ Optimum Yield Diversified Commodity Index places more weight in what it classifies as the most heavily traded and important physical commodities, so it had a larger weight to oil over the period compared to the Thomson Reuters Equal Weight Continuous Commodity Total Return Index, which employs an equal weighting methodology. A unique feature of the DTI® is its ability to go long or flat oil, but never short. Since August, the index has been flat (meaning no exposure) to oil, allowing it to largely avoid the decline in oil prices. If the price trend reverses, the index has the ability to go long oil, and it could benefit from a rebound in prices.

• Diversification Beyond Commodities Helped Drive Returns for DTI®—One of the most persistent trends year-to-date has been the strength of the U.S. dollar against other developed currencies. The flexibility for DTI® to go long or short non-U.S. currencies and U.S. Treasuries, beyond just commodities, has provided a further performance edge. DTI®’s performance has benefited from being long both Treasury bonds and Treasury notes, as interest rates have fallen in the U.S. year-to-date. DTI®’s performance also has benefited from being short the Japanese yen since August and short the euro since June. WisdomTree believes that we are still in the early innings for dollar strength, and this trend should continue into 2015 and beyond.

An Established Strategy—Now in the Exchange-Traded Fund (ETF) Structure

Traditionally, to access managed futures strategies, individuals would have to make significant investments with hedge funds or commodity trading advisors (CTAs)—an expensive proposition. These investments typically charge a 20% performance fee on top of a 2% annual fee. Additionally, CTAs generally lack transparency, have limited liquidity and can introduce single-manager risk.

The WisdomTree Managed Futures Strategy Fund (WDTI) is managed using a quantitative, rules-based strategy designed to provide returns that correspond to the performance of the DTI Index. These are some of the advantages we feel that an ETF structure can provide:

• Low fees of only 95 basis points2

• Intraday liquidity

• Full transparency of strategy and holding, displayed daily on wisdomtree.com

• No investment minimums, sales loads or redemption fees

• No K-1 filing3

1Source: Bloomberg, 12/31/13‒12/02/14. Refers to West Texas Intermediate Crude Oil Spot Price.

2Ordinary brokerage commissions apply.

3Schedule K-1 is a tax document issued for an investment in partnership interests.

For definitions of indexes in the chart please visit our glossary.

• Exposure to Oil Had a Large Impact on Returns—Because oil has declined so dramatically year-to-date, by over 32%, the larger an index’s exposure to oil, the lower the overall return.1 The DBIQ Optimum Yield Diversified Commodity Index places more weight in what it classifies as the most heavily traded and important physical commodities, so it had a larger weight to oil over the period compared to the Thomson Reuters Equal Weight Continuous Commodity Total Return Index, which employs an equal weighting methodology. A unique feature of the DTI® is its ability to go long or flat oil, but never short. Since August, the index has been flat (meaning no exposure) to oil, allowing it to largely avoid the decline in oil prices. If the price trend reverses, the index has the ability to go long oil, and it could benefit from a rebound in prices.

• Diversification Beyond Commodities Helped Drive Returns for DTI®—One of the most persistent trends year-to-date has been the strength of the U.S. dollar against other developed currencies. The flexibility for DTI® to go long or short non-U.S. currencies and U.S. Treasuries, beyond just commodities, has provided a further performance edge. DTI®’s performance has benefited from being long both Treasury bonds and Treasury notes, as interest rates have fallen in the U.S. year-to-date. DTI®’s performance also has benefited from being short the Japanese yen since August and short the euro since June. WisdomTree believes that we are still in the early innings for dollar strength, and this trend should continue into 2015 and beyond.

An Established Strategy—Now in the Exchange-Traded Fund (ETF) Structure

Traditionally, to access managed futures strategies, individuals would have to make significant investments with hedge funds or commodity trading advisors (CTAs)—an expensive proposition. These investments typically charge a 20% performance fee on top of a 2% annual fee. Additionally, CTAs generally lack transparency, have limited liquidity and can introduce single-manager risk.

The WisdomTree Managed Futures Strategy Fund (WDTI) is managed using a quantitative, rules-based strategy designed to provide returns that correspond to the performance of the DTI Index. These are some of the advantages we feel that an ETF structure can provide:

• Low fees of only 95 basis points2

• Intraday liquidity

• Full transparency of strategy and holding, displayed daily on wisdomtree.com

• No investment minimums, sales loads or redemption fees

• No K-1 filing3

1Source: Bloomberg, 12/31/13‒12/02/14. Refers to West Texas Intermediate Crude Oil Spot Price.

2Ordinary brokerage commissions apply.

3Schedule K-1 is a tax document issued for an investment in partnership interests.Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. An investment in this Fund is speculative and involves a substantial degree of risk. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivative investments can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long-only (or short-only) positions in commodities or currencies. The Fund could lose significant value during periods when long-only indexes rise (or short-only indexes decline). The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intramonth adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intramonth basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed, thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile. Diversification does not eliminate the risk of experiencing investment losses. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments. Alpha Financial Technologies, LLC (“AFT”) has developed, maintained and owns rights to the methodology that is employed in connection with the Diversified Trends IndicatorTM (DTI®). DTI® is a registered mark of AFT. The Fund is not sponsored, endorsed, sold or promoted by AFT. The DTI® was created, compiled, maintained and is owned by AFT without regard to the Fund. The DTI® is licensed on an “as-is” basis, without warranties or guarantees or other terms concerning merchantability, absence of defects, fitness or use for a particular purpose, timeliness, accuracy, completeness, currentness or quality. Neither AFT nor its affiliates make any warranties or guarantees as to the results to be obtained in connection with the use of the DTI® or an investment in the Fund, and AFT and its affiliates shall have no liability in connection with any Fund investment.