As Oil Falls, Indian Equities May Rise

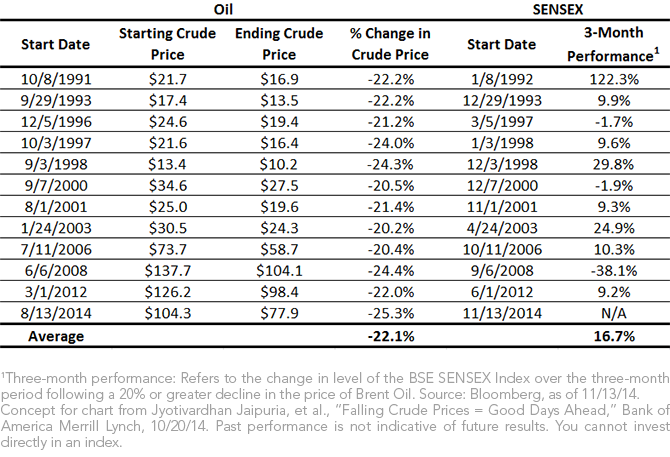

• Eleven Declines of 20% of More: Since India’s equity markets liberalized in 1991,6 there have been 11 three-month periods where the price of Brent oil has dropped by 20% or more. On eight of these occasions, the following three-month period for the BSE SENSEX delivered a positive return. The average return of all 11 periods was nearly 17%.

• Since August 13, 2014, Brent Oil Has Dropped More Than 25%: While we can never know what the future will bring, we can indicate the historical relationship that India’s equity markets have had with the price of Brent oil. India’s equities could therefore warrant a closer look.

Quantifying the Connections between India & Oil Prices

• Oil Prices to India’s Gross Domestic Product (GDP): A variety of studies have attempted to identify a predictive relationship between the price of oil and the rate of India’s GDP growth. One recent study indicates that, for every $10 drop in the price of a barrel of oil, India’s GDP increases by 0.1%7. While it’s difficult to determine a cause with that degree of precision for the GDP growth rate of an emerging market economy, given that India imports an average of about 2.6 million barrels of oil per day8, the savings can certainly be substantial when oil prices drop.

• Oil Prices to India’s Inflation Rate: Among emerging markets, India is known for stubbornly high inflation. At the beginning of 2014, the year-over-year change in India’s consumer price index was about 10%.9 As of the end of September, this measure was below 6.5%10 —a significant decrease. India imports more than 70% of the oil that it needs, and oil has a 9.5% weight in India’s CPI.11

Conclusion: A Lower Oil Price Helps India Manage Its Twin Deficits

While all of the relationships we’ve outlined between India and the price of Brent oil are certainly important, the most important could very well have to do with India’s “twin deficits.” India is known for having a significant current account deficit, which stems largely from its need to import oil. India also is known for having a particularly stubborn fiscal deficit, which stems largely from its need to subsidize fuel prices for its citizens.

A lower price of oil can mitigate both of these issues, thereby allowing Prime Minister Modi’s government greater flexibility to pursue other important reforms.

1Source for intro paragraph: Bloomberg, with data through 11/13/14.

2Source: Bloomberg; period measured is 12/31/13 to 11/13/14.

3Refers to MSCI Emerging Markets Index; performance measured from 12/31/13 to 11/13/14.

4Source: “India Analysis Report,” U.S. Energy Information Administration, 7/26/14.

5Source: Nidhi Verma, “India Ends Diesel Controls, Raises Gas Prices,” Reuters, 10/18/14.

6Source: Jyotivardhan Jaipuria, et al., “Falling Crude Prices = Good Days Ahead,” Bank of America Merrill Lynch, 10/20/14.

7Source: N. Madhavan, “Are Low Crude Oil Prices Here to Stay?” Forbes India, 11/3/14.

8Source: “The Future of the Indian Rupee Is Tied to Oil Imports,” Knowledge @ Wharton, 11/15/14.

9Source: Bloomberg, as of 12/31/13.

10Source: Bloomberg, as of 9/30/14.

11Source: “The Emerging Markets Weekly: Summer Smog,” Barclays, 7/17/14.

• Eleven Declines of 20% of More: Since India’s equity markets liberalized in 1991,6 there have been 11 three-month periods where the price of Brent oil has dropped by 20% or more. On eight of these occasions, the following three-month period for the BSE SENSEX delivered a positive return. The average return of all 11 periods was nearly 17%.

• Since August 13, 2014, Brent Oil Has Dropped More Than 25%: While we can never know what the future will bring, we can indicate the historical relationship that India’s equity markets have had with the price of Brent oil. India’s equities could therefore warrant a closer look.

Quantifying the Connections between India & Oil Prices

• Oil Prices to India’s Gross Domestic Product (GDP): A variety of studies have attempted to identify a predictive relationship between the price of oil and the rate of India’s GDP growth. One recent study indicates that, for every $10 drop in the price of a barrel of oil, India’s GDP increases by 0.1%7. While it’s difficult to determine a cause with that degree of precision for the GDP growth rate of an emerging market economy, given that India imports an average of about 2.6 million barrels of oil per day8, the savings can certainly be substantial when oil prices drop.

• Oil Prices to India’s Inflation Rate: Among emerging markets, India is known for stubbornly high inflation. At the beginning of 2014, the year-over-year change in India’s consumer price index was about 10%.9 As of the end of September, this measure was below 6.5%10 —a significant decrease. India imports more than 70% of the oil that it needs, and oil has a 9.5% weight in India’s CPI.11

Conclusion: A Lower Oil Price Helps India Manage Its Twin Deficits

While all of the relationships we’ve outlined between India and the price of Brent oil are certainly important, the most important could very well have to do with India’s “twin deficits.” India is known for having a significant current account deficit, which stems largely from its need to import oil. India also is known for having a particularly stubborn fiscal deficit, which stems largely from its need to subsidize fuel prices for its citizens.

A lower price of oil can mitigate both of these issues, thereby allowing Prime Minister Modi’s government greater flexibility to pursue other important reforms.

1Source for intro paragraph: Bloomberg, with data through 11/13/14.

2Source: Bloomberg; period measured is 12/31/13 to 11/13/14.

3Refers to MSCI Emerging Markets Index; performance measured from 12/31/13 to 11/13/14.

4Source: “India Analysis Report,” U.S. Energy Information Administration, 7/26/14.

5Source: Nidhi Verma, “India Ends Diesel Controls, Raises Gas Prices,” Reuters, 10/18/14.

6Source: Jyotivardhan Jaipuria, et al., “Falling Crude Prices = Good Days Ahead,” Bank of America Merrill Lynch, 10/20/14.

7Source: N. Madhavan, “Are Low Crude Oil Prices Here to Stay?” Forbes India, 11/3/14.

8Source: “The Future of the Indian Rupee Is Tied to Oil Imports,” Knowledge @ Wharton, 11/15/14.

9Source: Bloomberg, as of 12/31/13.

10Source: Bloomberg, as of 9/30/14.

11Source: “The Emerging Markets Weekly: Summer Smog,” Barclays, 7/17/14.Important Risks Related to this Article

Investments focused in India are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.