Japan Dips into Recession as “Japan, Inc.” Profits Set New Highs

For definitions of terms and Indexes in the chart, visit our glossary.

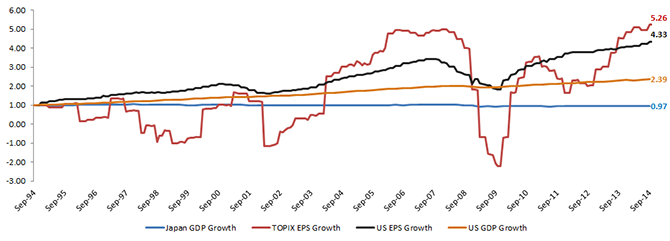

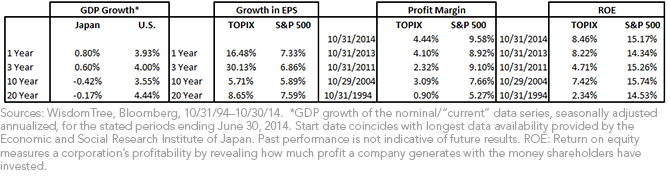

• GDP Growth ≠ Profit Growth: Despite lackluster GDP growth that trailed the U.S. by more than 4.5% annually for 20 years, Japan’s earnings per share (EPS) growth for TOPIX not only rivaled but surpassed that of the U.S. during that time—with especially compelling growth in the last one and three years with the revival of the weakening yen and coinciding with the start of Abenomics.

• More Room for Profit Margin Expansion? In the Unites States, profit margins grew from 5.27% in 1994 to 9.58% in 2014—and many worry that the United States is at a cyclical peak in profit margins, causing future pressure on EPS growth. Japan’s margins have surely grown, but at rates that are less than half those of the United States; it is possible for Japan to show even more room for improvement.

• Improving Profitability and Corporate Governance: While the U.S. return on equity has increased marginally over the last 20 years, Japan’s has increased markedly and remains below that of global peers. There are signs of pressure on Japan to be more competitive globally on a return-on-equity focus. In January, the government encouraged the development of the JPX-Nikkei 400 Index, which sought to reward and emphasize more profitable, higher-ROE companies. The Index is ultimately intended to serve as a new benchmark for large allocations from both the Japanese pension funds and the Bank of Japan in their exchange-traded funds (ETF) purchases. Some have referred to this Index as a “shame index,” highlighting companies not included and pressuring them to increase ROE. We are already seeing signs of increased dividends and buybacks to better manage balance sheets.

• Japanese earnings have grown 526% cumulatively from October 1994 to October 2014: Such envious growth was achieved against a backdrop of lackluster Japanese economic growth averaging -0.17%. Let’s contrast this with the 433% cumulative growth achieved under “more normal” conditions in the U.S., averaging a 4.44% GDP growth number in nominal terms. This suggests that Japan has vast earnings growth potential that has yet to be unlocked.

It’s important to note that over the last 20 years, none of these earnings metrics has shown any correlation to Japanese GDP’s relative stagnation. To reiterate, Japan, Inc. has grown profits from its global operations, while Japan’s local economic performance has languished.

In a nutshell, performance in the Japanese equity markets thus far has been strongly supported by earnings growth. When people talk about the Japanese economy and whether it can weather another bout of a consumption tax hike in the future, remember an important formula: GDP growth ≠ profit growth, or stated differently, GDP growth ≠ equity market potential.

Japan, Inc.’s overall profit profile is clearly being boosted by its global nature. This is one reason WisdomTree has focused on the exporters of Japan that we think are bound to reap longer-term gains from the more competitive yen exchange rates. This is a new trend that we see in place for the coming years based on shifting monetary accommodation at the Bank of Japan and the U.S. Federal Reserve. We thus think investors should stay favorable to Japan despite the recession headlines.

1Sources: WisdomTree, Bloomberg, 11/30/12–10/30/14, numbers are based off of the forward earnings filed on Bloomberg.

2Sources: WisdomTree, Bloomberg, 11/30/12–10/30/14, numbers are based off of the on forward P/E filed on Bloomberg.

For definitions of terms and Indexes in the chart, visit our glossary.

• GDP Growth ≠ Profit Growth: Despite lackluster GDP growth that trailed the U.S. by more than 4.5% annually for 20 years, Japan’s earnings per share (EPS) growth for TOPIX not only rivaled but surpassed that of the U.S. during that time—with especially compelling growth in the last one and three years with the revival of the weakening yen and coinciding with the start of Abenomics.

• More Room for Profit Margin Expansion? In the Unites States, profit margins grew from 5.27% in 1994 to 9.58% in 2014—and many worry that the United States is at a cyclical peak in profit margins, causing future pressure on EPS growth. Japan’s margins have surely grown, but at rates that are less than half those of the United States; it is possible for Japan to show even more room for improvement.

• Improving Profitability and Corporate Governance: While the U.S. return on equity has increased marginally over the last 20 years, Japan’s has increased markedly and remains below that of global peers. There are signs of pressure on Japan to be more competitive globally on a return-on-equity focus. In January, the government encouraged the development of the JPX-Nikkei 400 Index, which sought to reward and emphasize more profitable, higher-ROE companies. The Index is ultimately intended to serve as a new benchmark for large allocations from both the Japanese pension funds and the Bank of Japan in their exchange-traded funds (ETF) purchases. Some have referred to this Index as a “shame index,” highlighting companies not included and pressuring them to increase ROE. We are already seeing signs of increased dividends and buybacks to better manage balance sheets.

• Japanese earnings have grown 526% cumulatively from October 1994 to October 2014: Such envious growth was achieved against a backdrop of lackluster Japanese economic growth averaging -0.17%. Let’s contrast this with the 433% cumulative growth achieved under “more normal” conditions in the U.S., averaging a 4.44% GDP growth number in nominal terms. This suggests that Japan has vast earnings growth potential that has yet to be unlocked.

It’s important to note that over the last 20 years, none of these earnings metrics has shown any correlation to Japanese GDP’s relative stagnation. To reiterate, Japan, Inc. has grown profits from its global operations, while Japan’s local economic performance has languished.

In a nutshell, performance in the Japanese equity markets thus far has been strongly supported by earnings growth. When people talk about the Japanese economy and whether it can weather another bout of a consumption tax hike in the future, remember an important formula: GDP growth ≠ profit growth, or stated differently, GDP growth ≠ equity market potential.

Japan, Inc.’s overall profit profile is clearly being boosted by its global nature. This is one reason WisdomTree has focused on the exporters of Japan that we think are bound to reap longer-term gains from the more competitive yen exchange rates. This is a new trend that we see in place for the coming years based on shifting monetary accommodation at the Bank of Japan and the U.S. Federal Reserve. We thus think investors should stay favorable to Japan despite the recession headlines.

1Sources: WisdomTree, Bloomberg, 11/30/12–10/30/14, numbers are based off of the forward earnings filed on Bloomberg.

2Sources: WisdomTree, Bloomberg, 11/30/12–10/30/14, numbers are based off of the on forward P/E filed on Bloomberg.Important Risks Related to this Article

Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.