Is Your Portfolio Diversified Enough?

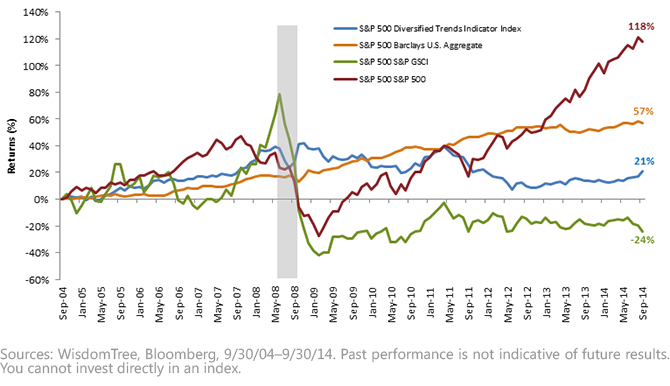

• Performance During a Crisis – The DTI Index was up 8.29% over the 2008 calendar year, impressive when compared to the S&P 500 Index return of -37.00%. During October 2008, the DTI Index was up 10.41%, compared to the S&P 500 Index return of -16.79%.

Low Correlations to Broad-Based Indexes

Over the past 10 years, the DTI Index had a correlation of -0.25 and -0.17 to the Barclays U.S. Aggregate Index and the S&P 500 Index, respectively. To put these numbers in perspective, the MSCI EAFE Index had a correlation of 0.12 and 0.89 to the Barclays U.S. Aggregate Index and the S&P 500 Index, respectively. The MSCI Emerging Markets Index had a correlation of 0.13 and 0.79 to the Barclays U.S. Aggregate Index and the S&P 500 Index, respectively.2

An Established Strategy—Now in the Exchange-Traded Fund (ETF) Structure

Traditionally, to access managed futures strategies, individuals would have to make significant investments with hedge funds or commodity trading advisors (CTAs)—an expensive proposition. These investments typically charge a 20% performance fee on top of a 2% annual fee. Additionally, CTAs generally lack transparency, have limited liquidity and can introduce single-manager risk.

The WisdomTree Managed Futures Strategy Fund (WDTI) is managed using a quantitative, rules-based strategy designed to provide returns that correspond to the performance of the DTI Index. These are some of the advantages we feel an ETF structure can provide:

• Low fees of only 95 basis points3

• Intraday liquidity

• Full transparency of strategy and holding

• No investment minimums, sales loads or redemption fees

• No K-1 filing

Learn more about our approach to alternatives here.

1Sources: WisdomTree, Bloomberg; refers to the S&P 500 Index high on 9/18/14.

2Sources: WisdomTree, Bloomberg, 9/30/04–9/30/14.

3Ordinary brokerage commissions apply.

• Performance During a Crisis – The DTI Index was up 8.29% over the 2008 calendar year, impressive when compared to the S&P 500 Index return of -37.00%. During October 2008, the DTI Index was up 10.41%, compared to the S&P 500 Index return of -16.79%.

Low Correlations to Broad-Based Indexes

Over the past 10 years, the DTI Index had a correlation of -0.25 and -0.17 to the Barclays U.S. Aggregate Index and the S&P 500 Index, respectively. To put these numbers in perspective, the MSCI EAFE Index had a correlation of 0.12 and 0.89 to the Barclays U.S. Aggregate Index and the S&P 500 Index, respectively. The MSCI Emerging Markets Index had a correlation of 0.13 and 0.79 to the Barclays U.S. Aggregate Index and the S&P 500 Index, respectively.2

An Established Strategy—Now in the Exchange-Traded Fund (ETF) Structure

Traditionally, to access managed futures strategies, individuals would have to make significant investments with hedge funds or commodity trading advisors (CTAs)—an expensive proposition. These investments typically charge a 20% performance fee on top of a 2% annual fee. Additionally, CTAs generally lack transparency, have limited liquidity and can introduce single-manager risk.

The WisdomTree Managed Futures Strategy Fund (WDTI) is managed using a quantitative, rules-based strategy designed to provide returns that correspond to the performance of the DTI Index. These are some of the advantages we feel an ETF structure can provide:

• Low fees of only 95 basis points3

• Intraday liquidity

• Full transparency of strategy and holding

• No investment minimums, sales loads or redemption fees

• No K-1 filing

Learn more about our approach to alternatives here.

1Sources: WisdomTree, Bloomberg; refers to the S&P 500 Index high on 9/18/14.

2Sources: WisdomTree, Bloomberg, 9/30/04–9/30/14.

3Ordinary brokerage commissions apply. Important Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment losses. There are risks associated with investing, including possible loss of principal. An investment in this Fund is speculative and involves a substantial degree of risk. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long-only (or short-only) positions in commodities or currencies. The Fund could lose significant value during periods when long-only indexes rise or short-only indexes decline. The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intramonth adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intramonth basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed, thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.